|

Even if you don’t have any loans or debts, having a credit card might be enough to significantly reduce your borrowing capacity.

The reason why a credit card can be a hindrance to your ability to borrow money, is that lenders assess your credit card on the overall limit, not on how much you currently have in credit card debt. Even if you’ve never reached your credit card limit since you’ve had the credit card, many lenders will assess a credit card as if it is maxed out. For example, if you have a credit card with a limit of $10,000, the lender is likely to assess your debt based on around 3% of this total amount per month. This monthly amount, which in this case would be $300, is added to your ongoing expenses, with the result that your overall borrowing capacity is reduced. With a credit card limit of $10,000, that could mean a $75,000 reduction in borrowing capacity, which is significant and can quickly limit the number of potential properties a first home buyer has access to. Assessing Your Situation Lenders do not only focus on what your credit card limit will do to your borrowing capacity. They also take other factors into consideration! One of the most important elements of any debt, in the eyes of a lender, is your track record of making repayments. If you continually miss payments and increase your debt levels, that doesn’t bode well in the eyes of a bank. Similarly, if you are living off your credit card, and are one pay cheque away from not just missing a payment, but also missing your rent, then that doesn’t make you look overly appealing in their eyes. It is important to understand that, with the implementation of Comprehensive Credit Reporting (CCR), lenders have incredibly detailed data on your spending habits, drilling down to how early or late you pay off your debts, or other bills. Credit Cards Are Not All Bad Now that we understand the impact credit cards have, it’s also important to note, that having a credit card is not necessarily a bad thing in the eyes of a bank. As mentioned, how you manage your credit cards is far more important than the fact that you have them. Lenders like to see that you are responsible with money. In fact, if you have a credit card and manage the credit very well, you will be looked upon far more favourably than someone who doesn’t have a credit card at all. Whether or not you get rid of your credit cards to help you get a home loan really comes down to a few key factors.

If you’re reliant on your credit cards, take a step back and assess your personal financial and living situation and get that in order before you start the home loan application process. One of the most frustrating things that could happen to a homebuyer is getting your application for finance declined.

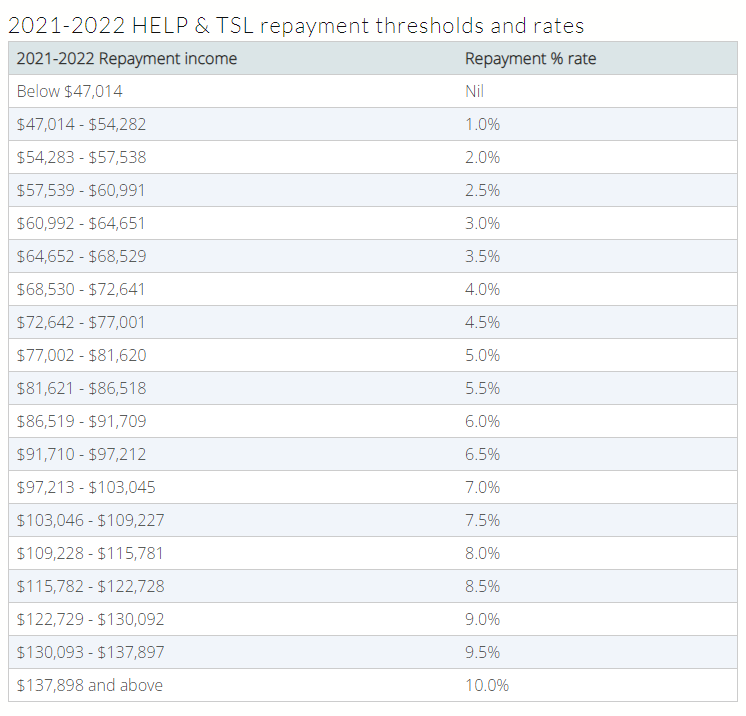

By this stage, you’ve already likely been to dozens of home opens, organised all your paperwork and potentially even put an offer in on a house. Falling over at the last hurdle is not only frustrating, but it can also feel like your dreams are over. But they don’t have to be, and more importantly, there are a few things you can do to make sure your loan application doesn’t get declined. Borrowing Amount The more you’re looking to borrow from a lender, the more risk it presents to them. If you want to borrow more than 95%, that can be a red flag for a lender. Most banks like to see you come up with a 20% deposit, which means an 80% LVR. While this might not be possible, there are other options you can look at like a higher LVR and paying Lenders Mortgage Insurance. If you do need to borrow with a higher LVR and only have a small deposit, you might want to look at a guarantor loan or even taking advantage of a Government program such as the First Home Loan Deposit Scheme. Stable Employment In a perfect world, when you apply for a loan, the lender would like to see that you’ve got a long-term stable job with a regular paycheck. Unfortunately, things are not always that simple and these days, many people have very unique work situations. If you’re self-employed or haven’t been in your current job for at least six months, then lenders might not look favourably on your application. Fortunately, there are lenders that understand your situation and therefore it is important that you work with a mortgage broker who can match your employment situation with the right lender. If you’re unemployed, you’re going to have a very tough time getting finance of any kind. These days, even if you’re asset rich, you still need to be able to show how you intend to service the debt. Credit History Having bad credit is often a red flag to a lender and it is not always one that is easy to overcome. If there is an error that has been made on your credit file, then that is something you can sort out. However, if you’ve been bankrupt in the past, you might need to work with a specialist lender. Spending Habits Banks and lenders like to see that you’re able to manage money effectively. If you’re spending habits aren’t great, then that’s likely a sign that you might not be able to manage a mortgage. Putting together a few months where you keep your spending habits under control is important. But it’s also more important to not have a host of debts that need paying each month, such as car loans or personal loans. Lenders don’t look favourably on these types of costs as they are fixed costs, unlike your discretionary spending. Buying an Unusual Property If you’re looking to buy a property that might be tricky to sell in the future, banks won’t like the look of it. That might mean a holiday home or even a rural block of land. Banks will always consider the worst-case scenario, and if they need to sell the property because you can’t make the payments, they want something that will be able to sell quickly and easily. Get Pre-Approved To avoid getting into a situation where you might get declined, it’s vital that you go and speak to a mortgage broker before you even start looking for properties. That way, they’ll be able to assess your personal situation and also give you some guidance around the types of properties you’re going to be able to afford. See your home loan options in less than 5 minutes The High Education Contribution Scheme (HECS) or Higher Education Loan Program (HELP) is effectively a Government loan that enables people to afford the costs of higher education. The program works by allowing people to pay back their student loans at a time in the future when they are earning enough money to comfortably cover the payments. In the last decade, the cost of higher education has skyrocketed, and this has forced many students to take up a program like HECS or HELP, so they can continue their education. Once they have completed their education, most people never really think about the impact of HECS debts, as it is normally something that is taken care of at tax time. The repayment rates are generally quite low and not overly burdensome for most people. However, what many people don’t realise is that these student debts will have an impact on your ability to borrow money when the time comes to buy a house. This can be particularly impactful for people like first home buyers, or even those on high incomes, as the repayment rates increase sharply. When banks and lenders assess your ability to service debt, what they are doing is determining your normal income and expenses, with the understanding that you will be able to service debt with spare income. If you are carrying a large amount of student debt that you are required to pay back by law, it can weigh heavily on your ability to borrow. For a lot of people, a few hundred dollars per week can be the difference between buying a home and not being able to get finance. For that reason, it is very important to understand what your student debt looks like and the level of repayments that you’re required to be making. This is the current repayment table.  If your income falls below $47,014, you’re not required to pay back any of your HECS debt. This is the category into which people who are new to the workforce will most likely fall.

By the time you are earning around $100,000 per year, you will be required to pay back approximately 7.5% of the total outstanding student debt. For a HECS debt of around $50,000, that could see your borrowing capacity reduced by anywhere from $75,000 - $100,000, which is quite significant if you’re looking at buying your first home. The reality is that the majority of Australians will have some form of student debt that they are required to pay back. The best option is to always speak to your mortgage broker and get a clear picture of your borrowing capacity well before you even look to put in an offer on a property. That way, regardless of your situation and current income and expenses, you will know where you stand. See your home loan options in less than 5 minutes As we know, all borrowers have different circumstances and that’s why there is never a one size fits all approach when it comes to lending. For the majority of full-time employees with a good credit history, you will likely have a range of options and be able to look at a regular home loan. To access a regular home loan, you might only need three months of payslips or two years of tax returns. Generally speaking, regular home loans are a lot more stringent and that’s why we see some regular home loans with very low interest rates. Unfortunately, for the self-employed and business owners, it’s not always possible to present two years of tax returns or payslips. For these types of borrowers, there are other avenues to getting finance for a home, one of which is by providing alternative documents (alt-docs). Lenders that offer alt-doc loans will normally require three months’ worth of personal bank statements and six months’ worth of business activity and business bank statements, or potentially even an accountant’s declaration. Given the borrowers’ income is not as black and white as a PAYG employee, interest rates will normally be higher, while there might also be higher loan application fees and setup costs. It is important to note that just because you might be self-employed or a business owner, you don’t automatically need to go for an alt-doc loan. If you’re able to produce two years of tax returns and have a good credit history, then you should be able to qualify for a regular home loan at lower interest rates. However, if your business has recently seen a large increase in revenue and you want to access a larger loan, then it might be worth looking at an alt-doc loan. Similarly, if you’ve had credit issues in the past that you’ve been able to turn around, then an alt-doc loan might work for you. There are also a few myths out there, surrounding alt-doc loans. The main one is that you can get a loan with no documentation at all. Those days are long gone and you will need to be able to prove that you have the means to service the repayments. The second myth is that the big banks don’t take on these types of loans. In many instances, the major banks are able to look at lending to people without the full documentation, given they have the size and diversity to handle different amounts of risk. Once again, the key is to talk to a mortgage broker who can quickly understand your personal circumstances and match you with the right solution for your needs. See your home loan options in less than 5 minutes Buying a home is quite often the largest financial decision most people make, and it’s one that needs to be carefully considered.

Prior to going down the path of purchasing a home, it’s vital that you get your finances in order to ensure that firstly, you can get the required finance, and secondly, you will be able to manage the repayments going forward. There are a few things you can do with your personal finances to give yourself the best chance of getting into your dream home. Start Saving Being able to manage money is an important life skill, and unfortunately, it is not one that everyone has. When it comes to purchasing a home, there are a number of benefits to having an effective savings plan. The first is that lenders require you to come up with a 20% deposit. While there are other options at your disposal that can help here, generally speaking, borrowers requiring an LVR (Loan-to-Value Ratio) greater than 80% will be required to pay Lenders Mortgage Insurance (LMI), which can be expensive. It’s also worth remembering that on top of your deposit, you could be required to pay stamp duty (unless exempt) and certainly settlement costs, amongst other expenses. Getting into the habit of putting money aside every week and working within a budget and towards a goal will also hold you in good stead when the time comes to start making repayments. Another important consideration is that lenders require you to have a certain amount of money in genuine savings. The ability to show them not only your savings but a track record of managing your money well makes you stand out as a person they will want to lend to. Improve Your Credit One of the key factors lenders look at is a borrower’s credit score. A credit score is effectively your track record of managing debt. Get into the habit of paying off bills when you receive them and always pay down your credit cards each month. Practices like this will help boost your credit score, and lenders will certainly take note. Pay Off Debt If you’re looking to take out finance for a new home, one of the things that a lender will certainly want to know about is any outstanding debts. Your payments on these debts will be a factor in calculating your ability to service any future loans. On top of this, lenders also assess your debt-to-income ratio, and many of the major banks have fixed metrics that they must adhere to. Paying off debts is typically a good idea, regardless. However, when you’re looking to take on more debt, it’s important that you don’t have things like overdue credit cards and personal loans with high interest rates weighing you down. Get Pre-Approved The best way to know just how you are looking financially, in the eyes of a lender, is to get a pre-approval. By talking to a mortgage broker and starting the process of getting pre-approved, you will get a very clear understanding of where you currently stand. If there are any issues with your credit history or outstanding debts, your mortgage broker will be able to sort them out; or at least start the process of turning things around. See your home loan options in less than 5 minutes When Christmas is coming up it’s important to start thinking about your budget over the holiday period.

While we all love giving presents, if you’re looking at potentially applying for a home loan in the new year, it’s important that you don’t do any damage to your chances of getting finance by overspending in the next few weeks. What we do know, is that lenders take a snapshot of your financial situation when they assess your application for finance and if you’ve been busy racking up credit card debt, it might come back to hurt you in the future. Here are some quick tips for budgeting at Christmas. Allocate Money Upfront There’s a good chance that you will be spending this Christmas, so do it wisely. Make a budget and try and stick to it. Lenders will look at your bank and credit card statements from at least a three month period, so if you’re looking to have a clean record for your loan application, it might be worth keeping the charges down. One idea could be withdrawing cash and paying for things with physical money, that way you can allocate funds upfront. Another budgeting idea is to simply spend a fixed amount per person. That way you can allocate a pool of money and everyone gets a fair deal. One of the big traps that a lot of people fall into is minimising the spending at Christmas, only to get sucked into all the Boxing Day and holiday sales. When you’re allocating your Christmas budget, it might be worth applying that to the entire holiday period. Don’t overextend yourself While any credit card debt isn’t great, the worst thing you can do is take on more credit cards. When it comes to borrowing money, your current debt is just as important as how high your credit limits are. If things are a bit tight on your loan application, it might even be worth getting rid of your credit cards to boost your borrowing capacity. This is tough to do if you have outstanding balances and it’s even more difficult if you can’t pay them off. Invariably, if people have the money (or credit) at their disposal, they tend to spend it. Keep both the credit card spending down and certainly don’t take out any new cards in the coming months. Even if there are some great sales on. Avoid Buy Now, Pay Later These days, everyone is moving toward the buy now, pay later (BNPL) phenomenon. While it might be convenient, you don’t want these types of payments to impact your chances of securing a loan. While BNPL isn’t technically an application for finance, it could impact your credit score. More importantly, a lender will make an assessment on what type of borrower you are and if you have hundreds of these types of payments coming out of your account, it won’t look that good on the application. These days, every lender will assess your credit score and go over your bank details with a fine-tooth comb, so it is important to have things in order. Christmas is an incredible time of year and it’s great to give to family and loved ones. Just don’t overdo it or it could cost you a lot more in the long run, when the time comes to get a loan approved. See your home loan options in less than 5 minutes Over the past few months, we’ve been hearing more about serviceability buffers and how they might impact home buyers’ ability to borrow. However, many people don’t understand what a serviceability buffer is and how it works. Simply put, a serviceability buffer is the minimum interest rate a lender is expected to use when assessing a loan application. Lenders look at a borrower’s income and expenses to determine how much capacity they have to borrow. On top of this, they take into account the potential interest rate payments both now, and in the future. They do this by applying a serviceability buffer over and above the minimum monthly payment, based on current interest rates. The body that implements these serviceability buffers on banks and lenders are known as The Australian Prudential Regulation Authority (APRA). APRA are an independent Government Agency that sets the serviceability buffer requirement and also implements other measures aimed at helping maintain the stability of property. Other measures APRA looks at include limits on debt-to-income ratios or LVRs. Recently, APRA announced that it would be increasing the serviceability buffer of home loan applications from 2.5% to 3%. This effectively means borrowers will be able to access less money and have a smaller borrowing capacity. APRA estimates the 50 basis points increase in the buffer will reduce maximum borrowing capacity for the typical borrower by around 5%. With interest rates at record low levels, the belief is that the RBA will eventually raise interest rates, however, at this stage, they have indicated that this might not happen for some time. Raising serviceability buffers are a way to reduce the overall level of lending and also cool property markets that have been running hot, particularly along the East Coast of Australia. Higher serviceability buffers generally impact investors more than owner-occupiers, given they often carry higher debt loads. The last time serviceability buffers were introduced were during the most recent property boom on the East Coast in 2015, which lead to a slowdown in house price growth. See your home loan options in less than 5 minutes |

EDITOrCategories

All

Archives

December 2023

|

|

Read about us on KochiesBusinessBuilders and Linkedin

Partner with Adobi Mortgage Solutions Contact Bruce Johnstone (03) 9996 8553 or email [email protected] |

©2021 ADOBI® MORTGAGE SOLUTIONS ABN 94465268443

Suite 405, 585 Little Collins Street, Melbourne, VIC 3000 Telephone: (03) 9996 8551 Credit Representative Number 536529 authorised under Australian Credit Licence 384324 Your complete financial situation will need to be assessed before acceptance of any proposal or product Please review our Lenders, Terms of Use and Privacy Policy Member 87449: AFCA - Australian Financial Complaints Authority Member M-351557: FBAA - Finance Brokers Association of Australia |

RSS Feed

RSS Feed