|

After a tough period over 2022 and 2023, the commercial property market can look ahead to consolidation and the prospect of a recovery emerging in 2024, according to Knight Frank.

Knight Frank Chief Economist, Ben Burston, said the sustained pressure of higher rates has naturally put pressure on asset values and this is still playing out to varying degrees. “Part of the uncertainty has been a disconnect between formal valuation metrics and market sentiment,” Mr Burston said. “However, with more deal evidence now coming through and formal valuations likely to be adjusted further in the December cycle, we expect the gap between sentiment and formal valuations to erode substantially over the next six months so that by mid-2024 the picture will be clearer for buyers and sellers alike, helping to restore confidence and liquidity.” Mr Burston said that while reductions in asset value are never welcome, the flipside is the re-emergence of value looking forward. “Higher yields act to reset the market and provide a more attractive entry point for investors, generating the prospect of higher returns,” he said. “This is clearly illustrated when we assess historic market cycles and the performance achieved after pricing is reset in the aftermath of interest rate hiking cycles.” He said the period immediately after the conclusion of previous rate hike cycles ending in 1994, 2000 and 2010, was in each case a very attractive time to buy, achieving above-average returns over the following five years. “This is not to say that history will repeat, and investors cannot take for granted that interest rates will fall exactly as anticipated,” he said. “But careful asset selection will maximise the chances of strong performance whether it is achieved through income growth or boosted by a return to yield compression as interest rates revert in 2024-26.” Record low vacancy rates across the industrial property sector will continue to put upward pressure on rents, according to a new CBRE report.

The CBRE report said that industrial rents are expected to rise by more than 5 per cent next year, with Sydney experiencing a spike of more than 11 per cent. Across Sydney, industrial rents rose 38 per cent this year to $200 per square metre with the vacancy rate falling to just 0.2 per cent. CBRE’s head of Industrial and Logistics Research Australia, Sass J-Baleh, said about 4.6 million square metres of warehousing is due to be built over the next two years, with half already pre-committed. “We expect that even if demand weakens significantly in 2023, there is still not enough supply to satisfy space requirements from major occupiers that are setting up their activities and supply chains for the long-term servicing of the Australian population,” Sass J-Baleh said. With property markets cooling down from the recent boom, there are now more opportunities for investors to enter the market. With listings increasing and less competition, it could be a good time to think about buying an investment property.

Here are some quick tips for investors. Get specific – while national property markets might be slowing down, it doesn’t mean that all locations are. When investing, research properties at the suburb level and compare the number of listings with overall demand to get a sense of what’s happening in that area. Tight supply can drive prices higher. Crunch the numbers – with borrowing costs on the rise, it’s important to have a clear understanding of how much your investment is going to cost and what it’s going to take in. Talk to experts like property managers if you need more information – and don’t get emotional about the purchase. Work with a mortgage broker – in the current interest rate environment it’s important to compare your mortgage options to get the best interest rate and loan product for your personal situation. A mortgage broker is an incredibly valuable asset for investors. Real estate around the world is expected to outperform both bonds and shares over the next five years, according to a new report from Oxford Economics.

Between 2022–2026, Oxford Economics have predicted total returns for real estate and real estate investment trusts (REITs) to average 6.5 to 7 per cent per annum. This is significantly higher than bonds and equities, which are expected to return just 0.7 per cent and 2.5 per cent per annum, respectively. Oxford Economics expects interest rates to remain at low levels in the coming years, which will help underpin real estate prices and drive economic growth. Prime industrial rents surged by double digits in most capital city markets in 2021 as tenants were pushed to compete for the small amount of available space on the market. According to JLL, the highest prime effective rental increases occurred in Perth (up 14.6 per cent), Melbourne (14 per cent) and Adelaide (13 per cent) over 2021. In the secondary market, effective rents rose 16 per cent in Brisbane and Melbourne and 10 per cent in Sydney. Around the country, a record 4.4 million square metres of warehouse space was taken up in 2021. This is a 52 per cent rise on the 2.9 million square metres taken up in 2020. The data from JLL shows that prime industrial rents increased by more than 10 per cent in most capital city markets, fuelled by the acceleration of online retailing and supply chain disruptions. JLL believe the completion of 1.3 million square metres of new logistics facilities in the next six months will ease pressure on companies needing warehouse space and create a more normalised rental market. Two-thirds of this new supply is already accounted for in leasing pre-commitments. Fourth-quarter 2021 figures from JLL show 877,200 square metres of space was leased over the last three months of the year. The majority of this activity was in Melbourne (39 per cent) and Sydney (33 per cent). Last year, JLL says 1.47 million square metres of new space was developed nationally, which was in line with the 10-year annual average. The full-year gross take-up total (4.4 million square metres) was 82 per cent higher than the long-term annual average. JLL still expects above-average growth in the major markets in 2022 with many owner-occupiers requiring immediate access to more space. While most people will typically look to take out a variable home loan, it is first worth considering what might happen with interest rates in the future and whether that means you should think about a fixed-rate home loan.

A fixed-rate home loan simply means that the interest rate on the home loan is fixed for a certain period of time. For most fixed-rate home loans, that is going to be around two to five years. However, there are a number of other factors that you need to consider apart from just the fixed interest rate. Advantages The main advantage of a fixed-rate home loan is that with a set interest rate, you will have a degree of certainty around your weekly and monthly repayments. If you have budget constraints, then fixing your home loan might be an option so you know where your finances stand each month. However, if you believe interest rates are going to rise in the future, it might be worth looking at locking in a fixed-rate loan. This will ensure your repayments remain at their current level for the term of the loan, regardless of what happens to underlying interest rates and changes from the RBA. Disadvantages While it is good to have certainty around your repayments, one of the big disadvantages of a fixed-rate home loan is the lack of flexibility. If you take out a fixed-rate loan and want to change out of it or refinance, there are likely going to be higher break costs involved than with a simple variable loan. Also, a number of the features that can save you a lot of money, such as offset accounts and redraw facilities, are typically not available on fixed-rate home loans. While you might save money with rising rates, you could have potentially saved even more if you’d had a superior loan product with more features. In the current environment with record-low interest rates, there are numerous home loans with very attractive introductory offers. If you qualify for a home loan with an introductory rate, that might be a better option than going with a fixed-rate loan. It would be more flexible, and the net result could be very similar. Finally, it’s also worth noting that actual rates that come with fixed-rate loans are often a reflection of where banks and lenders believe interest rates are headed. If fixed-rate loans have higher interest rates than comparable variable rates, it suggests lenders believe rates will rise. Even if you take out a fixed-rate home loan, your repayments might still end up being more, even if interest rates and your repayments would have risen with a variable home loan. If you like the idea of having some certainty, but you’re still not convinced about a fixed-rate home loan, then it is possible to fix a portion of your loan. That way you can get the best of both worlds. Be sure to contact your mortgage broker to discuss your options. See your home loan options in less than 5 minutes In the current economic climate, low interest rates are not just a bonus - they are expected. Fortunately, if you are working with a mortgage broker, they will be able to help you get the very best deal you can and that will mean you will be receiving the very best interest rates on your home loan. So how do you actually go about getting a lower interest rate? Ask for a Better Rate As simple as it sounds, if you feel you could be getting a better rate, you might simply be able to ask for one. If you’ve been with a lender for a long period of time and have a great track record of making your repayments on time, they won’t want to lose you. That gives you some power to go and ask for a better rate. In many instances, lenders will incentivise new borrowers with low rate deals for a period of time. Your mortgage broker might be able to help you get a better rate simply by asking them for the same type of deal new borrowers are getting. Be a Borrower Banks Love If you want to negotiate lower rates or even refinance, you need to be someone that banks will happily lend to in the first place. There are a number of factors that might make your loan application far more appealing than other borrowers. This might include, only asking for a lower LVR - this means your loan is a far safer proposition. Have a strong employment history. If you’ve been in the same job for many years and are in a permanent position, banks are going to be very happy to lend. Lenders are assessing the risk that you are going to pay them back, so having steady employment is a key indicator for them. You will also need to have a good credit history. A track record of payments made on time with no defaults is vital to get the best possible rates as any blemishes on your credit history will severely impact your application, let alone your negotiating power. Walk Away The reality is that refinancing is a real option for most borrowers and one they should strongly consider. If your bank is not prepared to budge, it might be worth looking elsewhere and walking away. If you are a borrower that banks love and you’ve already asked for a rate cut, then you should really be looking at your options. Your mortgage broker is always going to be your first port-of-call and they will be able to quickly and easily assess your options and match you with the right type of loan and the best possible interest rate. The days of sticking with the same lender for 30 years are long gone and it is important that all borrowers are constantly hunting for the very best deal they can find - especially when it comes to interest rates. See your home loan options in less than 5 minutes Now that the new year is here, it’s time to start looking at all the ways you can make the most of your investment property. Tax is a complicated subject, which is why you should always speak to an accountant. However, the onus is on you to keep good records.

Keep Good Records If you want to claim your expenses on your rental property, it’s vital that you have good records. If you’re working with a property manager, this can be made a lot simpler as they will likely take care of all the running costs for you. However, if this is a new investment property or you’re self-managing, then you need to keep all the documents and receipts that you think will be relevant. Know Your Deductions While your accountant will know exactly what you can and cannot claim, it’s important that you take responsibility for examining all the associated costs that come with the property and seeking clarification from the accountant. Typical expenses that you can claim include: ● Repairs and maintenance ● Improvements/Renovations ● Advertising costs ● Cleaning ● Gardening ● Water ● Electricity and gas charges ● Pest control ● Land taxes ● Lease / property management costs ● Security monitoring costs ● Capital works Pre-Pay Your Expenses Depending on the type of loan you have, it might be possible to pay your interest upfront; hence you can claim it as a deduction for that financial year. Depending on your overall income and tax planning, this might be a useful strategy to consider. Similarly, it is also possible to pre-pay things like insurance and even do repairs and maintenance early. Claiming Depreciation If you have a new property or if you’ve undertaken significant renovation, then it might be worth looking at how you can claim depreciation. To do this, you will need a depreciation schedule, and this is commonly done through a quantity surveyor. Many investors fail to claim depreciation, and this can be a mistake. It certainly is if you have a new house or apartment. Interest Expenses Often, the largest expense that investors face is interest on their home loan. It’s important to understand that interest expenses and the associated fees and charges are tax-deductible expenses. See your home loan options in less than 5 minutes While we all know that property prices have risen steadily in Australia for many decades, there is a big difference between the top-performing properties and those that have struggled. While the suburb and area are important factors in property selection, many investors fail to identify some of the red flags that might weigh on a property’s potential for growth.

These are some of the most common red flags to look out for: Hidden Costs While most investors will pay close attention to the asking price of a potential property, many miss some of the hidden costs. While building and pest issues are usually addressed, there are other hidden expenses that it is important to look for. If you’re looking at buying an apartment or unit, the costs that come with a strata complex can be very high. In most cases, you will be required to pay strata fees, which are typically higher in newer buildings that offer facilities such as gyms and pools. Similarly, strata companies generally put money towards things such as sinking funds or even have special levies in place to pay for large capital works. Older buildings can experience a range of expenses relating to maintenance, upgrades, or restoration. Be sure to get a copy of the minutes from the past few strata meetings to see what the board has in mind for expenses going forward before buying a strata-titled property. Whereas if you own a house or even a block of land, councils can require ratepayers to contribute additional levies for projects in the area. This has the potential to hurt your investment as you not only have to pay the costs, but you’ll also have trouble selling the property until those expenses have been met. Public Housing While we all know that suburbs grow at different rates, it’s important to take into consideration things like public housing in the area. If there is a lot of public housing on a certain street, it’s likely that the entire block will be negatively impacted in terms of possible growth. A Long Listing If a property has been on the market for a long time, there is likely a reason for this. It could just be that the vendor has unrealistic expectations. However, in certain circumstances, there might be a more serious issue with the property. This doesn’t necessarily rule the property out; however, if the vendor is unwilling to negotiate, you are well within your rights to walk away. On the other hand, it is important to remember, that just because a property is reasonably priced, doesn’t always mean it’s good value. Incorrect Listings While sales agents might be good at selling properties, they are not always property experts. This is often the case when it comes to things like the development potential of property. These days, if you can subdivide a property, it will likely be marketed as having that potential. A property with development potential will often be priced higher than a comparable property that can’t be subdivided. The issue with these properties is that not all sales agents are experts at property development. Just because an area has been rezoned to encourage development doesn’t necessarily mean that every property will be a viable one. It is always best to do your own due diligence on a property before making an offer. Or, at the very least, include in your offer some key clauses that protect you. Most Australians are familiar with investing in real estate and understand the value that a property portfolio can create over time.

However, few property investors venture outside the world of residential property and consider commercial property. While commercial property is a little more difficult to understand than residential, it offers several significant advantages for investors. Higher Yields Most commercial properties have far higher yields than residential properties. It’s not uncommon to see 7-10% yields on commercial properties, which is something that few residential properties can generate. The benefit of high yields is that your asset is contributing to your cash flow every month. Most residential properties are negatively geared investments. Lower Costs Generally, the tenant of a commercial property pays all the outgoing costs associated with the property. That includes maintenance, rates and any strata fees. That means that the rent you receive each month is net of costs and the only real expense that you need to consider is property management fees. All leases are different, so it is important to get the lease reviewed prior to purchasing a commercial property. Loyal Tenants One of the big appeals of commercial properties is that they have long-term leases. It’s not uncommon to see commercial properties leased out to the same tenant for many decades. The reason for this is simple; it is the place of business, and the location is often a vital component of a business. However, the flip side of a long lease is that it can take longer to attract a new tenant in the event the business decides to end the lease. Steady Growth Commercial properties are priced a little differently from residential properties, in that the price is based on a multiple of the lease price. This can make commercial properties a little harder to understand for many new investors. The important thing to understand is that lease increases are generally incorporated into the lease. What this means is that each year the lease will increase in line with either inflation or the broader market. Capital Growth Potential Many people believe residential property is superior to commercial because of the ability to improve a property and add value to it. However, this is equally true of commercial property. As mentioned, the value of the property is tied to how much that property leases for. Anything you’re able to do to increase that lease will mean a higher property value. Things like renovations and subdivisions are quite feasible with commercial properties. Ultimately, whether to invest in commercial or residential isn’t mutually exclusive. A balanced property portfolio should contain a combination of both residential and commercial, and the mix will depend on where you are in your investment journey and what your financial goals are. One of the most frustrating things that could happen to a homebuyer is getting your application for finance declined.

By this stage, you’ve already likely been to dozens of home opens, organised all your paperwork and potentially even put an offer in on a house. Falling over at the last hurdle is not only frustrating, but it can also feel like your dreams are over. But they don’t have to be, and more importantly, there are a few things you can do to make sure your loan application doesn’t get declined. Borrowing Amount The more you’re looking to borrow from a lender, the more risk it presents to them. If you want to borrow more than 95%, that can be a red flag for a lender. Most banks like to see you come up with a 20% deposit, which means an 80% LVR. While this might not be possible, there are other options you can look at like a higher LVR and paying Lenders Mortgage Insurance. If you do need to borrow with a higher LVR and only have a small deposit, you might want to look at a guarantor loan or even taking advantage of a Government program such as the First Home Loan Deposit Scheme. Stable Employment In a perfect world, when you apply for a loan, the lender would like to see that you’ve got a long-term stable job with a regular paycheck. Unfortunately, things are not always that simple and these days, many people have very unique work situations. If you’re self-employed or haven’t been in your current job for at least six months, then lenders might not look favourably on your application. Fortunately, there are lenders that understand your situation and therefore it is important that you work with a mortgage broker who can match your employment situation with the right lender. If you’re unemployed, you’re going to have a very tough time getting finance of any kind. These days, even if you’re asset rich, you still need to be able to show how you intend to service the debt. Credit History Having bad credit is often a red flag to a lender and it is not always one that is easy to overcome. If there is an error that has been made on your credit file, then that is something you can sort out. However, if you’ve been bankrupt in the past, you might need to work with a specialist lender. Spending Habits Banks and lenders like to see that you’re able to manage money effectively. If you’re spending habits aren’t great, then that’s likely a sign that you might not be able to manage a mortgage. Putting together a few months where you keep your spending habits under control is important. But it’s also more important to not have a host of debts that need paying each month, such as car loans or personal loans. Lenders don’t look favourably on these types of costs as they are fixed costs, unlike your discretionary spending. Buying an Unusual Property If you’re looking to buy a property that might be tricky to sell in the future, banks won’t like the look of it. That might mean a holiday home or even a rural block of land. Banks will always consider the worst-case scenario, and if they need to sell the property because you can’t make the payments, they want something that will be able to sell quickly and easily. Get Pre-Approved To avoid getting into a situation where you might get declined, it’s vital that you go and speak to a mortgage broker before you even start looking for properties. That way, they’ll be able to assess your personal situation and also give you some guidance around the types of properties you’re going to be able to afford. See your home loan options in less than 5 minutes Summer is a great time of year to do a few jobs around the house. It’s also a good time to start planning ways to build some equity in your home with a simple renovation. Here are some strategies that can quickly build equity with a small renovation or even just a touch-up.

Landscaping The first thing a new buyer looks at when they enter a property is the exterior and the gardens. Tidying up the garden and outdoor areas and making them into beautiful places that a family could enjoy is a great way to build appeal. Convert the Laundry These days, there’s less need for an entire room to be dedicated to a laundry. So, the space is perfectly set up to be converted into another bathroom or even an ensuite. Adding an additional bathroom can really increase the appeal of a property and give it a modern touch. Remove Internal Walls If there is the opportunity to remove an internal wall to open up the living area, this can really make a big difference. This is the type of renovation that might only cost a few thousand dollars, depending on the nature of the wall that is being removed, but could have a big impact on its value, as it can modernise an older style property. Remember that every property is a little different and it’s not always possible to do this. Clean the Roof A very quick and easy way to make the exterior of your home more appealing is to wash the roof with a high-pressure cleaner. This method can turn an older roof into one that looks fresh and modern. Cleaning the roof is an especially good option if you’re looking to sell the property. Kitchen/Bathroom These are the classic two updates that have a huge impact on the state of a property. Potential renters will likely pay a premium for a new bathroom and kitchen, while the property will also be a lot easier to sell if both are modernised. Even the simplest kitchen renovation takes time and planning. You will need to make sure you have the budget in place to get the result you want. Painting & Window Coverings When it comes to value for money, you can’t go past a fresh coat of paint and new window coverings. While it will likely cost you a few thousand dollars to have a property painted by a professional, this is one job that you can take on yourself. New window coverings are also a great way to make your home look a lot more modern. If you’re looking to sell, you should consider investing in both. See your home loan options in less than 5 minutes When you purchase a property with finance, the lender will typically order a bank valuation to help them ascertain the loan to value ratio (LVR) of your home loan. For new home buyers, this might be something that you’ve never thought about before, but the outcome of the bank valuation could have big implications for your home loan. How does a bank valuation work? When you purchase a property that is subject to finance, the bank will order a valuation of the property through an independent valuer. The independent valuer will use a certain method to estimate the true value of the property. A valuer could use a desktop valuation, where they estimate the property’s value based on comparable sales and never visit the actual property. Alternatively, they would do what is known as a kerbside valuation, where they will attend the property and look at it from the exterior to do their valuation. The most common form of valuation is the full valuation, which involves the valuer attending the property and looking through it. They then formulate their valuation based on comparable sales of the other properties. When the bank has the independent valuation, they use this figure to calculate the borrower’s LVR. How does the bank valuation impact borrowing? When applying for a loan with a lender, a bank will normally want to see the borrower has a 20% deposit. This gives them a level of security in the event of a property price fall, or if the borrower defaults on their loan. Borrowers can obtain higher LVR loans, however, they normally come with Lenders Mortgage Insurance (LMI). There are also other programs in place such as the FHLDS or specialist loans (like guarantor loans) that can help first homebuyers who need to take out higher LVR loans. If a bank valuation comes in lower than the price you paid for a property, then you could find yourself in a situation where you have to make up the difference to ensure you are keeping within the LVR required by the lender. That could mean needing a higher deposit or looking at other options such as paying Lenders Mortgage Insurance (LMI). Both of which could cost tens of thousands of dollars. See your home loan options in less than 5 minutes One of the key differences between buying at auction or buying using a private treaty is that a sale at auction is unconditional. That means, as a buyer, you’re not able to add conditions such as subject to finance or subject to a building and pest inspection. Therefore, you need to be prepared and organised when the time comes to make a bid at auction.

Here are some things you should do to best prepare when a house you want goes under the hammer. Know the True Value When a property is selling at auction, it’s important to have a realistic understanding of what that property is likely going to sell for. Typically, properties will sell for a similar price to comparable houses that have recently sold in the same area. The best way to identify comparable sales is to look at property sales in the same suburb, with a similar property type and land component as the real estate you’re looking to buy. Understand Auction Day Most people only buy a few properties over the course of their life. That means if you’re buying a home at auction, it’s likely you’re not going to be very experienced at the process. It’s a good idea to attend a number of auctions in advance so you can get an idea of how the process works and to help you feel more relaxed on the day. Organise Your Finances It’s vital that you have your finances in order before any property purchase, but it’s even more important when you are buying at auction, given the sale is unconditional. The easiest way to do this is to speak to a mortgage broker and start the loan preapproval process. The most important part of preapproval is that it should give you confidence you can likely get a home loan when you bid at auction. However, it will also give you clarity around exactly how much you can pay for a property. Understand the Conditions If you are to bid at auction day, you will need to register with the sales agent and make yourself familiar with the conditions of sale. It’s vital that you review the conditions of sale as it will outline when and how much deposit is to be paid. If you’re unsure about anything, consider getting the documents reviewed by a professional. If you want any inspections done, such as building and pest, it’s up to you to take care of that prior to auction day. See your home loan options in less than 5 minutes Leading Australian valuer Knight Frank believes the sharp growth we’ve seen in industrial assets is set to continue in 2022.

Industrial assets have seen growth of around 15% over the course of 2021 and Knight Frank believes this is a trend that can continue for years to come. Ben Burston, chief economist at Knight Frank Australia, forecasts capital growth at 6% in 2022, as well as a rent rise of 6% in Melbourne, 5% in Sydney, 4% in Brisbane and 3% in Adelaide. Mr Burston suggests the recent growth we’ve seen in industrial assets has come about from investors being prepared to pay more for the same streams of income. He believes this is going to change with price growth likely to come from tighter supply and upward pressure on leases, with demand starting to drive up rents. According to Mr Burston, leasing take-up volumes are 31% above their long-run average on the east coast, pre-leasing activity for new buildings grew by 11% in the year to October 2021 and demand from large users for industrial real estate is likely to exceed supply in 2022. Knight Frank also notes, that there is likely to be an increasing shift towards local manufacturing on the back of the ongoing supply chain issues faced throughout the past 2 years. Mr Burston also believes the office market is set for a turnaround in 2022 after a long period of high vacancy rates. He says that pent-up demand for office space will boost absorption rates and drive market recovery, with the flight to quality indicating that premium and upper A-grade space will be at the forefront of the resurgence in demand. Many businesses that require office space have been waiting for conditions to improve and with the opening of international borders and lockdowns likely to have ended, there will be a push for companies to upgrade their space and return to their respective CBDs. See your home loan options in less than 5 minutes Despite a tough year for many businesses, Australia recorded a record level of foreign investment in commercial property.

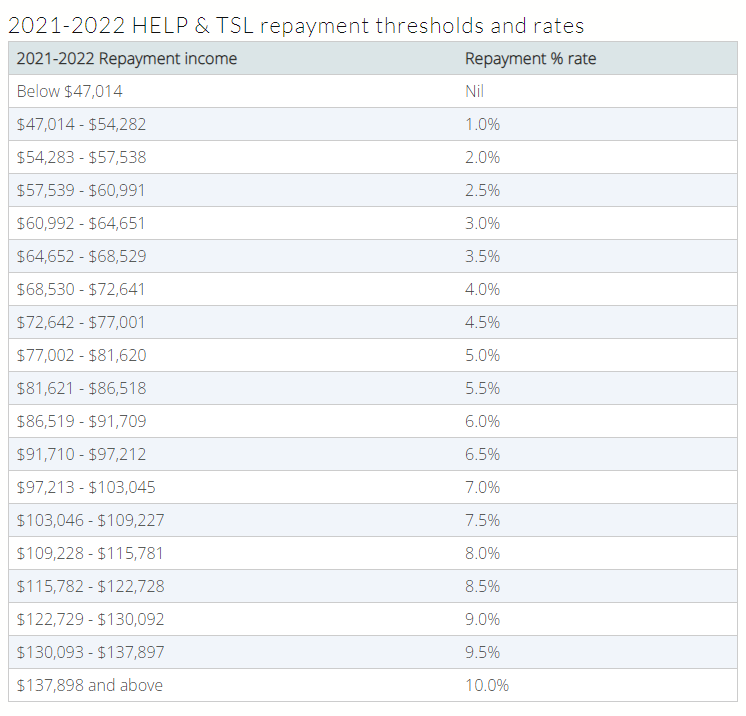

According to analysis from CBRE, 2021 saw $16.6 billion in office, retail, industrial and hotel assets changing hands, outstripping the previous record high level of $15.5 billion achieved in 2015. CBRE notes that while many experts predicted closed international borders would hinder international investment in commercial property, the opposite turned out to be true. This is due to many international investors partnering with local fund managers to identify commercial property investment opportunities. In terms of which countries are most actively investing in Australian commercial property assets, North America accounted for the highest share at 39% of all funds invested. North America has been the number one country looking to invest in Australian commercial real estate over the past five years. This year’s level of investment from North America was up sharply from pre-pandemic levels. In second place was Singapore, which contributed 35% of this year's activity, also up on the pre-pandemic average. According to CBRE, some of the major transactions this year involving foreign investors include the $925 million sale of a 50% stake in Grosvenor Place to Blackstone, the $3.8 billion sale of the Milestone industrial portfolio to a partnership between GIC and ESR Australia, the $538.2 million sale of a half stake in Sydney's Queen Victoria Building, The Strand Arcade and The Galeries to a Link REIT/EG Funds partnership and the $315 million of the Sofitel Wentworth Sydney hotel to KKR, Futuro Capital and Marprop. Looking at the different sectors and it has once again been Industrial & Logistics that were the most invested asset class with 44% of total sales. The office sector was closely followed in second place with 43% of total sales. Despite having a tough two years, the retail sector is expected to see renewed interest in 2022 with the reopening of international and state borders and the end of many other restrictions. CBRE expects Australia to continue to see strong international capital inflows into commercial property market next year, with the market being viewed as an attractive proposition given the available returns and the relative strength of the economy compared to parts of Asia, North America, and Europe. See your home loan options in less than 5 minutes The High Education Contribution Scheme (HECS) or Higher Education Loan Program (HELP) is effectively a Government loan that enables people to afford the costs of higher education. The program works by allowing people to pay back their student loans at a time in the future when they are earning enough money to comfortably cover the payments. In the last decade, the cost of higher education has skyrocketed, and this has forced many students to take up a program like HECS or HELP, so they can continue their education. Once they have completed their education, most people never really think about the impact of HECS debts, as it is normally something that is taken care of at tax time. The repayment rates are generally quite low and not overly burdensome for most people. However, what many people don’t realise is that these student debts will have an impact on your ability to borrow money when the time comes to buy a house. This can be particularly impactful for people like first home buyers, or even those on high incomes, as the repayment rates increase sharply. When banks and lenders assess your ability to service debt, what they are doing is determining your normal income and expenses, with the understanding that you will be able to service debt with spare income. If you are carrying a large amount of student debt that you are required to pay back by law, it can weigh heavily on your ability to borrow. For a lot of people, a few hundred dollars per week can be the difference between buying a home and not being able to get finance. For that reason, it is very important to understand what your student debt looks like and the level of repayments that you’re required to be making. This is the current repayment table.  If your income falls below $47,014, you’re not required to pay back any of your HECS debt. This is the category into which people who are new to the workforce will most likely fall.

By the time you are earning around $100,000 per year, you will be required to pay back approximately 7.5% of the total outstanding student debt. For a HECS debt of around $50,000, that could see your borrowing capacity reduced by anywhere from $75,000 - $100,000, which is quite significant if you’re looking at buying your first home. The reality is that the majority of Australians will have some form of student debt that they are required to pay back. The best option is to always speak to your mortgage broker and get a clear picture of your borrowing capacity well before you even look to put in an offer on a property. That way, regardless of your situation and current income and expenses, you will know where you stand. See your home loan options in less than 5 minutes One of the most powerful elements of property as an asset class is the fact that you can use leverage.

Not only are you able to access finance through a lender, such as a bank, who will lend you 80% or more of the value of the property, but you can also access the equity that has been created in other properties as well. For example, if you purchased a property for $500,000 that increased in value to $700,000, then you’ve seen a $200,000 increase in equity. Assuming that you initially contributed a 20% deposit which was $100,000, that means you’ve got a spare $100,000 of equity sitting in the property that you can use after it increased in value. Equity is simply, the value of the property, less the outstanding debt you have on it - which is your mortgage. By accessing the equity in your property, whether that’s your PPOR or another investment property, is how investors are able to buy multiple properties in a short space of time. Equity is also valuable because you can also use it for other purposes as well. For example, you could use it to renovate your current property and increase value in that way or use it to assist with the costs involved in a subdivision. What should you consider before accessing equity?The reality is that withdrawing equity to use elsewhere does add an element of risk. It’s important to get advice from a professional such as a mortgage broker, before deciding to go down that path. There are also some considerations that you will need to take into account.

With interest rates at record low levels, and restrictions around lending being reduced by various Government bodies in recent years, getting finance is easier than it has been for a long time. However, it is still very important to get the right advice before looking to access any equity you might have. By using your equity, you are effectively increasing your leverage. This is a very powerful tool to jump into your next property far sooner than if you had to save up a deposit. See your home loan options in less than 5 minutes As the Australian economy gets back to normal on the back of the COVID-19 enforced shutdowns and restrictions easing, there is an expectation of interest rate rises in the future but borrowers are still sitting in an enviable position.

The official cash rate is still at a record low, of 0.1 per cent. What that means for borrowers is that this is one of the best times since the 1950s to access money. If you’ve already got a home loan, then you should consider refinancing, to take advantage of the current low cash rate and to make sure you’re getting the very best deal you possibly can. However, there are also several other benefits to refinancing. Better Interest Rates The first thing to understand is what exactly it means to refinance. Basically, refinancing is just taking out a new home loan on the same property. The first and most obvious reason to do that is to get a lower rate of interest. Lower interest rates mean lower mortgage payments, which can mean thousands of dollars being saved over the lifetime of your home loan. A number of lenders offer great introductory rates when you take out a loan with them. However, unlike with other industries, you’re not rewarded by sticking with one lender for the long term. In some cases, it’s the opposite. Those who have not reviewed (or refinanced) their loans can get stuck with far worse deals than necessary. We must remember that banks and lenders are businesses and sometimes it’s far more valuable to attract new clients than worry about the ones’ you’ve already got. This is where a good mortgage broker can really help you with sifting through the fine print on suitable loans. Better Loan Products Back in our parents’ day, it was really just a matter of taking out a principal and interest loan and paying it off over the next 30 years. Fortunately, things have changed for the better and now lenders have a host of great products that can really save you money on your home loan. A great example would be a 100% offset account attached to your mortgage. An offset account is a transaction account meaning you can use it for everyday things. However, because it is linked to your mortgage it attracts the same higher rate of interest as your mortgage. More accurately, it saves you interest, in that you effectively only pay interest on the difference between your outstanding loan and your offset account balance. An offset account can really supercharge your progress if you park your spare money in there and use smart money management techniques. Access to Cash If we’ve learnt anything during the COVID crisis, it’s that having some money tucked away for a rainy day is important. Fortunately, if you’re a homeowner who has owned their property for any length of time you might very well have built up some equity in your property. That’s certainly the case for owner-occupiers and investors in large parts of the east coast, particularly in Sydney and Melbourne who have seen median homes values rise dramatically in the last decade. By refinancing, it’s possible to access that equity and draw it out as cash. That money can then be used to buy another property as an investment, or as required. It’s quite possible to access equity and leave it in an offset account. That way it’s not costing you anything but it’s there if you need it. Again, speaking to a mortgage broker will be the best way for you to find out what you can do, given your individual circumstances. Consolidate Debt Not all debt is good debt. When you buy a house to live in or as an investment, that’s an example of good debt. The asset you’re purchasing has a high likelihood of appreciating in value over a long period of time, which will leave you well placed. Using credit or a loan to buy things that do not appreciate, like a new car or online shopping, will get you into ‘bad debt’. These things will not only depreciate in value almost instantly, but the debt comes with a high rate of interest. High-interest debt not only weighs heavily on your borrowing capacity, but it is expensive to pay back. An option when you refinance is to roll some of these debts into your home loan and capitalise on the lower rates of interest. This is a great time to be borrowing money and it hasn’t been this good since the 1950s. With the economy facing a short-term downturn, it’s more important than ever to have access to cash for a rainy day. There’s plenty of additional benefits to refinancing and a mortgage broker will be able to get you on the right track. See your home loan options in less than 5 minutes When the time comes to apply for a home loan, many would-be borrowers are shocked to learn that a few simple mistakes have cost them the chance to get finance.

Lenders have several checks they run on all applications and if you’ve made these errors you might be out of luck. Fortunately, there are some things you can do to turn these things around and get approved. Not Paying Bills on Time When you go to apply for a loan one of the first things a lender will do is look at your credit score. If you pay bills late, you might find yourself with a number of defaults. This is when a payment is well overdue. Defaults will hurt your credit score and can make a lender less likely to lend you money. It’s also important to note that there is so much data available to credit agencies these days, that they can tell just how efficient you are at paying your bills. If you are always late that doesn’t bode well for them, when the time comes for you to pay them back. Too Many Credit Cards These days, just about anyone can get a credit card. In fact, many banks will send out letters offering to increase your credit card limit or give you another credit card. The problem is that while it might be great to have a $50,000 credit card limit when the time comes to borrow money from a bank, this limit will impact your chances. The bank assumes you have maxed out your card and will reduce your borrowing capacity accordingly. These credit card limits are often the difference between getting approved or coming up short. Short-Term Loans While it might be nice to drive the latest car or take out a personal loan for a holiday, these types of debts could be weighing you down. Personal loans, car loans and credit card debt all attract high interest rates and those monthly expenses add up and can really hurt your borrowing capacity. Lenders also don’t like to see these types of debts as they suggest you’re not someone who has good money management skills. Applying for Too Many Loans Credit is often available to those people who need it the least. If you’ve been applying for loans regularly and even worse, if you’ve been applying for loans and getting declined often, that is going to make it much more difficult to get a loan when you really need it. Every time you apply for credit it shows up on your credit record which lenders can easily access. Getting rejected or making lots of small applications for credit is viewed negatively by lenders and also tells them a lot about your money management habits. The best thing to do is to seek a pre-approval before officially applying for a loan. That way your mortgage broker can quickly and easily tell you how your application is looking and suggest changes to the way you’re managing your finances, if a loan is unlikely. If you can clean up your finances for a few months, a lender will be far more willing to take you on, as opposed to someone with a patchy credit record and lots of short-term debt. See your home loan options in less than 5 minutes In years gone by, homebuyers would stick with the same bank for the life of their home loan.

While this might be an easier option, you will likely end up paying far more in interest than you otherwise would, if you found a more competitive interest rate. There are many reasons that people regularly refinance their home loans; doing so could benefit you in many ways. Saving Money As mentioned, if you are paying a lower interest rate, you are effectively paying less interest over the life of the loan. At the same time, this money that you’re saving could be used to help pay down the principal component of the loan, meaning that you will also pay off the outstanding debt faster. This is another reason it’s worth looking at a more competitive interest rate. On an average 30-year loan, you can end up paying just as much in interest as you do in debt repayments, so every little bit you can save matters in the long run. Fixed or Variable In the current environment, we’ve seen interest rates drop to record low levels, and many believe that the only way is up. When you refinance your home loan, you’re effectively taking out an entirely new loan product. That means you can change all elements of it, including things such as fixed or variable interest rates or even whether to pay down interest only. While everyone’s situation is a little different, it’s important to understand that you’re not stuck with a basic 30-year variable loan if you don’t want to be. In fact, when you refinance, you should also be looking for superior loan products that contain options such as an offset account, which also helps you reduce your interest payments and saves you money over time. Access Equity If you’ve owned a property for a reasonable length of time, it’s likely that the value of that property has increased. By refinancing, it’s possible to access some of that equity increase and put it towards other things. Most people use the equity to put down a deposit on another property or even to renovate their current home. The ability to access equity is one of the most powerful tools at the disposal of property investors and a big reason why you should look to refinance. Debt Consolidation The great thing about home loans is they come with some of the lowest interest rates you can get, certainly in comparison to things like credit cards, personal loans or even car loans. When you refinance, it’s a great opportunity to roll any of those high-interest debts into one place and get a far lower interest rate. You are effectively paying out those other debts and using the equity in your current home to do it. In the long run, this saves you money, and it is money you can use to pay down your home loan. See your home loan options in less than 5 minutes The majority of Australian homeowners can be classified into a few different categories. There are first home buyers, upgraders, downsizers or investors.

The data on homeownership in Australia would suggest that the vast majority of Australians fit into just one of these categories. Less than 10 per cent of the population owns an investment property, which means that for the most part, Australians work their way up the real estate ladder by following the tried and true process of upgrading until retirement. However, there is a section of the population who doesn’t continually upgrade their properties by selling their previous homes. These people effectively turn their ‘principle place of residence’ (PPOR) into an investment property. So, is this something you should consider when the time comes to move into a bigger and better home? Finances First and foremost, the decision as to whether to sell or hold your former PPOR will be based predominately around your finances. The first consideration will be whether you have the income to service the debt on two homes, one of which being an investment property. It’s important to note that many lenders will assess only 70 per cent of any rental income, making it a little tricky at times. Similarly, you might need to sell your previous home to use some of the equity as a deposit on your next bigger and better family home. Assuming you have the means to hold onto the property, there are some important things to look at and consider. Opportunity Cost Just because you can hold onto your former home as an investment, doesn’t mean you should. You will need to carefully assess what the outlook for your house is; both as a rental property and in terms of potential capital growth. If your property is in an area that has seen strong price growth recently, then perhaps in the short-term that area might not be as likely to see significant price appreciation. Similarly, if you own a property that is not fitting in with what buyers are looking for, then the demand, both as a rental and for future growth, might be limited. When assessing your former PPOR, you need to weigh up the pros and cons of keeping it versus the opportunity of investing in different areas. Other suburbs or even states might be at different phases of their growth cycles, and also might be offering higher rental yields, which would make it easier to service any debt. Therefore, it is vital that you weigh up the opportunity cost of holding. Benefits of Holding By far most of the benefits of holding onto your former PPOR as an investment, come down to the savings you will be able to achieve, in terms of both taxes and transaction costs. When you buy and sell property, there are significant costs involved. You will incur selling agent fees, marketing costs and other expenses such as auctioneer fees and settlement costs. One of the other big benefits of holding onto a property that was previously your PPOR, is that you are able to enjoy the capital gains tax exemptions for a period of time. In Australia, the ATO has what’s known as the six-year-rule, which allows your former PPOR to be exempt from capital gains tax for a period of six years. After this period of time, your property will be treated as a normal investment property and the sale will be seen as a capital gain for tax purposes. This can be a significant cost and something you need to consider. Of course, if you don’t sell the property, then you won’t need to pay any tax. Whether you want to sell, hold or build a large investment portfolio, it all comes down to your own personal goals. There is no right answer, but the first step should always be speaking to a mortgage broker to understand your borrowing capacity and identifying what you are looking to achieve. See your home loan options in less than 5 minutes Investing in property in Australia has proven to be a sound long-term investment, with prices growing steadily for many decades. However, when the time comes to choose exactly where you should be buying a property, there are a myriad of things for you to think about. One of the very first questions you’re going to need to consider is whether to buy in a capital city or a regional area. While there is no correct answer, there are advantages and disadvantages to both. Investing in a Capital City For the most part, capital cities grow in value at a faster rate than their regional counterparts. Cities like Sydney and Melbourne have traditionally been locations that have seen heavy levels of migration, both from overseas and interstate. With limited supply, in the form of land, prices have been trending higher for a long time, and the growth rates are very strong. Your blue-chip areas of most capital cities normally see steady growth while also being less prone to falling during times of broader market weakness. On the flip side, because these prices are higher, rental yields are a lot lower. While we are in a low interest rate environment at the moment, historically blue-chip areas will be negatively geared investments. Another advantage of properties located in the city is that there is normally a steady stream of tenants available. That means properties will be easy to rent out and you can usually find high-quality tenants. Investing in a Regional Area One of the main reasons people choose to invest in regional areas is the fact that rental yields are often far higher. It’s not unusual to find rental yields of 5-6% in regional areas, which, in the current environment, normally means your investment will be positively geared and putting cash in your pocket each month. The other side of this equation is that the growth is normally not as high as the blue-chip areas of our major cities. However, when you have a strong yield, it’s a lot easier to hold onto your investment property. The other clear benefit to investing regionally is that the price of the properties is normally far lower. If you have limited borrowing capacity, you might not have the option of investing in a major city to begin with. In many regional areas, you can buy properties under $300,000 which makes them affordable to new investors. City vs Regional While there is no best place to invest, as everyone has their own goals and circumstances, it is possible to get the best of both worlds. There are cities in Australia that do have very high yields, and there are also regional areas that have a track record of strong capital growth. Many property investors look for a combination of these factors as it allows them to grow their equity while also being able to service their loans and continue to borrow. See your home loan options in less than 5 minutes As we know, all borrowers have different circumstances and that’s why there is never a one size fits all approach when it comes to lending. For the majority of full-time employees with a good credit history, you will likely have a range of options and be able to look at a regular home loan. To access a regular home loan, you might only need three months of payslips or two years of tax returns. Generally speaking, regular home loans are a lot more stringent and that’s why we see some regular home loans with very low interest rates. Unfortunately, for the self-employed and business owners, it’s not always possible to present two years of tax returns or payslips. For these types of borrowers, there are other avenues to getting finance for a home, one of which is by providing alternative documents (alt-docs). Lenders that offer alt-doc loans will normally require three months’ worth of personal bank statements and six months’ worth of business activity and business bank statements, or potentially even an accountant’s declaration. Given the borrowers’ income is not as black and white as a PAYG employee, interest rates will normally be higher, while there might also be higher loan application fees and setup costs. It is important to note that just because you might be self-employed or a business owner, you don’t automatically need to go for an alt-doc loan. If you’re able to produce two years of tax returns and have a good credit history, then you should be able to qualify for a regular home loan at lower interest rates. However, if your business has recently seen a large increase in revenue and you want to access a larger loan, then it might be worth looking at an alt-doc loan. Similarly, if you’ve had credit issues in the past that you’ve been able to turn around, then an alt-doc loan might work for you. There are also a few myths out there, surrounding alt-doc loans. The main one is that you can get a loan with no documentation at all. Those days are long gone and you will need to be able to prove that you have the means to service the repayments. The second myth is that the big banks don’t take on these types of loans. In many instances, the major banks are able to look at lending to people without the full documentation, given they have the size and diversity to handle different amounts of risk. Once again, the key is to talk to a mortgage broker who can quickly understand your personal circumstances and match you with the right solution for your needs. See your home loan options in less than 5 minutes Arguably, the most important element of the property journey is obtaining finance. One of the most confusing parts of the process for first home buyers is the difference between the various types of approvals. Most commonly, when you are looking to obtain finance to purchase a home, there will be two separate approvals that you’re likely to encounter, and it is vital that you understand the differences between them. Conditional Approval If you choose to purchase a home using a ‘subject to finance’, without some form of indication from a lender that you will be able to access that finance, you could find yourself in a tricky situation. Commonly, homebuyers will look to gain conditional approval for a loan, which is more commonly known as a pre-approval. A pre-approval is a powerful tool for the homebuyer, as it gives them a very clear indication from a lender as to what they will be able to borrow, based on their personal and financial situation. Once you have submitted your loan documents and all the required documentation, such as payslips, group certificates and/or bank statements, the credit team will assess your application and if you are successful, you will be issued with a conditional loan approval. What this means is that a bank will pre-approve your home loan, up to a certain borrowing limit, subject to you finding a property that meets the agreed criteria, and provided that your situation doesn’t change in the coming months. Generally, a pre-approval is valid for three months, but it is merely an indication, and not a guarantee that you will get a loan. A pre-approval is a powerful tool for you as a buyer, because it makes you appear serious in the eyes of vendors and sales agents, whilst also giving clarity as to just how much you are able to spend on a property. Unconditional Approval Once a homebuyer has found a property, they can go back to the lender that offered a pre-approval and seek a home loan. When a lender is satisfied that you have met all of their criteria, including LVRs, valuations and your own personal financial situation, you will be fully approved and you will have unconditional approval. It is possible that a lender won’t offer you a home loan after you have made an offer on a property, if that property is unique in some way, or if there are issues with it in the eyes of the lender. The most important part of the loan application process is to work closely with a mortgage broker. They are in the best position to be able to help you navigate any issues that might arise, and they also communicate closely with the lender. If you’re unsure about where your application is at any given time, your mortgage broker will be able to help guide you through the process. See your home loan options in less than 5 minutes |

EDITOrCategories

All

Archives

December 2023

|

|

Read about us on KochiesBusinessBuilders and Linkedin

Partner with Adobi Mortgage Solutions Contact Bruce Johnstone (03) 9996 8553 or email [email protected] |

©2021 ADOBI® MORTGAGE SOLUTIONS ABN 94465268443

Suite 405, 585 Little Collins Street, Melbourne, VIC 3000 Telephone: (03) 9996 8551 Credit Representative Number 536529 authorised under Australian Credit Licence 384324 Your complete financial situation will need to be assessed before acceptance of any proposal or product Please review our Lenders, Terms of Use and Privacy Policy Member 87449: AFCA - Australian Financial Complaints Authority Member M-351557: FBAA - Finance Brokers Association of Australia |

RSS Feed

RSS Feed