|

As the price of property surges across Australia, so does the cost of getting into the property market for many first home buyers.

For the most part, if you’re wanting to get a home loan from a bank or lender, they will require you to come up with a deposit. Depending on the lender, this can be anywhere from 5-20%. With house prices continuing to climb, many first home buyers get stuck in the trap of trying to save money for a deposit, only to watch house prices increasing in value and leaving them behind. Fortunately, there are ways first home buyers can get into the market more quickly and with a lower deposit to ensure they don’t miss the opportunity to enter the market. One of the most popular options for many first home buyers is to use a ‘Family Guarantee’ or ‘Guarantor Loan’. A family guarantee effectively uses the equity in another person’s property to account for a portion of your deposit. The most common situation is when parents use the equity in their home to help their children buy their first home. In practice, it is possible to use the equity in a family member’s home to cover the 20% deposit for the purchase of a property. The balance of the loan is then secured against the property you are buying. It’s also worth noting that the person or persons that act as a guarantor can limit their guarantee to only that portion of the loan. In the example of parents putting up the 20% deposit through their equity, they would not be liable for the full value of the property. However, this is something you should speak to your mortgage broker about. When you use this type of strategy, it is possible to effectively get a high loan-to-valuation ratio (LVR) without the need to pay lenders mortgage insurance (LMI). LMI is a form of insurance that is in place to protect the lender, and the borrower is required to pay it when they are borrowing more than 80% of the value of the property. LMI can run into the tens of thousands of dollars and is a significant cost that borrowers need to manage if they intend to access a loan with an LVR above 80%. The other advantage of using a guarantor-type loan is that first home buyers are still able to access the various first home buyer grants. For many first home buyers, the ability to access the various grants and also be exempt from stamp duty is the real reason why they are able to get into the property market. In recent times, first home buyers have been able to access other programs such as the First Home Loan Deposit Scheme (FHLDS), which operates in a similar manner and where it is the government that effectively helps guarantee higher LVR loans. However, there are price caps on the properties you can purchase, and the program is limited each financial year. While using a family guarantee is a great way for first home buyers to get into the property market, it is still not without its risks. The guarantor is putting their property at risk should the borrower default on their payments. It is vital that you speak with your mortgage broker and get professional advice before deciding to go down the path of using a family guarantee or guarantor loan. See your home loan options in less than 5 minutes Even if you don’t have any loans or debts, having a credit card might be enough to significantly reduce your borrowing capacity.

The reason why a credit card can be a hindrance to your ability to borrow money, is that lenders assess your credit card on the overall limit, not on how much you currently have in credit card debt. Even if you’ve never reached your credit card limit since you’ve had the credit card, many lenders will assess a credit card as if it is maxed out. For example, if you have a credit card with a limit of $10,000, the lender is likely to assess your debt based on around 3% of this total amount per month. This monthly amount, which in this case would be $300, is added to your ongoing expenses, with the result that your overall borrowing capacity is reduced. With a credit card limit of $10,000, that could mean a $75,000 reduction in borrowing capacity, which is significant and can quickly limit the number of potential properties a first home buyer has access to. Assessing Your Situation Lenders do not only focus on what your credit card limit will do to your borrowing capacity. They also take other factors into consideration! One of the most important elements of any debt, in the eyes of a lender, is your track record of making repayments. If you continually miss payments and increase your debt levels, that doesn’t bode well in the eyes of a bank. Similarly, if you are living off your credit card, and are one pay cheque away from not just missing a payment, but also missing your rent, then that doesn’t make you look overly appealing in their eyes. It is important to understand that, with the implementation of Comprehensive Credit Reporting (CCR), lenders have incredibly detailed data on your spending habits, drilling down to how early or late you pay off your debts, or other bills. Credit Cards Are Not All Bad Now that we understand the impact credit cards have, it’s also important to note, that having a credit card is not necessarily a bad thing in the eyes of a bank. As mentioned, how you manage your credit cards is far more important than the fact that you have them. Lenders like to see that you are responsible with money. In fact, if you have a credit card and manage the credit very well, you will be looked upon far more favourably than someone who doesn’t have a credit card at all. Whether or not you get rid of your credit cards to help you get a home loan really comes down to a few key factors.

If you’re reliant on your credit cards, take a step back and assess your personal financial and living situation and get that in order before you start the home loan application process. First home buyers in Australia are in an enviable position at the moment, with a host of both state and federal government incentives available, making it far easier than it has been to get into a home of their own.

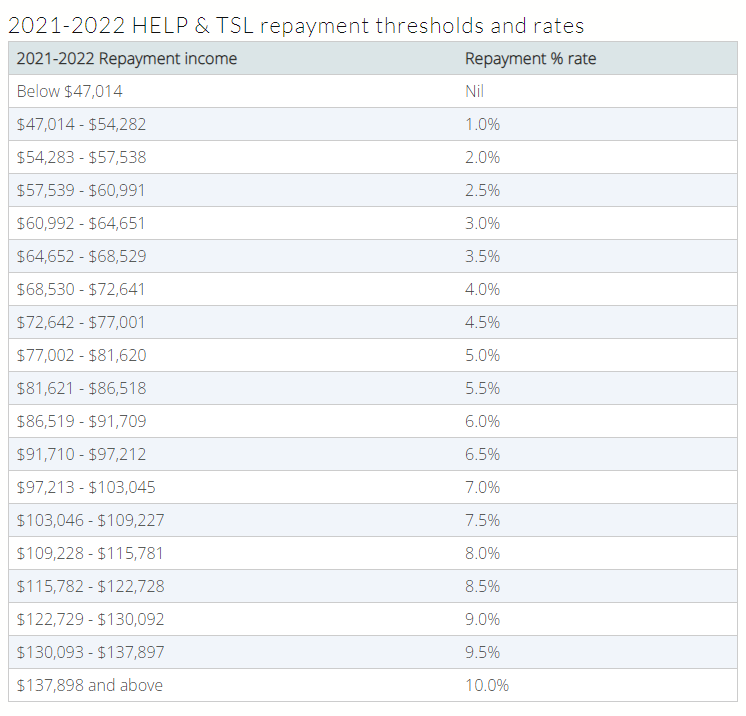

While there are a range of grants and exemptions available in the current environment, one of the most effective is the First Home Loan Deposit Scheme. The First Home Loan Deposit Scheme is a federal government backed initiative, that allows first home buyers to buy a home without needing a large deposit. Generally speaking, most lenders like to see a homebuyer contribute a 20 per cent deposit, which equates to an LVR (loan to value ratio) of 80 per cent. When the deposit drops below that 20 per cent threshold, the buyer is often asked to pay Lenders Mortgage Insurance or LMI. LMI is an insurance policy that effectively protects the lender if either the value of the property falls significantly, or if the borrower gets themselves into financial trouble. While LMI is a one-off premium, the cost can be well above $10,000 which puts more pressure on the home buyer, who is also being asked to contribute a deposit. As a result, the Federal Government introduced the First Home Loan Deposit Scheme, which allows a first home buyer to contribute as little as five per cent as a deposit and the Government will effectively act as the guarantor to the loan. In some ways, this is similar to a guarantor loan, which would commonly see a first home buyer’s parents acting as the guarantor. The added benefit of the First Home Loan Deposit Scheme, is that it can be used in conjunction with the other incentives and grants that are available to first home buyers. That means a first home buyer will still be able to access the First Home Owners grant and stamp duty exemptions that most state governments provide. The First Home Loan Deposit Scheme is also available to be used alongside some of the other federal and state government building grants such as HomeBuilder. However, there is an important consideration when looking at the packages. To access the First Home Loan Deposit Scheme, you will still be required to contribute a five per cent deposit from genuine savings. That means things like the first home owners grant won’t count towards your deposit. Accessing the First Home Loan Deposit Scheme While the First Home Loan Deposit Scheme, will be able to get people into their first home faster, there are still a list of requirements that you must meet to access the program. The first is that the property you’re intending on purchasing must be less than the various caps that have been set for each state and territory. State or Territory Capital city and regional centres Rest of state New South Wales $700,000 $450,000 Victoria $600,000 $375,000 Queensland $475,000 $400,000 Western Australia $400,000 $300,000 South Australia $400,000 $250,000 Tasmania $400,000 $300,000 Australian Capital Territory $500,000 – Northern Territory $375,000 – On top of these limitations, there are also requirements around how much you’re able to earn. Singles must be making less than $125,000 per year, while couples can only earn $200,000. Each financial year the Commonwealth Government makes 10,000 grants available and 5,000 of these are allocated to both CBA and NAB, while the remaining 5,000 are spread amongst second and third-tier lenders. It’s also important to note, that you will still have to meet the normal serviceability requirements to access the grant. That means you’ll have to have enough income to service any debt, based on your current earnings and expenses. The best way to see if you’re able to access the First Home Loan Deposit Scheme, is by speaking with a mortgage broker who will be able to assess your current situation and what you’re looking to achieve. The High Education Contribution Scheme (HECS) or Higher Education Loan Program (HELP) is effectively a Government loan that enables people to afford the costs of higher education. The program works by allowing people to pay back their student loans at a time in the future when they are earning enough money to comfortably cover the payments. In the last decade, the cost of higher education has skyrocketed, and this has forced many students to take up a program like HECS or HELP, so they can continue their education. Once they have completed their education, most people never really think about the impact of HECS debts, as it is normally something that is taken care of at tax time. The repayment rates are generally quite low and not overly burdensome for most people. However, what many people don’t realise is that these student debts will have an impact on your ability to borrow money when the time comes to buy a house. This can be particularly impactful for people like first home buyers, or even those on high incomes, as the repayment rates increase sharply. When banks and lenders assess your ability to service debt, what they are doing is determining your normal income and expenses, with the understanding that you will be able to service debt with spare income. If you are carrying a large amount of student debt that you are required to pay back by law, it can weigh heavily on your ability to borrow. For a lot of people, a few hundred dollars per week can be the difference between buying a home and not being able to get finance. For that reason, it is very important to understand what your student debt looks like and the level of repayments that you’re required to be making. This is the current repayment table.  If your income falls below $47,014, you’re not required to pay back any of your HECS debt. This is the category into which people who are new to the workforce will most likely fall.

By the time you are earning around $100,000 per year, you will be required to pay back approximately 7.5% of the total outstanding student debt. For a HECS debt of around $50,000, that could see your borrowing capacity reduced by anywhere from $75,000 - $100,000, which is quite significant if you’re looking at buying your first home. The reality is that the majority of Australians will have some form of student debt that they are required to pay back. The best option is to always speak to your mortgage broker and get a clear picture of your borrowing capacity well before you even look to put in an offer on a property. That way, regardless of your situation and current income and expenses, you will know where you stand. See your home loan options in less than 5 minutes When the time comes to apply for a home loan, many would-be borrowers are shocked to learn that a few simple mistakes have cost them the chance to get finance.

Lenders have several checks they run on all applications and if you’ve made these errors you might be out of luck. Fortunately, there are some things you can do to turn these things around and get approved. Not Paying Bills on Time When you go to apply for a loan one of the first things a lender will do is look at your credit score. If you pay bills late, you might find yourself with a number of defaults. This is when a payment is well overdue. Defaults will hurt your credit score and can make a lender less likely to lend you money. It’s also important to note that there is so much data available to credit agencies these days, that they can tell just how efficient you are at paying your bills. If you are always late that doesn’t bode well for them, when the time comes for you to pay them back. Too Many Credit Cards These days, just about anyone can get a credit card. In fact, many banks will send out letters offering to increase your credit card limit or give you another credit card. The problem is that while it might be great to have a $50,000 credit card limit when the time comes to borrow money from a bank, this limit will impact your chances. The bank assumes you have maxed out your card and will reduce your borrowing capacity accordingly. These credit card limits are often the difference between getting approved or coming up short. Short-Term Loans While it might be nice to drive the latest car or take out a personal loan for a holiday, these types of debts could be weighing you down. Personal loans, car loans and credit card debt all attract high interest rates and those monthly expenses add up and can really hurt your borrowing capacity. Lenders also don’t like to see these types of debts as they suggest you’re not someone who has good money management skills. Applying for Too Many Loans Credit is often available to those people who need it the least. If you’ve been applying for loans regularly and even worse, if you’ve been applying for loans and getting declined often, that is going to make it much more difficult to get a loan when you really need it. Every time you apply for credit it shows up on your credit record which lenders can easily access. Getting rejected or making lots of small applications for credit is viewed negatively by lenders and also tells them a lot about your money management habits. The best thing to do is to seek a pre-approval before officially applying for a loan. That way your mortgage broker can quickly and easily tell you how your application is looking and suggest changes to the way you’re managing your finances, if a loan is unlikely. If you can clean up your finances for a few months, a lender will be far more willing to take you on, as opposed to someone with a patchy credit record and lots of short-term debt. See your home loan options in less than 5 minutes Over the past few years, it’s become more common for parents to help their children purchase a property. As property prices have risen sharply, particularly in places like Sydney and Melbourne, entry into the property market is not as easy as it was a generation ago.

More and more parents are helping their children get a foot into the market, given that prices continue to rise each year. Here are some ways parents can help their children get that first property. A Guarantor Loan A guarantor loan is a way that a close family member (normally parents) can help provide a deposit for a home loan. Generally speaking, lenders like to see that a borrower is able to come up with a 20% deposit on the property they wish to purchase. This shows the lender, that they are a borrower that can manage money, while it also gives the lender some security in the event the borrower is unable to meet their repayments and they have to step in. A guarantor loan works by having a parent put up equity in their own property (normally the family home) as a deposit. This means the borrower can potentially get a loan and avoid things like Lenders Mortgage Insurance (LMI). There are some considerations with this type of strategy. Significantly, the parent’s property is at risk in the event the children can’t meet the repayments. A guarantor loan also means you are effectively borrowing nearly 100% of the property’s value. The ability to get a loan is still dependent on the borrower’s ability to service the loan, based on their current income and expenditure. A Gift In many instances, parents will simply give their children a sum of money to use as a down payment on their first property. The main issue with this is a lender will likely still want to see that a borrower has some kind of genuine savings. Genuine savings is really just money a borrower has saved up over a period of time. Ideally, this would be the 20% deposit that they had been working towards saving. Lenders will typically want to see that these funds have been sitting in a bank account for some period of time. The policy with genuine savings and gifts varies between lenders and it’s always advisable to speak with a mortgage broker about your personal situation. Property co-ownership While not as common, it is possible for parents and children to own a property together. Before entering into this type of arrangement it’s advisable to speak to an accountant who can direct you on the correct tax structure to use. This is due to the capital gains implications that might not be present with just a single property owner or a couple. Another consideration with property co-ownership is how the arrangement works on a practical level. Who pays what and when? If the children are living in the property, are they going to be paying rent to the parents and how much? These are things that you will need to outline, even before you begin searching for a suitable property. The other consideration will be how do you actually finance the property? If both the parents and children have regular incomes to service any debts, then it might not be an issue. However, if one party does not have a regular income – for example, if the parents are retired or the children are students – then this might impact their ability to borrow. See your home loan options in less than 5 minutes Buying a home is typically the most expensive purchase you’re ever going to make. The thing that makes property a powerful investment is that you can borrow a large portion of that cost from a bank. However, there are still a number of other costs that homebuyers need to be aware of before they start their search for a property, as those costs could impact what they can afford. LMI While banks are prepared to lend a large portion of the value of a property, they still like to see that a borrower is able to contribute 20%. That deposit shows them that the borrower is capable of managing money effectively, and it also protects them in the event they do default. It is possible to borrow more than 80% of the value of the property; however, you will likely be required to pay lenders mortgage insurance (LMI). LMI is a one-off upfront premium that is put in place to protect the lender. The cost itself varies, depending on how much you are looking to borrow, the LVR and even the location of the property. This can be a sizeable amount and needs to be factored in prior to starting your property search if you have only a small deposit. Valuation/Loan Costs To have your loan application formally approved, one of the conditions is usually that the property undergoes an adequate bank valuation. This gives the lender an indication that you have paid a fair price for the property. There are different types of valuations a lender will require in terms of how the property is valued. However, as the borrower, you will need to pay those costs. These fees are also on top of any loan establishment or application fees. Insurance When you are approved for a loan and ultimately settle on the property, you need to immediately start thinking about looking after that property. The first thing you will need to do is to make sure you have the right types of insurance in place. The most important is normally home and building insurance as this will cover the structure itself. If you are buying a freestanding home, this will be your responsibility. If you’re buying into a strata complex, this might be recovered in the strata fees. On top of this, you can also consider contents insurance or rental insurance if the property is for investment purposes. Property Management If you’re buying an investment property, it is easy to forget about the upfront costs associated with property management. A property manager can be a valuable resource in helping you take care of your asset while also making your life a lot easier. However, you will need to pay them for various services. Property managers charge their fees based on a percentage of the rental income, usually somewhere between 5 - 10%. There are several other upfront costs as well, such as the letting fee, which is normally two weeks’ rent, the cost of getting professional photos done, and various other admin costs. You should expect to receive no rental income for around two months after taking into consideration the upfront fees and the monthly payment cycle most property managers use. See your home loan options in less than 5 minutes Buying a home is quite often the largest financial decision most people make, and it’s one that needs to be carefully considered.

Prior to going down the path of purchasing a home, it’s vital that you get your finances in order to ensure that firstly, you can get the required finance, and secondly, you will be able to manage the repayments going forward. There are a few things you can do with your personal finances to give yourself the best chance of getting into your dream home. Start Saving Being able to manage money is an important life skill, and unfortunately, it is not one that everyone has. When it comes to purchasing a home, there are a number of benefits to having an effective savings plan. The first is that lenders require you to come up with a 20% deposit. While there are other options at your disposal that can help here, generally speaking, borrowers requiring an LVR (Loan-to-Value Ratio) greater than 80% will be required to pay Lenders Mortgage Insurance (LMI), which can be expensive. It’s also worth remembering that on top of your deposit, you could be required to pay stamp duty (unless exempt) and certainly settlement costs, amongst other expenses. Getting into the habit of putting money aside every week and working within a budget and towards a goal will also hold you in good stead when the time comes to start making repayments. Another important consideration is that lenders require you to have a certain amount of money in genuine savings. The ability to show them not only your savings but a track record of managing your money well makes you stand out as a person they will want to lend to. Improve Your Credit One of the key factors lenders look at is a borrower’s credit score. A credit score is effectively your track record of managing debt. Get into the habit of paying off bills when you receive them and always pay down your credit cards each month. Practices like this will help boost your credit score, and lenders will certainly take note. Pay Off Debt If you’re looking to take out finance for a new home, one of the things that a lender will certainly want to know about is any outstanding debts. Your payments on these debts will be a factor in calculating your ability to service any future loans. On top of this, lenders also assess your debt-to-income ratio, and many of the major banks have fixed metrics that they must adhere to. Paying off debts is typically a good idea, regardless. However, when you’re looking to take on more debt, it’s important that you don’t have things like overdue credit cards and personal loans with high interest rates weighing you down. Get Pre-Approved The best way to know just how you are looking financially, in the eyes of a lender, is to get a pre-approval. By talking to a mortgage broker and starting the process of getting pre-approved, you will get a very clear understanding of where you currently stand. If there are any issues with your credit history or outstanding debts, your mortgage broker will be able to sort them out; or at least start the process of turning things around. See your home loan options in less than 5 minutes Traditionally, the Christmas and New Year period is the time of year where many of us tend to overspend. While this might be well-meaning, as most people are simply buying gifts for family and friends at Christmas or going on holiday, you need to be sure that it doesn’t blow your budget.

If your goal is to buy a property in the new year, then it’s important to not let a Christmas splurge get in the way of your real estate dreams. Here are a few ways to better manage your money ahead of the holiday season. Put the Credit Card Away The problem with credit cards is they are easy to use and not always easy to keep track of. During the lead-up to Christmas, it’s very easy to get carried away spending. This can not only hurt your savings, but it also makes it appear that your typical spending habits are a lot higher than they might be. A lender will take close look at your expenses over the previous three months when assessing a home loan application, and if they are excessive, it could dent your serviceability and risk getting your loan application rejected. If you don’t particularly use or need your credit card, it can often be a good idea to get rid of it altogether, as lenders assess your credit card as if it is fully maxed out. Allocate Funds in Advance We all know that budgeting is important but for most people it is not only hard to do, but hard to implement. One of the best ways to effectively budget is to allocate all your spending money in advance and put it on a debit card. This way, there is no chance you can go over budget. It’s even possible to have multiple debit cards for different areas of your life, such as essentials, spending money and things like bills and expenses. Then, you simply transfer funds to them each week. While this might seem a little over the top, if your goal is to get on the property ladder, then it might be well worth going to these lengths for even a short period of time. Avoid Borrowing While it might be very tempting to jump on a plane after what has been a few rough years for those that love to travel, don’t take on any debts in the process. Many people like to put their holidays on credit or even take out a personal loan. The problem with adding debt is that this money needs to be paid back. When you have debts, it weighs on your serviceability. Given that credit cards and other unsecured debts attract incredibly high interest rates and need to be paid back in a matter of years at the latest, this can really hurt your bottom line when applying for a loan. For first home buyers, even a $100 per week payment on a credit card or loan could be enough for you to miss out on getting a loan for your first property. If your goal is to buy a property, wait until you’ve settled on the property and made a new budget before going out and spending money you don’t have on a trip. See your home loan options in less than 5 minutes |

EDITOrCategories

All

Archives

December 2023

|

|

Read about us on KochiesBusinessBuilders and Linkedin

Partner with Adobi Mortgage Solutions Contact Bruce Johnstone (03) 9996 8553 or email [email protected] |

©2021 ADOBI® MORTGAGE SOLUTIONS ABN 94465268443

Suite 405, 585 Little Collins Street, Melbourne, VIC 3000 Telephone: (03) 9996 8551 Credit Representative Number 536529 authorised under Australian Credit Licence 384324 Your complete financial situation will need to be assessed before acceptance of any proposal or product Please review our Lenders, Terms of Use and Privacy Policy Member 87449: AFCA - Australian Financial Complaints Authority Member M-351557: FBAA - Finance Brokers Association of Australia |

RSS Feed

RSS Feed