|

For borrowers trying to save money on their home loan, it might be worth looking at the frequency of your repayments.

A small change from monthly to weekly might not make much of a difference to your household budget, but it could go a long way to cutting down your interest over the life of the loan. The most important thing to know about home loans is that interest is calculated on the daily balance and charged to the loan account monthly in arrears. If you take the minimum monthly repayment and pay half every two weeks, borrowers can save a significant amount off both the term and interest. There are 26 fortnights in a year – the equivalent of 13 monthly repayments rather than 12, meaning you’re actually paying more than the minimum. If borrowers choose to pay weekly, they could save more on interest but not so much on the term. While many people are excited about the idea of buying their first home, it can also be overwhelming knowing that you have to eventually pay off a large mortgage.

The good news is that with some simple strategies, there are ways to pay off your home loan faster than expected. Borrow less than you can afford It’s important to have a very clear understanding of what your financial situation is going to look like once you’ve taken on a mortgage. If you’re struggling to qualify for a home loan, then an option is to simply purchase a cheaper property. While you might not get into your dream suburb straight away, as your equity position improves you can use that to move forward and upgrade. In addition, a more affordable home would mean you can pay down your debt faster. Increase your repayment frequency Most lenders will typically put you on monthly mortgage repayments. While this might be convenient, it might not be the most cost-effective option for you. If you increase your repayment frequency to fortnightly or weekly, you will end up making more repayments over the course of the year and be paying down a higher amount of debt. There are only 12 months in a year, while there are 52 weeks and 26 fortnights. That means your loan gets paid off faster and you’ll also be saving interest along the way. Along the same lines, you also have the option of increasing your repayments. You don’t have to simply pay down the minimum each month. The more you can pay down that principal component the better. Use an offset account These days, there are several home loans that come with useful features that can help save you money on interest. An offset account is one such tool. This feature operates like a transaction account, however, it is linked to your home loan account. Your total interest repayments are calculated based of the value of your home loan, less the funds in your offset account. This means the more money in your offset account, the less interest you’ll pay. In turn, you can use those extra funds to make higher repayments on the principal loan. If your current home loan doesn’t come with an offset account or lacks the flexibility that you need, it might be worth speaking to a mortgage broker to compare your options. While most people will typically look to take out a variable home loan, it is first worth considering what might happen with interest rates in the future and whether that means you should think about a fixed-rate home loan.

A fixed-rate home loan simply means that the interest rate on the home loan is fixed for a certain period of time. For most fixed-rate home loans, that is going to be around two to five years. However, there are a number of other factors that you need to consider apart from just the fixed interest rate. Advantages The main advantage of a fixed-rate home loan is that with a set interest rate, you will have a degree of certainty around your weekly and monthly repayments. If you have budget constraints, then fixing your home loan might be an option so you know where your finances stand each month. However, if you believe interest rates are going to rise in the future, it might be worth looking at locking in a fixed-rate loan. This will ensure your repayments remain at their current level for the term of the loan, regardless of what happens to underlying interest rates and changes from the RBA. Disadvantages While it is good to have certainty around your repayments, one of the big disadvantages of a fixed-rate home loan is the lack of flexibility. If you take out a fixed-rate loan and want to change out of it or refinance, there are likely going to be higher break costs involved than with a simple variable loan. Also, a number of the features that can save you a lot of money, such as offset accounts and redraw facilities, are typically not available on fixed-rate home loans. While you might save money with rising rates, you could have potentially saved even more if you’d had a superior loan product with more features. In the current environment with record-low interest rates, there are numerous home loans with very attractive introductory offers. If you qualify for a home loan with an introductory rate, that might be a better option than going with a fixed-rate loan. It would be more flexible, and the net result could be very similar. Finally, it’s also worth noting that actual rates that come with fixed-rate loans are often a reflection of where banks and lenders believe interest rates are headed. If fixed-rate loans have higher interest rates than comparable variable rates, it suggests lenders believe rates will rise. Even if you take out a fixed-rate home loan, your repayments might still end up being more, even if interest rates and your repayments would have risen with a variable home loan. If you like the idea of having some certainty, but you’re still not convinced about a fixed-rate home loan, then it is possible to fix a portion of your loan. That way you can get the best of both worlds. Be sure to contact your mortgage broker to discuss your options. See your home loan options in less than 5 minutes One of the most common new year’s resolutions is to try and save money. One of the easiest ways to save money is to take a look at your home loan and find some creative ways to cut down on your repayments. Fortunately, there are a number of different things you can do with your home loan to reduce your ongoing monthly repayments.

Get a Better Interest Rate If you stick with the same lender for a long period of time, it’s very likely that you’re not getting the best rate you could be. By refinancing, you’re able to seek out a lower interest rate and that alone has the potential to save you money every month. Typically, you should be reviewing your home loan products regularly with the help of your mortgage broker and always looking for the best deal to suit your needs. Use an Offset Account If your home loan product doesn’t come with an offset account, it’s very likely that you’re missing out on some good opportunities to save money. An offset account is a lot like a transaction account. However, it has the added benefit of saving you interest on any funds that are sitting in the account as it works in conjunction with your home loan account. Given the financial environment that have seen savings accounts attracting incredibly low rates of interest, it’s well worth considering parking any spare funds in an offset account. Make More Payments A simple change like making fortnightly repayments over monthly has a huge impact on how much money you’re putting into your home loan over a long period of time. Instead of making 12 payments, you end up making 26 smaller payments, with the net amount paid being higher. This means that you’re paying down your mortgage faster and reducing your interest charges in the process. Add Additional Funds If you have the opportunity to pay down your mortgage with a large lump sum payment, this has the additional impact of saving you money on interest. These types of funds might come your way thanks to a bonus at work, a gift, an inheritance or even from the sale of an asset such as a car. The faster you can reduce your mortgage balance, the lower your interest payments will be. Consolidate Debts If you have a home loan and you also have high-interest debt such as car loans, credit card debt or personal loans, it might be worth looking at rolling all those debts into your home loan. By doing that, you’ll reduce your ongoing weekly interest costs which is money that you can then use to pay down those debts faster. See your home loan options in less than 5 minutes As the Australian economy gets back to normal on the back of the COVID-19 enforced shutdowns and restrictions easing, there is an expectation of interest rate rises in the future but borrowers are still sitting in an enviable position.

The official cash rate is still at a record low, of 0.1 per cent. What that means for borrowers is that this is one of the best times since the 1950s to access money. If you’ve already got a home loan, then you should consider refinancing, to take advantage of the current low cash rate and to make sure you’re getting the very best deal you possibly can. However, there are also several other benefits to refinancing. Better Interest Rates The first thing to understand is what exactly it means to refinance. Basically, refinancing is just taking out a new home loan on the same property. The first and most obvious reason to do that is to get a lower rate of interest. Lower interest rates mean lower mortgage payments, which can mean thousands of dollars being saved over the lifetime of your home loan. A number of lenders offer great introductory rates when you take out a loan with them. However, unlike with other industries, you’re not rewarded by sticking with one lender for the long term. In some cases, it’s the opposite. Those who have not reviewed (or refinanced) their loans can get stuck with far worse deals than necessary. We must remember that banks and lenders are businesses and sometimes it’s far more valuable to attract new clients than worry about the ones’ you’ve already got. This is where a good mortgage broker can really help you with sifting through the fine print on suitable loans. Better Loan Products Back in our parents’ day, it was really just a matter of taking out a principal and interest loan and paying it off over the next 30 years. Fortunately, things have changed for the better and now lenders have a host of great products that can really save you money on your home loan. A great example would be a 100% offset account attached to your mortgage. An offset account is a transaction account meaning you can use it for everyday things. However, because it is linked to your mortgage it attracts the same higher rate of interest as your mortgage. More accurately, it saves you interest, in that you effectively only pay interest on the difference between your outstanding loan and your offset account balance. An offset account can really supercharge your progress if you park your spare money in there and use smart money management techniques. Access to Cash If we’ve learnt anything during the COVID crisis, it’s that having some money tucked away for a rainy day is important. Fortunately, if you’re a homeowner who has owned their property for any length of time you might very well have built up some equity in your property. That’s certainly the case for owner-occupiers and investors in large parts of the east coast, particularly in Sydney and Melbourne who have seen median homes values rise dramatically in the last decade. By refinancing, it’s possible to access that equity and draw it out as cash. That money can then be used to buy another property as an investment, or as required. It’s quite possible to access equity and leave it in an offset account. That way it’s not costing you anything but it’s there if you need it. Again, speaking to a mortgage broker will be the best way for you to find out what you can do, given your individual circumstances. Consolidate Debt Not all debt is good debt. When you buy a house to live in or as an investment, that’s an example of good debt. The asset you’re purchasing has a high likelihood of appreciating in value over a long period of time, which will leave you well placed. Using credit or a loan to buy things that do not appreciate, like a new car or online shopping, will get you into ‘bad debt’. These things will not only depreciate in value almost instantly, but the debt comes with a high rate of interest. High-interest debt not only weighs heavily on your borrowing capacity, but it is expensive to pay back. An option when you refinance is to roll some of these debts into your home loan and capitalise on the lower rates of interest. This is a great time to be borrowing money and it hasn’t been this good since the 1950s. With the economy facing a short-term downturn, it’s more important than ever to have access to cash for a rainy day. There’s plenty of additional benefits to refinancing and a mortgage broker will be able to get you on the right track. See your home loan options in less than 5 minutes In years gone by, homebuyers would stick with the same bank for the life of their home loan.

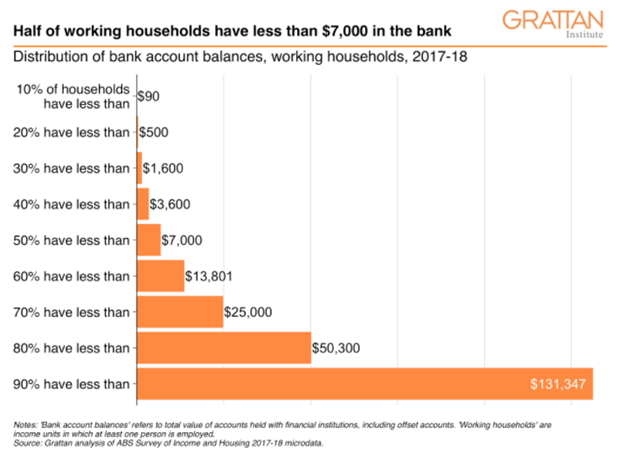

While this might be an easier option, you will likely end up paying far more in interest than you otherwise would, if you found a more competitive interest rate. There are many reasons that people regularly refinance their home loans; doing so could benefit you in many ways. Saving Money As mentioned, if you are paying a lower interest rate, you are effectively paying less interest over the life of the loan. At the same time, this money that you’re saving could be used to help pay down the principal component of the loan, meaning that you will also pay off the outstanding debt faster. This is another reason it’s worth looking at a more competitive interest rate. On an average 30-year loan, you can end up paying just as much in interest as you do in debt repayments, so every little bit you can save matters in the long run. Fixed or Variable In the current environment, we’ve seen interest rates drop to record low levels, and many believe that the only way is up. When you refinance your home loan, you’re effectively taking out an entirely new loan product. That means you can change all elements of it, including things such as fixed or variable interest rates or even whether to pay down interest only. While everyone’s situation is a little different, it’s important to understand that you’re not stuck with a basic 30-year variable loan if you don’t want to be. In fact, when you refinance, you should also be looking for superior loan products that contain options such as an offset account, which also helps you reduce your interest payments and saves you money over time. Access Equity If you’ve owned a property for a reasonable length of time, it’s likely that the value of that property has increased. By refinancing, it’s possible to access some of that equity increase and put it towards other things. Most people use the equity to put down a deposit on another property or even to renovate their current home. The ability to access equity is one of the most powerful tools at the disposal of property investors and a big reason why you should look to refinance. Debt Consolidation The great thing about home loans is they come with some of the lowest interest rates you can get, certainly in comparison to things like credit cards, personal loans or even car loans. When you refinance, it’s a great opportunity to roll any of those high-interest debts into one place and get a far lower interest rate. You are effectively paying out those other debts and using the equity in your current home to do it. In the long run, this saves you money, and it is money you can use to pay down your home loan. See your home loan options in less than 5 minutes As we know, all borrowers have different circumstances and that’s why there is never a one size fits all approach when it comes to lending. For the majority of full-time employees with a good credit history, you will likely have a range of options and be able to look at a regular home loan. To access a regular home loan, you might only need three months of payslips or two years of tax returns. Generally speaking, regular home loans are a lot more stringent and that’s why we see some regular home loans with very low interest rates. Unfortunately, for the self-employed and business owners, it’s not always possible to present two years of tax returns or payslips. For these types of borrowers, there are other avenues to getting finance for a home, one of which is by providing alternative documents (alt-docs). Lenders that offer alt-doc loans will normally require three months’ worth of personal bank statements and six months’ worth of business activity and business bank statements, or potentially even an accountant’s declaration. Given the borrowers’ income is not as black and white as a PAYG employee, interest rates will normally be higher, while there might also be higher loan application fees and setup costs. It is important to note that just because you might be self-employed or a business owner, you don’t automatically need to go for an alt-doc loan. If you’re able to produce two years of tax returns and have a good credit history, then you should be able to qualify for a regular home loan at lower interest rates. However, if your business has recently seen a large increase in revenue and you want to access a larger loan, then it might be worth looking at an alt-doc loan. Similarly, if you’ve had credit issues in the past that you’ve been able to turn around, then an alt-doc loan might work for you. There are also a few myths out there, surrounding alt-doc loans. The main one is that you can get a loan with no documentation at all. Those days are long gone and you will need to be able to prove that you have the means to service the repayments. The second myth is that the big banks don’t take on these types of loans. In many instances, the major banks are able to look at lending to people without the full documentation, given they have the size and diversity to handle different amounts of risk. Once again, the key is to talk to a mortgage broker who can quickly understand your personal circumstances and match you with the right solution for your needs. See your home loan options in less than 5 minutes Over the course of the last few months, the COVID situation has shown us just how important it is to have some money in the bank. During the lockdown, many Aussies experienced job losses and lowered income, and as the weeks in isolation rolled by, even generous government payments couldn’t stretch to cover the bills and many savings accounts were depleted. According to research from the Gratten Institute, only 20 per cent of Australians have more than $50,300 in savings. A whopping 50 per cent of Australians have less than $7,000 in the bank. Unfortunately, these numbers are certainly telling us that the average Australian isn’t prepared for that rainy day when it finally arrives. Source: Gratten Institute Given the long-term strength of the housing market in Australia, it’s understandable that most Australians have a large portion of their wealth tied up in the family home. Perhaps they put any spare cash into paying down their loans, which is a prudent thing to do. However, that doesn’t always make it easy when you need to access some spare cash.

Fortunately, there are a few money management options for homeowners who want to get their hands on some cash - just in case. Redraw Facilities In years gone by, most borrowers have looked to a simple principal and interest loan with the goal of paying it over the lifetime of the loan - normally 25 to 30 years. Some of these loans afford you the ability to redraw any extra money you’ve put into the loan, over and above the contracted principal loan and interest repayments. Basically, if you’re ahead on your payments, some lenders will let you access that money, a little bit like a savings account. While this is good in theory, and certainly some Australians will have accessed this type of facility in recent months, the big issue is that the offer to redraw is still at the discretion of the lender. So theoretically, a lender can refuse a request to access these extra funds. With that being the case, while a redraw facility is still a positive step toward having cash on hand when you need it, there might just be better options for borrowers to consider. Offset Account These days there is a wide array of loan products that can significantly increase a borrower’s flexibility and reduce the amount of interest paid over the lifetime of the loan. For most borrowers, the best feature is often having a 100 per cent offset account. An offset account is basically a transaction account, that is linked to your loan. Money in the offset account reduces the overall loan balance which in effect, cuts down your interest payments. It’s a way of having your cake and eating it too. By parking some spare cash, or your savings in your offset account, you are going to be saving a significant amount of interest. This is because mortgage rates are virtually always higher than the interest you pay on your mortgage than on savings accounts, or even term deposits. And you can be sure they are far higher than any type of transactional account. You’ll be saving a significant amount of interest and that will put you ahead of just trying to save. Refinancing Depending on your personal circumstances, you could consider refinancing and accessing equity that has been built up in your home. You can then take advantage of your offset account by parking that equity in there and accessing it as you need it, while not paying interest on it. This money could be used in an emergency or even for something like the purchase of an investment property. Not all offset accounts are created equal, but that’s something you can talk to your mortgage broker about. What’s important is that you have control of your finances and you’re able to use that extra money or equity should you need it. As we’ve already seen, $7,000 in savings is not a lot, when something unforeseen comes along. See your home loan options in less than 5 minutes |

EDITOrCategories

All

Archives

December 2023

|

|

Read about us on KochiesBusinessBuilders and Linkedin

Partner with Adobi Mortgage Solutions Contact Bruce Johnstone (03) 9996 8553 or email [email protected] |

©2021 ADOBI® MORTGAGE SOLUTIONS ABN 94465268443

Suite 405, 585 Little Collins Street, Melbourne, VIC 3000 Telephone: (03) 9996 8551 Credit Representative Number 536529 authorised under Australian Credit Licence 384324 Your complete financial situation will need to be assessed before acceptance of any proposal or product Please review our Lenders, Terms of Use and Privacy Policy Member 87449: AFCA - Australian Financial Complaints Authority Member M-351557: FBAA - Finance Brokers Association of Australia |

RSS Feed

RSS Feed