|

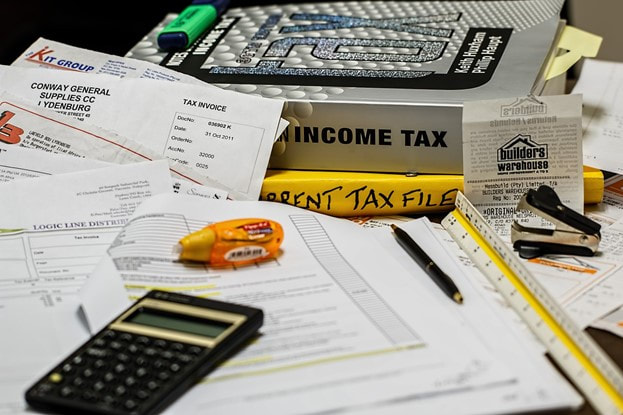

Now that the new year is here, it’s time to start looking at all the ways you can make the most of your investment property. Tax is a complicated subject, which is why you should always speak to an accountant. However, the onus is on you to keep good records.

Keep Good Records If you want to claim your expenses on your rental property, it’s vital that you have good records. If you’re working with a property manager, this can be made a lot simpler as they will likely take care of all the running costs for you. However, if this is a new investment property or you’re self-managing, then you need to keep all the documents and receipts that you think will be relevant. Know Your Deductions While your accountant will know exactly what you can and cannot claim, it’s important that you take responsibility for examining all the associated costs that come with the property and seeking clarification from the accountant. Typical expenses that you can claim include: ● Repairs and maintenance ● Improvements/Renovations ● Advertising costs ● Cleaning ● Gardening ● Water ● Electricity and gas charges ● Pest control ● Land taxes ● Lease / property management costs ● Security monitoring costs ● Capital works Pre-Pay Your Expenses Depending on the type of loan you have, it might be possible to pay your interest upfront; hence you can claim it as a deduction for that financial year. Depending on your overall income and tax planning, this might be a useful strategy to consider. Similarly, it is also possible to pre-pay things like insurance and even do repairs and maintenance early. Claiming Depreciation If you have a new property or if you’ve undertaken significant renovation, then it might be worth looking at how you can claim depreciation. To do this, you will need a depreciation schedule, and this is commonly done through a quantity surveyor. Many investors fail to claim depreciation, and this can be a mistake. It certainly is if you have a new house or apartment. Interest Expenses Often, the largest expense that investors face is interest on their home loan. It’s important to understand that interest expenses and the associated fees and charges are tax-deductible expenses. See your home loan options in less than 5 minutes |

EDITOrCategories

All

Archives

December 2023

|

|

Read about us on KochiesBusinessBuilders and Linkedin

Partner with Adobi Mortgage Solutions Contact Bruce Johnstone (03) 9996 8553 or email [email protected] |

©2021 ADOBI® MORTGAGE SOLUTIONS ABN 94465268443

Suite 405, 585 Little Collins Street, Melbourne, VIC 3000 Telephone: (03) 9996 8551 Credit Representative Number 536529 authorised under Australian Credit Licence 384324 Your complete financial situation will need to be assessed before acceptance of any proposal or product Please review our Lenders, Terms of Use and Privacy Policy Member 87449: AFCA - Australian Financial Complaints Authority Member M-351557: FBAA - Finance Brokers Association of Australia |

RSS Feed

RSS Feed