|

Buying a home is typically the most expensive purchase you’re ever going to make. The thing that makes property a powerful investment is that you can borrow a large portion of that cost from a bank. However, there are still a number of other costs that homebuyers need to be aware of before they start their search for a property, as those costs could impact what they can afford. LMI While banks are prepared to lend a large portion of the value of a property, they still like to see that a borrower is able to contribute 20%. That deposit shows them that the borrower is capable of managing money effectively, and it also protects them in the event they do default. It is possible to borrow more than 80% of the value of the property; however, you will likely be required to pay lenders mortgage insurance (LMI). LMI is a one-off upfront premium that is put in place to protect the lender. The cost itself varies, depending on how much you are looking to borrow, the LVR and even the location of the property. This can be a sizeable amount and needs to be factored in prior to starting your property search if you have only a small deposit. Valuation/Loan Costs To have your loan application formally approved, one of the conditions is usually that the property undergoes an adequate bank valuation. This gives the lender an indication that you have paid a fair price for the property. There are different types of valuations a lender will require in terms of how the property is valued. However, as the borrower, you will need to pay those costs. These fees are also on top of any loan establishment or application fees. Insurance When you are approved for a loan and ultimately settle on the property, you need to immediately start thinking about looking after that property. The first thing you will need to do is to make sure you have the right types of insurance in place. The most important is normally home and building insurance as this will cover the structure itself. If you are buying a freestanding home, this will be your responsibility. If you’re buying into a strata complex, this might be recovered in the strata fees. On top of this, you can also consider contents insurance or rental insurance if the property is for investment purposes. Property Management If you’re buying an investment property, it is easy to forget about the upfront costs associated with property management. A property manager can be a valuable resource in helping you take care of your asset while also making your life a lot easier. However, you will need to pay them for various services. Property managers charge their fees based on a percentage of the rental income, usually somewhere between 5 - 10%. There are several other upfront costs as well, such as the letting fee, which is normally two weeks’ rent, the cost of getting professional photos done, and various other admin costs. You should expect to receive no rental income for around two months after taking into consideration the upfront fees and the monthly payment cycle most property managers use. See your home loan options in less than 5 minutes One of the biggest mistakes new home buyers make is not having their finances organised prior to starting their search for a property. Many people assume that if one has a good income, a home loan is simple to get. Unfortunately, there are a number of steps in the process, and it often takes many weeks or even months to get everything formally approved. By far, the best option is to seek pre-approval before even starting the search for a new home. A pre-approval will allow you to know exactly how much you can spend and give you confidence that your loan application has a high chance of success when the time comes. However, there are still several steps you can take to fast-track the home loan application process, whether that’s pre-approval or unconditional approval. Boost Your Deposit Lenders like to see, firstly, that a potential borrower can manage money and that they represent a low level of risk. The best way to do this is to come up with a larger deposit. Normally, lenders like to see 20%, and anything less than that will mean that you’ll likely be forced to pay Lender’s Mortgage Insurance (LMI). LMI is a one-off insurance premium that the borrower is required to pay to protect the lender in the event of a default. If you’re putting down a larger deposit, you will not need to pay LMI, which makes the loan application process easier. It also opens you up to more lenders who will be willing to take you on. Reduce other debts When a lender is assessing your loan application, they are really assessing how likely you are to be able to continue to make repayments on any money they lend to you. If you already have large debts, particularly unsecured debts such as credit cards, it can make your application less appealing. If you are in a position to do so, it is well worth paying down all of your smaller debts or consolidating them. It is worth noting that lenders are also very interested in your overall borrowing limit when it comes to things like credit cards. Even if you don’t use that limit, they assess you as if you do. If you don’t need that extra capacity, it might be worth reducing your credit card limits. Check your credit record The very first thing most lenders are going to do when you apply for a home loan is take a close look at your credit record and credit score. Your credit record is your track record of how you have managed credit in the past. It contains a list of all the times you’ve applied for credit, records any missed payments and even shows if you’ve paid on time or early. The good news is that if you’ve been diligent with your repayments in the past, this will be reflected in a good credit score. However, if you’ve had a few issues, you can still turn things around. Start by making all your repayments on time and pay your bills the day you receive them. If you’re having trouble with current debts, it might be worth looking to consolidate them and tidying up your finances. Make sure your credit history is in order, and this will dramatically speed up your application process. See your home loan options in less than 5 minutes We all want to get a bargain when we buy a property, however, the reality is that you need to meet the vendor halfway in most cases. Knowing how much you should offer and exactly where you need to meet the vendor when it comes to price comes down to asking a few key questions. What’s the basis for the asking price? Just because a house is listed at a certain price by the sales agent doesn’t mean the price is a realistic one. The key to understanding whether a price is fair and reasonable is to do your market research beforehand. These days it’s easy to access sales data on the real estate portals and you can quickly and easily see what other comparable properties have been selling for in the same area. Try and find a house of similar age, land component and condition that has sold in the last three to six months, and present those to the agent when making an offer. Are there multiple offers? If you’re the only one putting an offer in on a property, then there is a fair chance you’ll be able to negotiate a lower price. If there are multiple parties interested then the odds of you getting a bargain are slim. At the end of the day, buying and selling is about supply and demand and if you need to compete for a property, then you likely won’t be able to put in a low ball offer successfully. How long has the property been listed? If a property has been sitting on realeaste.com.au for six months with no interest then there is a fair chance the property is overpriced. At that point, the vendor might be willing to accept something less then they had previously hoped for and meet the market’s expectation. If they aren’t then it’s likely that they are simply asking too much and are not prepared to budge. What’s the vendor’s motivation? How eager is the vendor to get a deal done? If they need to sell the property quickly for family or financial reasons, then you might be able to put in a lower offer with good terms. If the vendor has a set price in mind and no reason to sell, then there is not much chance of getting a low offer through. Has the asking price changed? If the asking price is slowly dropping each week or month, then it’s fair to say that the property was initially priced too high, either by the agent or the vendor. This also shows the vendor does want to sell and that they are prepared to be flexible on what they accept. In this case, a low offer might be something that the vendor is prepared to consider. See your home loan options in less than 5 minutes Typically, the holiday period is a time of year where people spend the majority of their money and increase their debts.

Come the start of the new year, many people can find themselves struggling with that additional debt burden and often turn to short-term, payday loans to try and help them get by. What is a payday loan? A payday loan is a short-term loan for small sums of money that, more often than not, need to be paid back quickly. Frequently, payday loans are up to $2,000 which are then to be paid back by your next payday, hence the name. There are also payday lenders that let you borrow up to $5,000, with longer loan terms. These loans are usually backed by the fact that you have some form of income and can pay them back within weeks. When a loan application is approved with a payday lender, you will generally receive the funds within a few hours. Costs of Payday Loans Payday loans often come with some of the highest costs of any loan type, which is due to a number of factors. Firstly, the amounts are small and are repaid quickly - payday lenders are not able to charge interest on small loan amounts. Secondly, those applying for payday loans generally have poor credit ratings and are not always able to get finance through traditional means. According to ASIC, payday lenders are limited in what they can charge on loans under $2,000 and come with these terms: - a 20% loan establishment fee - a 4% monthly account keeping fee - a 200% fee for defaults - a Government fee - expenses, if the lender needs to take a borrower to court Will a Payday Loan Impact My Credit? All lenders will examine your credit score, which is effectively your track record of paying off debts in the past. They will also assess the types of debts you currently carry, as well as how they impact your disposable income. A lender wants to know that you are someone who manages money well and if you’ve been using payday lenders to get through when money gets tight, this might not be something that is looked on favourably by banks. If you are wanting to get a home loan in the future, it is worth creating a budget to ensure you don’t need to use payday lenders to pay bills for a number of months before applying for a loan or even seeking pre-approval. If you’re struggling with debts, talk to a mortgage broker and find out how consolidating your debts might be another way to better manage your current debts, rather than take on more. See your personal loan options in less than 5 minutes Arguably, the most important element of the property journey is obtaining finance. One of the most confusing parts of the process for first home buyers is the difference between the various types of approvals. Most commonly, when you are looking to obtain finance to purchase a home, there will be two separate approvals that you’re likely to encounter, and it is vital that you understand the differences between them. Conditional Approval If you choose to purchase a home using a ‘subject to finance’, without some form of indication from a lender that you will be able to access that finance, you could find yourself in a tricky situation. Commonly, homebuyers will look to gain conditional approval for a loan, which is more commonly known as a pre-approval. A pre-approval is a powerful tool for the homebuyer, as it gives them a very clear indication from a lender as to what they will be able to borrow, based on their personal and financial situation. Once you have submitted your loan documents and all the required documentation, such as payslips, group certificates and/or bank statements, the credit team will assess your application and if you are successful, you will be issued with a conditional loan approval. What this means is that a bank will pre-approve your home loan, up to a certain borrowing limit, subject to you finding a property that meets the agreed criteria, and provided that your situation doesn’t change in the coming months. Generally, a pre-approval is valid for three months, but it is merely an indication, and not a guarantee that you will get a loan. A pre-approval is a powerful tool for you as a buyer, because it makes you appear serious in the eyes of vendors and sales agents, whilst also giving clarity as to just how much you are able to spend on a property. Unconditional Approval Once a homebuyer has found a property, they can go back to the lender that offered a pre-approval and seek a home loan. When a lender is satisfied that you have met all of their criteria, including LVRs, valuations and your own personal financial situation, you will be fully approved and you will have unconditional approval. It is possible that a lender won’t offer you a home loan after you have made an offer on a property, if that property is unique in some way, or if there are issues with it in the eyes of the lender. The most important part of the loan application process is to work closely with a mortgage broker. They are in the best position to be able to help you navigate any issues that might arise, and they also communicate closely with the lender. If you’re unsure about where your application is at any given time, your mortgage broker will be able to help guide you through the process. See your home loan options in less than 5 minutes When property markets are hot, vendors often choose to go to auction to try and attract the very best price they can. However, many vendors are open to accepting an offer prior to the start of the auction itself. That includes the days and weeks beforehand, not just on the day. Do Your Homework Most homes for sale by auction don’t have a specific price. If anything, the selling agents will likely offer a loose ‘price guide’, which, in many cases, is at the lower end of the spectrum. They do this to encourage as many people as possible to attend the auction and bid, in the hopes it will drive up the price. As a buyer, you need to know how much a property is worth, and that’s even more important when making a pre-auction offer. Use comparable sales from the surrounding area in the last 3-6 months. Ideally, you will find recent sales history for a similar property type, age, and also land component. When making a pre-auction offer, you can point to the sales data to help in your negotiation. Avoid a Dutch Auction If you’re hoping to swoop in early with a strong offer, you don’t want to get yourself into a situation where you are bidding against someone else. This is often termed a ‘Dutch auction’, and it is not all that different to buying a property at auction. All a sales agent really needs are two interested buyers, and that can be enough to push the price well above what it should be selling for, based on comparable sales alone. Know Your Limit If you’re going to be confident making a strong offer, it’s vital that you’re pre-approved for finance so you know exactly where you stand. If your borrowing capacity is limited, this can actually be a good thing in the negotiating process as you can simply state that fact to the sales agent and even prove it to them. It’s hard to make a strong offer, including appealing terms, if you don’t know for sure that a bank will lend you the money. Walk Away The worst thing you can do is get into a situation where you are continually upping your offer. In effect, you are just bidding against yourself. If it’s a matter of a few thousand dollars and the sales agent is clear that is what the vendor needs to make a transaction happen, then that might be the time to work with them. However, if you know your finance limit and also what you believe a property is worth based on comparable sales, then you should stick with that number. See your home loan options in less than 5 minutes Property investing has been a powerful way to build wealth that Australian’s have been using for generations.

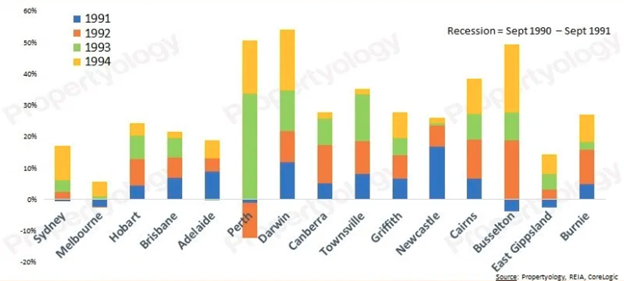

The great thing about property is that there are a number of different approaches you can use that all increase your wealth over time. The exact strategy that you use as an investor will be dependent on your own personal situation, but here are 4 powerful strategies you can use to add value to your property or build a portfolio. Renovate The great thing about investing in property is that, as the owner, you have the ability to add value to your investment. Compare that to the share market and there isn’t much you can do to increase a company’s share price. By doing a renovation, you are able to add value to the property and at the same time, increase the rental yield and overall appeal to potential buyers. The trick to a renovation is to do your research before you start. You want to look at other properties in the same suburb that have similar characteristics. Ideally, you want to see a large difference in price between renovated and unrenovated homes in that suburb. That way, there’s room to make a profit after taking into consideration all the costs involved. Cash Flow With interest rates at record low levels and mortgage rates incredibly affordable, the vast majority of properties in the current environment will be at least neutrally geared. The idea of finding a positive cash flow property is that the income you receive from rent is more than the costs of owning the property. That includes mortgage and interest payments and all costs such as maintenance, repairs, and management fees. A positively geared property puts money in your pocket each month and allows you to build a larger property portfolio than one that is negatively geared. However, just because a property has a high yield and is potentially a positive cash flow property, doesn’t mean it’s a good investment. You still need to buy a property that has the potential for capital growth over time. Getting a Good Deal When a vendor sells a property, they are doing it for their own reasons. Depending on how motivated that vendor is to sell, will tell you how much they are willing to negotiate. Generally speaking, a highly motivated seller, will be far more willing to accept a lower price in return for a quick settlement. A motivated seller is often someone who needs to sell for personal or financial reasons and if you can identify these types of properties, you may be more likely to get yourself a great deal and also create instant equity in the process. Capital Growth Arguably the key objective of most Australian property investors is to look for capital growth potential. Australian property has a long history of appreciating in value and that is expected to continue over the long term. However, the property market is not one big market, but rather thousands of smaller markets made up of tens of thousands of suburbs. If you can identify areas where demand will outstrip supply, then you’ll likely see above-average capital growth as well. These types of areas are often located in highly sought-after owner-occupier areas that have great amenity, access to rivers and beaches and good school zones. Alternatively, they can be areas that are being rezoned and going through gentrification. There’s no one right strategy for property investors, and a more powerful way to create wealth is to try and combine as many of the elements mentioned as you can into your next property purchase. See your home loan options in less than 5 minutes There’s been a lot of talk recently, about the prospect of Australia and many other countries around the world falling into a recession. These days, the word ‘recession’ isn’t as scary as it used to be as most people understand that this is a technical definition, that just means two consecutive periods of negative economic growth. With the severe limitations placed on the economy, through lockdown measures, used to combat the spread of COVID-19, it’s no surprise that the economy might slow down. But as we’ve also seen, things are improving rapidly and business is getting back to normal relatively quickly. That said, it is interesting to look at just how resilient Australian property has been in the past and why we should be optimistic about what that means for the coming months and years. ‘The Recession We Had to Have’ The last time Australia fell into a recession, it was the residential property market that really did buck the trend. The ‘recession we had to have’ happened in the early 1990s after a period of strong growth in the ‘roaring ’80s’ and the ensuing property boom. At the time, growth fell by 1.7 per cent and the unemployment rate jumped to 10.1 per cent. While the numbers looked bad on the surface, they didn’t impact property prices like many thought it might. In fact, it was quite the opposite. In the 12 months after the recession began, property prices in Sydney fell by only 0.7 per cent, Melbourne by 2.4 per cent and Perth by 1 per cent. On the flip side, house prices grew in value in Brisbane by 6.8 per cent and Hobart by 4.2 per cent. Not exactly what many might have expected. In the three years after 1991, property prices showed cumulative growth of more than 20 per cent in 5 of Australia’s 8 major capital cities. Source: Propertyology During that same period of time, unemployment was sitting around 10 per cent, with some areas even higher than that.

As we can see, property prices grew significantly in Perth and Darwin between 1991 and 1994, while our major two cities of Melbourne and Sydney both saw growth of between 5 and 18 per cent. Again, a long way from the calls being made recently of 30 per cent falls. Interestingly, there were also a number of regional areas that performed very strongly through that period as well. House prices in Townsville grew by over 30 per cent, Griffith by around 25 per cent, Cairns by nearly 40 per cent and Busselton in Western Australia by around 50 per cent. This data really highlights the fact that not only does Australian property have a history of performing strongly during tough times, but there really isn’t just one single house market in Australia. The most recent data from CoreLogic has indicated that the combined capital cities fell in value by just 0.5 per cent in May, which they labelled a sign of just how ‘resilient’ the property market has been. As lockdown measures across the country ease and the real estate industry gets back to business, the chances of a ‘V-Shaped’ recovery continue to increase. And once again it looks like property could play an important role in Australia’s economic recovery. See your home loan options in less than 5 minutes In the current low interest rate environment, there are a lot of attractive offers for car finance, particularly coming from dealers.

In some cases, you can even find dealers offering 0% finance. While that might look good on the surface, it’s important to understand that the low interest rate might very well come with some additional costs that you hadn’t anticipated. Here are a few things you need to consider before taking on such a low interest rate. The Car’s Price If you’re getting a deal with 0% interest, it’s possible that you will have to pay more for the car itself. It’s highly unlikely that you’re going to be able to negotiate on the price of the car, and you could even pay far more than you need to. Trade-In Value of Your Old Car If you are looking to trade in your old car, you might not get the best possible price from a dealer if you require a lower interest rate on your car loan. There’s generally a spread that a dealer must make on the purchase of a second-hand car, and that could mean you get a lower price and/or you pay more for your new car. Higher Deposit In many instances, it’s possible to get a car loan and pay little or no deposit. This is unlikely if you are getting a very low interest rate as there is some risk to the lender and dealer. Finance is a trade-off at times, and you will need to provide something more if you need a lower interest rate. Shorter Loan Terms Generally speaking, low interest rates or even introductory offers are only for short set periods of time. While it might be possible to get a standard car loan over seven years, if you’re getting a low interest rate, it might be for only two or three years. If you have a shorter term, then a low interest rate might not make that much sense, because your overall payments will be higher. Fees Sometimes, these type of interest-rate offers come with other fees and charges that soon add up. It’s important to look at the total cost of the car, the finance and the repayments over the lifetime of the loan; not just how much your interest rate is in comparison to others as it does not always tell the full story. Lack of Choice In most instances, low interest rate offers are limited to select vehicles within the dealership. While this might not be an issue, if you are in the market specifically for a certain type of car, you might not find what you want. It is far better to have a finance broker look at your personal situation and find a loan that suits you, rather than focusing on getting the lowest interest rate. Often, the interest rate itself is the least important part of getting finance, even though it is the most talked about. See your vehicle finance options in less than 5 minutes Commercial real estate is attractive to investors for several reasons, and it’s normally the high yields on offer in comparison to residential property that are particularly appealing.

However, commercial property comes with an added advantage in that the tenant generally pays many of the outgoing costs. This can be a significant amount of money and can make an investment in commercial property even more attractive for those investors in search of cash flow. Understanding net vs gross yield Gross yield is the rental income you receive before taking into account the expenses. Net yield is your income after expenses. When you purchase a residential property and rent it out as an investment, as the owner, you’re obligated to pay many of the ongoing costs of the property. This can have a significant impact on your rental yield. These costs include things such as the council rates, strata fees, maintenance and repairs, gardening, insurance, property management fees and water costs. While you have an attractive gross yield of 5%, when you factor in the expenses that you’re paying, your net yield might be only half that. When we look at commercial property and the fact that the tenant is paying many of the outgoing costs, your net yield might be very close to your 5% gross yield. It’s important to note that every commercial tenancy agreement is a little different, and what the tenant is required to pay will be different in most circumstances. The other advantage of commercial property from a yield perspective is that it is normally far greater than its residential counterpart. It’s not uncommon for commercial yields to be well above 7% or even 10% at times, and with the tenant paying outgoings, this is very appealing. For an investor in search of cash flow, it can be an attractive proposition. When looking at the high net yields on offer in commercial property, it is also important to factor in periods of vacancy. Generally, when you have a residential property, it’s quick and easy to find a new tenant to take over. Commercial properties can be harder to find tenants for, as it is businesses that take up the space. With commercial properties, the lease agreements are normally for a lot longer; there are many cases where businesses stay in the same building for decades. See your home loan options in less than 5 minutes One of the most powerful elements of property investing is that you can access the equity you have in your current property to continue to invest and grow your portfolio.

It can be a misconception that you need to have huge sums of money to grow a large portfolio when in reality, you just need to wait for the natural growth that occurs over time and leverage the equity that has been created. What is Equity? Equity is simply the market value of your property, less the money you have owing on it. For example, if your property is worth $500,000 and you have a mortgage of $300,000 remaining on the property, then you have $200,000 in equity that you can access to continue to invest. Building on this example, if the value of your property grew further to $600,000, that would mean that you would then have $300,000 in equity in which to invest. This highlights the power capital growth can have, when it comes to building a large property portfolio. Accessing Equity The first step in accessing the equity you already have in your home is to get your property valued. It is important to get it valued by an independent valuer who works with a range of lenders. Your mortgage broker will be able to guide you on the process. Similarly, they will also be able to help you structure your loans in a way that will be most suitable for your situation. For instance, you might want to cash out a portion of your equity and leave it in an offset account to use as a deposit on an investment property. It’s also worth noting that to access the equity in your home, you will still need to meet the normal requirements from the lenders when applying for a home loan. Mainly, that means you will need to be able to service the loan based on your current income and expenses. Investing Your Equity Your mortgage broker will be able to work with the lender to determine not only how much equity you can access, but they will also be able to set a pre-approval limit for your next purchase. As a general rule, you only want to borrow up to 80% of the property’s value in order to avoid other costs such as Lenders Mortgage Insurance. Returning to the example of our property that is worth $500,000 with a $300,000 mortgage - while you have $200,000 in equity, you will likely only want to access $100,000, which is 20% of the property’s value. These funds can then be used to pay for the deposit on another property as well as additional costs such as stamp duty, settlement and your valuation expenses. Over time, we know that property is an appreciating asset and when your properties rise in value, you will be creating more and more equity that you can continue to access. This is how you can build up a large portfolio, with only the one initial deposit on your first property. See your home loan options in less than 5 minutes Buying a home is quite often the largest financial decision most people make, and it’s one that needs to be carefully considered.

Prior to going down the path of purchasing a home, it’s vital that you get your finances in order to ensure that firstly, you can get the required finance, and secondly, you will be able to manage the repayments going forward. There are a few things you can do with your personal finances to give yourself the best chance of getting into your dream home. Start Saving Being able to manage money is an important life skill, and unfortunately, it is not one that everyone has. When it comes to purchasing a home, there are a number of benefits to having an effective savings plan. The first is that lenders require you to come up with a 20% deposit. While there are other options at your disposal that can help here, generally speaking, borrowers requiring an LVR (Loan-to-Value Ratio) greater than 80% will be required to pay Lenders Mortgage Insurance (LMI), which can be expensive. It’s also worth remembering that on top of your deposit, you could be required to pay stamp duty (unless exempt) and certainly settlement costs, amongst other expenses. Getting into the habit of putting money aside every week and working within a budget and towards a goal will also hold you in good stead when the time comes to start making repayments. Another important consideration is that lenders require you to have a certain amount of money in genuine savings. The ability to show them not only your savings but a track record of managing your money well makes you stand out as a person they will want to lend to. Improve Your Credit One of the key factors lenders look at is a borrower’s credit score. A credit score is effectively your track record of managing debt. Get into the habit of paying off bills when you receive them and always pay down your credit cards each month. Practices like this will help boost your credit score, and lenders will certainly take note. Pay Off Debt If you’re looking to take out finance for a new home, one of the things that a lender will certainly want to know about is any outstanding debts. Your payments on these debts will be a factor in calculating your ability to service any future loans. On top of this, lenders also assess your debt-to-income ratio, and many of the major banks have fixed metrics that they must adhere to. Paying off debts is typically a good idea, regardless. However, when you’re looking to take on more debt, it’s important that you don’t have things like overdue credit cards and personal loans with high interest rates weighing you down. Get Pre-Approved The best way to know just how you are looking financially, in the eyes of a lender, is to get a pre-approval. By talking to a mortgage broker and starting the process of getting pre-approved, you will get a very clear understanding of where you currently stand. If there are any issues with your credit history or outstanding debts, your mortgage broker will be able to sort them out; or at least start the process of turning things around. See your home loan options in less than 5 minutes When Christmas is coming up it’s important to start thinking about your budget over the holiday period.

While we all love giving presents, if you’re looking at potentially applying for a home loan in the new year, it’s important that you don’t do any damage to your chances of getting finance by overspending in the next few weeks. What we do know, is that lenders take a snapshot of your financial situation when they assess your application for finance and if you’ve been busy racking up credit card debt, it might come back to hurt you in the future. Here are some quick tips for budgeting at Christmas. Allocate Money Upfront There’s a good chance that you will be spending this Christmas, so do it wisely. Make a budget and try and stick to it. Lenders will look at your bank and credit card statements from at least a three month period, so if you’re looking to have a clean record for your loan application, it might be worth keeping the charges down. One idea could be withdrawing cash and paying for things with physical money, that way you can allocate funds upfront. Another budgeting idea is to simply spend a fixed amount per person. That way you can allocate a pool of money and everyone gets a fair deal. One of the big traps that a lot of people fall into is minimising the spending at Christmas, only to get sucked into all the Boxing Day and holiday sales. When you’re allocating your Christmas budget, it might be worth applying that to the entire holiday period. Don’t overextend yourself While any credit card debt isn’t great, the worst thing you can do is take on more credit cards. When it comes to borrowing money, your current debt is just as important as how high your credit limits are. If things are a bit tight on your loan application, it might even be worth getting rid of your credit cards to boost your borrowing capacity. This is tough to do if you have outstanding balances and it’s even more difficult if you can’t pay them off. Invariably, if people have the money (or credit) at their disposal, they tend to spend it. Keep both the credit card spending down and certainly don’t take out any new cards in the coming months. Even if there are some great sales on. Avoid Buy Now, Pay Later These days, everyone is moving toward the buy now, pay later (BNPL) phenomenon. While it might be convenient, you don’t want these types of payments to impact your chances of securing a loan. While BNPL isn’t technically an application for finance, it could impact your credit score. More importantly, a lender will make an assessment on what type of borrower you are and if you have hundreds of these types of payments coming out of your account, it won’t look that good on the application. These days, every lender will assess your credit score and go over your bank details with a fine-tooth comb, so it is important to have things in order. Christmas is an incredible time of year and it’s great to give to family and loved ones. Just don’t overdo it or it could cost you a lot more in the long run, when the time comes to get a loan approved. See your home loan options in less than 5 minutes The two most common property investment strategies that Australian investors use are to seek capital gains through buying blue-chip property and to look for higher yields outside the capital cities.

For the most part, there is no right or wrong answer. However, if you execute either strategy incorrectly, you could run into problems. How do these two strategies compare, and what do you need to know about them? Buying Blue-Chip Investing for capital gains invariably means buying properties in blue-chip locations. This simply means buying in premium inner-city areas that have typically seen a long period of capital growth in the past. Capital growth is achieved over the long term because demand will continue to outstrip supply as these are areas that are popular and feature high levels of amenity. The best examples would be areas such as capital cities, their surrounds and beachside suburbs across Australia. The problem with investing in blue-chip suburbs is that the rental yields are generally very poor. While these properties might grow over the long term, if you buy multiple properties, there will come a time when the bank or lender will stop giving you more money simply because the cost of servicing the debt is too high for your income to support. The other issue with this strategy is that you need to buy into the right suburb at the right time. If you buy into a good suburb late in the property cycle, there might not be any growth for a number of years, and if the property is negatively geared, you will have to make up the difference for a long time, which means paying out of pocket each month. Investing for Yield The opposite type of strategy is one where investors seek yield over anything else. Typically, this is when an investor buys into a regional town that could be generating 5% or more in rental yield. When this occurs, there is a good chance the rental income will cover the loan repayments and all the costs associated with owning the property. We call this, a positive cash flow property. The great thing about positive cash flow properties is that you will be able to continue to borrow to buy more properties because the rental income services the debt. While there are other considerations here, such as the overall debt-to-equity ratio of the investor, and also the fact that lenders don’t typically take into account 100% of the rental income, it is still usually easier to obtain finance than if the property was negatively geared. On the flip side, these high-yielding properties might not have the potential for capital growth that a property in a blue-chip suburb would. As a result, while the rental income might be nice even if there is no growth, the investor would still be forced to pay the deposit on another property out of their own pocket. Best of Both Worlds Many of the most successful property investors in Australia recognise the limitations of both strategies in their own right, and look for a combination of both capital growth and yield. There are many regional areas in Australia with large populations that have seen good capital growth over a long period of time. These areas also have solid rental yields that will allow investors’ portfolios to grow over time. It’s also possible to manufacture growth through strategies such as subdivision or renovations. Before starting on your property investing journey, it’s important that you think not just about the first property that you’re going to purchase but also how you can possibly buy more properties down the track. Often, being able to get finance to build a large property portfolio is the hardest part. You should always speak to your mortgage broker, not just about buying one property but how you can work together to buy multiple properties and build wealth over a long period of time by using the correct strategy to get you there. See your home loan options in less than 5 minutes At the moment potential vendors are likely talking to real estate agents about the best way to sell their current property. Particularly in New South Wales and Victoria, it’s very common to sell your property through the auction process.

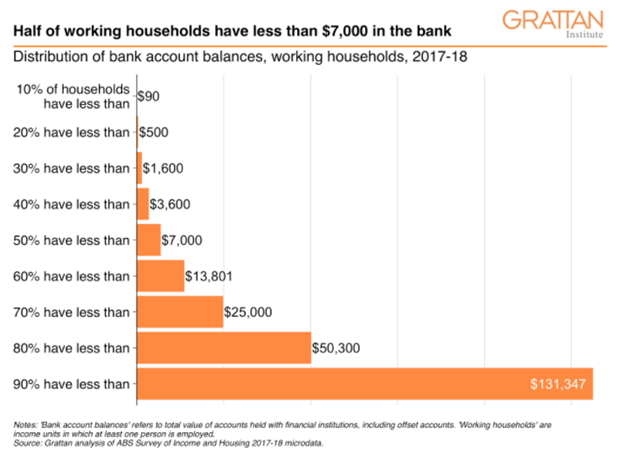

There are several benefits for vendors choosing to sell by auction. Manufacturing Competition If you’re hoping to sell your property for more than it might be worth, the only way you can do that is by having multiple bidders trying to buy it. If you have two or more interested parties, you have a chance that the sales price will keep being pushed higher. If you’re selling by private treaty with only one interested party, that’s unlikely to occur. One of the main advantages of going to auction is that it naturally manufacturers a certain level of competition between would-be buyers. These buyers are forced to compete for a property on auction day, and this often leads to a very good result for the vendor, particularly if your property is in a sought-after location. The Emotional Element If you’re selling a property and the likely buyer is an owner-occupier, the auction process can heighten the emotional aspect of the purchase. When buyers form an emotional attachment to a property, this can then lead to higher sales price for a property on auction day. Generally speaking, most people don’t buy many homes over the course of their lifetime and being required to buy through auction is daunting for many potential buyers. Unconditional Sale When selling your home by private treaty, you are negotiating with a buyer on both the sale price and the terms. When buying a home at auction, the terms of the sale are normally laid out in advance, including how long you have until settlement. Generally, when the hammer falls, the sale is unconditional, which means there are no sunset clauses or opportunities for a buyer to back out. This puts the seller in the driver’s seat and means they can lay out how they want the sales process to unfold. A Quicker Sale The auction process usually takes place over a number of weeks leading up to the auction day itself. Having this hard end date in place often leads to a faster sale. Purchasers know the property is going to be sold and are thus required to be organised and act quickly if they are interested in buying the property. Private treaty sales can become drawn-out processes with a lot of negotiation, and if there is only one interested buyer, this has the potential to continue for many months. You Can Still Sell Beforehand Even if you choose to sell through the auction process, that doesn’t mean you can’t accept an offer prior to auction day. If you have a keen buyer who is putting up a strong offer and it’s one that you’re happy with, you are still able to accept it. Knowing that the property is going to sell at auction can often motivate buyers to approach the vendor with attractive terms, in hopes of persuading the vendor to sell to them direct. See your home loan options in less than 5 minutes In the current environment, with auctions seeing reduced activity, there is once again more focus on private treaty sales. A key part of the sales process when using a private treaty is the offer and acceptance process. Understanding what makes a strong offer is not only important, it could potentially help you achieve a positive outcome. When making an offer on a property, it’s important to understand the implications of what that offer might look like to the vendor. Here are five things to consider before making an offer. Understand a Property’s ValueWhen a real estate agent lists a property for sale at a given price, they are generally going to be using comparable sales data to get a better picture of what that property might be worth. They will be looking at properties of similar size, age and land component and trying to determine how much demand that type of product is receiving in the current market. The first step to putting in a strong offer is to know the market, as well as the sales agent. You need to monitor recent sales and see how fast properties are selling and at what price. Vendor MotivationAfter examining what’s been selling in the vicinity of your property of interest, you need to then focus on why the vendor is selling. While this information might not always be made available to a potential buyer, speaking with the agent is usually the best way to get a better understanding of the vendor’s position. As a general rule, a vendor that needs to sell quickly for personal reasons could potentially be willing to accept a lower price to make that happen. Consider Your Conditions of SaleOne of the big differences between buying at auction or via private treaty is the buyer is often able to include a range of conditions. Conditions are generally things like ‘subject to building and pest inspection’ or a ‘subject to finance’ clause. From the vendors perspective, the fewer conditions you attach to the offer, the more appealing it is. However, a vendor is far more likely to accept an offer with multiple conditions attached if the price is what they want. Always Put an Offer in WritingAn offer is always going to be far more effective if it is in writing. In fact, a vendor has no obligation to even consider a verbal offer. As a buyer, you could potentially even start negotiating against yourself if you don’t have an offer written down. Having Finance Pre-Approved is VitalThese days a ‘subject to finance’ clause is virtually never going to be a deal-breaker for a vendor. Most people buying or selling a home understand the role finance plays when large sums of money are involved. As a buyer, you can have your finance organised well in advance by way of a pre-approval. A pre-approval is something that you can use to show the sales agent you’re a serious buyer, which could help get the deal done. Likewise, a pre-approval will give the vendor more confidence in your offer. This could be important if it is a hotly contested property with multiple offers. The good news is, a pre-approval is something you can talk to your mortgage broker about well in advance. It will help you get a better understanding of what you will be able to borrow and therefore how much to spend. If you’re constrained by your borrowing capacity, this could also be a good negotiating tactic. See your home loan options in less than 5 minutes Over the course of the last few months, the COVID situation has shown us just how important it is to have some money in the bank. During the lockdown, many Aussies experienced job losses and lowered income, and as the weeks in isolation rolled by, even generous government payments couldn’t stretch to cover the bills and many savings accounts were depleted. According to research from the Gratten Institute, only 20 per cent of Australians have more than $50,300 in savings. A whopping 50 per cent of Australians have less than $7,000 in the bank. Unfortunately, these numbers are certainly telling us that the average Australian isn’t prepared for that rainy day when it finally arrives. Source: Gratten Institute Given the long-term strength of the housing market in Australia, it’s understandable that most Australians have a large portion of their wealth tied up in the family home. Perhaps they put any spare cash into paying down their loans, which is a prudent thing to do. However, that doesn’t always make it easy when you need to access some spare cash.

Fortunately, there are a few money management options for homeowners who want to get their hands on some cash - just in case. Redraw Facilities In years gone by, most borrowers have looked to a simple principal and interest loan with the goal of paying it over the lifetime of the loan - normally 25 to 30 years. Some of these loans afford you the ability to redraw any extra money you’ve put into the loan, over and above the contracted principal loan and interest repayments. Basically, if you’re ahead on your payments, some lenders will let you access that money, a little bit like a savings account. While this is good in theory, and certainly some Australians will have accessed this type of facility in recent months, the big issue is that the offer to redraw is still at the discretion of the lender. So theoretically, a lender can refuse a request to access these extra funds. With that being the case, while a redraw facility is still a positive step toward having cash on hand when you need it, there might just be better options for borrowers to consider. Offset Account These days there is a wide array of loan products that can significantly increase a borrower’s flexibility and reduce the amount of interest paid over the lifetime of the loan. For most borrowers, the best feature is often having a 100 per cent offset account. An offset account is basically a transaction account, that is linked to your loan. Money in the offset account reduces the overall loan balance which in effect, cuts down your interest payments. It’s a way of having your cake and eating it too. By parking some spare cash, or your savings in your offset account, you are going to be saving a significant amount of interest. This is because mortgage rates are virtually always higher than the interest you pay on your mortgage than on savings accounts, or even term deposits. And you can be sure they are far higher than any type of transactional account. You’ll be saving a significant amount of interest and that will put you ahead of just trying to save. Refinancing Depending on your personal circumstances, you could consider refinancing and accessing equity that has been built up in your home. You can then take advantage of your offset account by parking that equity in there and accessing it as you need it, while not paying interest on it. This money could be used in an emergency or even for something like the purchase of an investment property. Not all offset accounts are created equal, but that’s something you can talk to your mortgage broker about. What’s important is that you have control of your finances and you’re able to use that extra money or equity should you need it. As we’ve already seen, $7,000 in savings is not a lot, when something unforeseen comes along. See your home loan options in less than 5 minutes With property markets looking very strong, many potential sellers are looking at ways to spruce up their homes. One of the best ways to entice buyers and make an immediate impact on the value of the property is to increase the curb side appeal of your home.

Here are 4 ways to quickly improve your property’s exterior. Outdoor Dining/Living As the seller, it’s in your best interest to help buyers see the potential of your home. Most people like to dine and spend time outside. If you have an attractive outdoor area or garden, adding a table and chairs is a simple way to show people how they can use that space. Do the creative work for them. Tidy up the Garden If you have a potential family home or even an inviting outside area, cleaning up the garden can make a huge difference. Pruning back trees and mowing the lawn is a great start and really adds to the immediate appeal of an outside area. On top of this, take a quick trip to your local garden centre and grab some simple and cost-effective things - like pebbles - to use in areas that are a bit bare. Similarly, adding some pots of succulents can do a lot to make things look more aesthetic. Paint the Doors One of the most cost-effective ways to boost appeal straight away, is with a coat of paint, and the front door is a part of the home that often gets overlooked. A wooden door and even wooden window frames are ideal to paint; this gives the entrance a fresh and tidy feel when you first walk through the door. Clean the Roof A relatively cheap way to make an older house look newer is to clean the roof. While in some cases your roof can be painted, it’s time-consuming and expensive. A far better option, especially if you have a tiled roof, is to hire someone to clean it. Most professionals use high-pressure water to spray it down. This can make an ageing roof look new again, which will only add to the overall appeal of your property. See your home loan options in less than 5 minutes A commercial property is simply a premises in which business takes place. Many investors may have never considered investing in commercial property, purely because they may not fully understand it.

Most people would set foot in a commercial property almost every single day of their life. From their office building to the local supermarket, service station and even day care centre. Generally, commercial properties fall into specific categories, based on what they are used for. Retail Whenever you go to a restaurant, café, or go shopping at a boutique or shopping centre – you’re stepping into a retail property. Retail is normally located in popular areas where there is plenty of foot traffic, as the types of businesses that own and lease these locations need direct access to customers. Generally speaking, retail properties are more expensive and have lower yields than other types of commercial properties. That’s often due to the nature of the locations they are in. These are already popular areas with great amenities, and the land value is high for both residential and commercial properties. These properties can be quick to lease out. However, there are some risks as businesses such as restaurants can turnover regularly. The great thing about retail businesses like restaurants and cafés is that they are often synonymous with a certain location. That means that if a business is successful, they will potentially stay there for a very long time. Office If you go to work in an office, then the odds are that your business leases that building. However, in some circumstances they might own it. Offices can vary greatly from the premium high-rise locations that you might see in a CBD, all the way out to small office blocks in the outer suburbs that might be used by a small accounting firm or lawyer. Offices can therefore be priced very differently depending on where they are located. One consideration with office space is that businesses might leave if they outgrow the space, as the types of businesses that lease offices don’t always rely on a location. Industrial Industrial property encompasses different types of spaces such as warehouses or manufacturing factories. Typically, industrial properties are not in premium locations and are therefore priced a little lower than other types of commercial properties. This also means yields can be higher at times. Some industrial properties can be very appealing as tenants stay for long periods of time. Conversely, properties like warehouses are simply renting out floor space and not generally fixed in that location. In recent years, warehouses have been in high demand as many businesses move online and need additional space for storage. Specialist Properties Some commercial properties are considered more specialised and don’t fit into one of the above categories. The most common specialised properties are places like services stations and childcare centres. While these types of properties can be attractive, they also come with some risk. Specialist properties typically only attract a single type of tenant – one who operates those types of business – whereas other properties such as office, retail and industrial can be used for a wide range of purposes across different businesses. See your loan options in less than 5 minutes  Those individuals that work for themselves or run a business can, at times, find it a little trickier to get different types of loans. Lenders like to see regular income and ongoing work to give them some degree of comfort that a borrower will be able to repay the loan.

A self-employed borrower will have an income, however, it’s likely not going to be as regular as someone who is paid a salary. With that in mind, there are still options that self-employed borrowers can look at, to get a car loan. Lo-Doc Loan A lo-doc loan is effectively a loan given to a borrower that doesn’t have as much income documentation as a regular wage earner would. When assessing an application for a lo-doc loan, a lender will want to see other forms of income verification such as an accountant’s letter, BAS statements or tax returns. Given there is less evidence to suggest a borrower can make their repayments, the interest rate can be higher than a different type of loan product. It might be possible to offset this higher rate by putting up a larger deposit, or by securing the loan with the car. A secured car loan means the car is put up as security which gives the lender an additional degree of comfort as their risk is reduced. If a borrower can’t make the repayments, they are able to sell the car to recoup any costs. If you’re trying to get a lo-doc loan, it’s important that you have a good credit score, which means ensuring you’ve been paying off all your debts and bills on time in the past. A good credit score means you’re someone who can manage debts well and this should give the lender confidence that you will do the same now. A Chattel Mortgage If the car you’re looking to purchase is for business purposes, then one option you could look at is a chattel mortgage. A chattel mortgage is a type of car financing for business owners. If you use a car for work more than 50% of the time in the day-to-day operations of running your business, you might be able to qualify for this type of finance. The benefit of using a car for work is the ability to deduct some expenses from your taxes. However, it’s important to seek the advice of a qualified accountant prior to taking out this type of loan. Business owners might not be protected by the National Consumer Credit Protection Act (NCCP), which could be an issue for some purchasers. See your vehicle finance options in less than 5 minutes In the current market where property prices are trending higher and there’s a shortage of stock, upgraders and downgraders can find it difficult to get into a new property. For many, the age-old question of whether to buy first or sell first is more prominent than ever with the present housing market favouring sellers.

Fortunately, there is an option that can help in the form of a bridging loan. A bridging loan is a short-term loan that helps buyers purchase a property before needing to sell their current property. In a perfect world, you would sell your property and then go out and find a new property. However, if the perfect home comes along beforehand, you might not want to miss out on the opportunity. That said, there are advantages and disadvantages to bridging loans. Advantages Speed The main benefit of a bridging loan is that you can buy a property right away. You don’t have to wait for the property to sell or even to settle, which can be a long time in some instances. It will also give you room to sell your property, so you aren’t forced to sell immediately at a worse price than you might have received otherwise. Capitalised Interest When you take out a bridging loan, it is normally an interest-only loan, where you pay back all the interest at the end when you sell your original property. With this type of loan, you’re only needing to pay back one mortgage at a time and can pay off all the accrued interest when you sell and settle on your current property. Standard Rates In years gone by, bridging loans weren’t as appealing as they often came with very high interest rates. These days many lenders will offer standard variable rates, but as always, policies differ between lenders and products. Disadvantages More Interest When you are taking on a bridging loan you are technically carrying two properties and therefore will be paying interest on both. The longer it takes to sell your current property the more interest you will be required to pay. Some lenders might even force you to pay higher interest rates after a set period of time. Higher Costs There are certain areas where you will need to pay additional costs when using a bridging loan. For example, given that you have two properties, you will need to pay for two valuations. There can also be costs involved with breaking your current loan to take on a bridging loan. Need To Service the Debt To qualify for a bridging loan, you still need to be able to service the total amount of debt based on your income and expenses. In some ways, this is similar to getting an investment loan. You will also need to have a reasonable amount of equity built up in your current home. See your home loan options in less than 5 minutes One of the biggest mistakes new property buyers make is not understanding how much a property is actually worth. This is common with inexperienced buyers who have trouble purchasing a property at auction.

The auction process is not always easy to navigate, which is why it’s important to find out how you can quickly and easily get a better understanding of what a property’s true value actually is. Ask An Agent Sales agents are at the coalface of the property market. They are normally very approachable people who are prepared to take the time to discuss property in their local area. If you’re interested in purchasing a certain property, it’s possible to contact a number of local agents and get their opinion on what it might be worth. Agents know what types of property are currently in high demand, as well as what has recently sold and for how much. They can be a very valuable tool in getting a clear understanding of what your property (or one you want to purchase) might be worth. Online Tools These days there are a host of free online tools that can value a property. It’s simply a matter of entering the address and the algorithm will give you a quick idea of what a property is likely to be worth based on recent sales history. While this is not a perfect valuation, it should give you some idea of what a property is worth because it does factor in what has been selling in the local area. Hire A Valuer If you want a very accurate idea of a property’s true value, you can hire a professional valuer. Many buyers choose to do this as a lender will require a valuation before approving a home loan. While a lender may not accept your independent valuation, it will give you an accurate idea of what a property is worth and if you can afford it. Comparable Sales The vast majority of valuers in Australia price a property based on comparable sales. Comparable sales are simply sales of similar properties that have occurred in the past few months. The good thing these days is that much of the sales data is available for free online, and you can use those figures independently to come up with a rough valuation. The most effective way to do this is to go to a listing portal that provides recent sales data and find all the properties in the same suburb that have occurred in the past three to six months. From there, you can narrow that list down to properties that match yours in terms of the dwelling type, age, condition, and land component. At this point you can see the sales of properties very similar to your own. This will give you a good idea of what the property might be worth. If there is a property that has sold that is very similar to your property of interest, you can take this one step further and contact the sales agent to get an idea of how the property sold. Ask them how many people viewed the property and how many offers were made. If the property sold at auction, see if you can get any insight into the number of bidders and how it went. The more information you have the better, as this will help you make the most informed decision about your own property, or one that you’re looking at buying. See your home loan options in less than 5 minutes Owning your own property is normally very high up on the list of things people want to achieve in their life. However, depending on your financial goals and what stage of life you’re at, what you hope to achieve with property will likely differ quite considerably.

For first home buyers, the biggest question is usually whether to rent or buy? Advantages of Buying Capital Gains The most obvious advantage of buying a property is that you own it and benefit from the capital gain on the property, should its value increase. However, you also have to pay all the costs such as council and water rates and ongoing maintenance. You Control It When you own a property, you get to do anything you want to it. A common complaint from renters is that they aren’t even allowed to put up a picture hook. That’s not an issue if you buy a house. Add Value If you own a property, you’re able to add value to it and manufacture equity in certain ways. The most common strategy for this is to do a small renovation or even a subdivision. More Affordable In a lot of cases, you will find it is more cost effective to buy than rent, in the current environment, thanks to record-low interest rates. If you’re living in an area where you can pay less on your mortgage than you would renting, then the incentive is certainly there to go out and buy. Advantages of Renting Flexibility One of the greatest benefits renters enjoy is flexibility. Many people who choose to rent do so because they are able to rent in highly desirable locations, like the inner city that offers a great lifestyle and amenity. For many of these high-demand locations, purchasing a property can be very expensive and outside the budget. Lower Fixed Costs Costs are usually less of a burden for renters as the landlord is generally required to pay many of the ongoing costs of the property, including strata fees, water and council rates, and maintenance. Cash Flow Renting can allow you to free up more cash, so you can put it into other ventures. If you’re trying to start a business or you want to spend your money on things like travel, then renting can be advantageous. Rentvesting Over the past few years, there has been a growing push from property investors in Australia to continue renting and purchasing an investment property instead of a home to live in. This is a way you can get the best of both worlds – you can live in a great location and still invest in property elsewhere. Rentvesting is increasingly common in places like Sydney and Melbourne, where house prices are higher. See your home loan options in less than 5 minutes While we all have different goals when it comes to property investment, for those out there that want to continue to grow their portfolio there are a number of important considerations to take into account. Many homeowners unwittingly become investors when they look to upgrade their first home and decide to keep the original property. However, if you are looking to build a property portfolio quickly, you will need to consider many other factors.

Capital Growth The most common way investors continue to expand their property portfolios is by accessing the equity in their homes to use as a deposit on future investments. This is only possible if the initial property grows in value. Capital growth ultimately comes down to supply and demand. If a property has steady demand, then over time the value of that property will increase. We see this a lot with inner-city locations that are well-located and have plenty of amenities. The first step to finding great locations to invest in is to look beyond your own backyard. Most new investors like to invest in an area they are familiar and comfortable with. However, this might not be the best way to grow your property portfolio. Cash Flow While capital growth is what ultimately increases your property portfolio’s value and lets you expand your portfolio, it’s cash flow that will help you service the debt. If you invest in a property that has a low yield where the rental income is less than the cost to service the debt, then you have a negatively geared property. This type of property is typically found in larger cities and well-located areas. While these properties make great investments if you want to expand your property portfolio, down the track a negatively geared property will weigh on your ability to service future loans. A positively geared property is one in which the rental income is greater than the cost of holding the property. These types of properties are found in outer suburbs and regional locations. While not as well-located, the higher yields help to boost your cash flow, making it easier to grow your portfolio. Adding Value Arguably the most powerful thing about property is that you have the ability to increase the value of your investment. If you were to invest in shares, for example, there is really nothing you can do to boost their value, leaving you at the mercy of the market. With property, there are a number of strategies you can use to add significant value to an asset. The most obvious way to do that is through a cosmetic renovation. A renovation adds value to a property, and also has the benefit of making it more appealing to tenants, which can boost rental yield. Houses on larger blocks of land might also be candidates for subdivision or development. It’s possible to subdivide a portion of a property and sell off an unused area of land. You could even build a new home on that piece of land. The benefit of this strategy is that you can very quickly manufacture value and you don’t have to wait for either capital growth or rental income. See your home loan options in less than 5 minutes Over the past few months, we’ve been hearing more about serviceability buffers and how they might impact home buyers’ ability to borrow. However, many people don’t understand what a serviceability buffer is and how it works. Simply put, a serviceability buffer is the minimum interest rate a lender is expected to use when assessing a loan application. Lenders look at a borrower’s income and expenses to determine how much capacity they have to borrow. On top of this, they take into account the potential interest rate payments both now, and in the future. They do this by applying a serviceability buffer over and above the minimum monthly payment, based on current interest rates. The body that implements these serviceability buffers on banks and lenders are known as The Australian Prudential Regulation Authority (APRA). APRA are an independent Government Agency that sets the serviceability buffer requirement and also implements other measures aimed at helping maintain the stability of property. Other measures APRA looks at include limits on debt-to-income ratios or LVRs. Recently, APRA announced that it would be increasing the serviceability buffer of home loan applications from 2.5% to 3%. This effectively means borrowers will be able to access less money and have a smaller borrowing capacity. APRA estimates the 50 basis points increase in the buffer will reduce maximum borrowing capacity for the typical borrower by around 5%. With interest rates at record low levels, the belief is that the RBA will eventually raise interest rates, however, at this stage, they have indicated that this might not happen for some time. Raising serviceability buffers are a way to reduce the overall level of lending and also cool property markets that have been running hot, particularly along the East Coast of Australia. Higher serviceability buffers generally impact investors more than owner-occupiers, given they often carry higher debt loads. The last time serviceability buffers were introduced were during the most recent property boom on the East Coast in 2015, which lead to a slowdown in house price growth. See your home loan options in less than 5 minutes |

EDITOrCategories

All

Archives

December 2023

|

|

Read about us on KochiesBusinessBuilders and Linkedin

Partner with Adobi Mortgage Solutions Contact Bruce Johnstone (03) 9996 8553 or email [email protected] |

©2021 ADOBI® MORTGAGE SOLUTIONS ABN 94465268443

Suite 405, 585 Little Collins Street, Melbourne, VIC 3000 Telephone: (03) 9996 8551 Credit Representative Number 536529 authorised under Australian Credit Licence 384324 Your complete financial situation will need to be assessed before acceptance of any proposal or product Please review our Lenders, Terms of Use and Privacy Policy Member 87449: AFCA - Australian Financial Complaints Authority Member M-351557: FBAA - Finance Brokers Association of Australia |

RSS Feed

RSS Feed