|

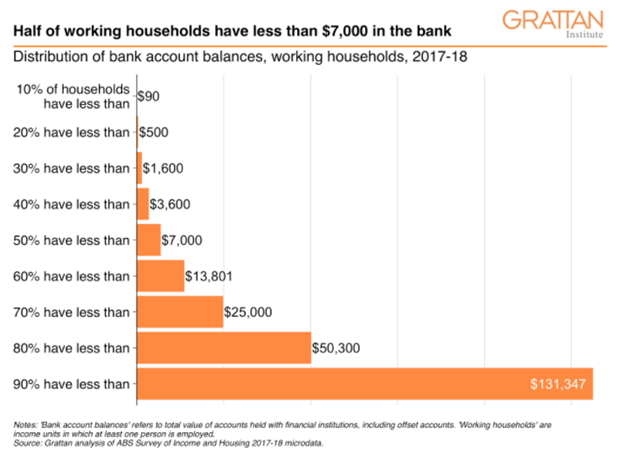

Over the course of the last few months, the COVID situation has shown us just how important it is to have some money in the bank. During the lockdown, many Aussies experienced job losses and lowered income, and as the weeks in isolation rolled by, even generous government payments couldn’t stretch to cover the bills and many savings accounts were depleted. According to research from the Gratten Institute, only 20 per cent of Australians have more than $50,300 in savings. A whopping 50 per cent of Australians have less than $7,000 in the bank. Unfortunately, these numbers are certainly telling us that the average Australian isn’t prepared for that rainy day when it finally arrives. Source: Gratten Institute Given the long-term strength of the housing market in Australia, it’s understandable that most Australians have a large portion of their wealth tied up in the family home. Perhaps they put any spare cash into paying down their loans, which is a prudent thing to do. However, that doesn’t always make it easy when you need to access some spare cash.

Fortunately, there are a few money management options for homeowners who want to get their hands on some cash - just in case. Redraw Facilities In years gone by, most borrowers have looked to a simple principal and interest loan with the goal of paying it over the lifetime of the loan - normally 25 to 30 years. Some of these loans afford you the ability to redraw any extra money you’ve put into the loan, over and above the contracted principal loan and interest repayments. Basically, if you’re ahead on your payments, some lenders will let you access that money, a little bit like a savings account. While this is good in theory, and certainly some Australians will have accessed this type of facility in recent months, the big issue is that the offer to redraw is still at the discretion of the lender. So theoretically, a lender can refuse a request to access these extra funds. With that being the case, while a redraw facility is still a positive step toward having cash on hand when you need it, there might just be better options for borrowers to consider. Offset Account These days there is a wide array of loan products that can significantly increase a borrower’s flexibility and reduce the amount of interest paid over the lifetime of the loan. For most borrowers, the best feature is often having a 100 per cent offset account. An offset account is basically a transaction account, that is linked to your loan. Money in the offset account reduces the overall loan balance which in effect, cuts down your interest payments. It’s a way of having your cake and eating it too. By parking some spare cash, or your savings in your offset account, you are going to be saving a significant amount of interest. This is because mortgage rates are virtually always higher than the interest you pay on your mortgage than on savings accounts, or even term deposits. And you can be sure they are far higher than any type of transactional account. You’ll be saving a significant amount of interest and that will put you ahead of just trying to save. Refinancing Depending on your personal circumstances, you could consider refinancing and accessing equity that has been built up in your home. You can then take advantage of your offset account by parking that equity in there and accessing it as you need it, while not paying interest on it. This money could be used in an emergency or even for something like the purchase of an investment property. Not all offset accounts are created equal, but that’s something you can talk to your mortgage broker about. What’s important is that you have control of your finances and you’re able to use that extra money or equity should you need it. As we’ve already seen, $7,000 in savings is not a lot, when something unforeseen comes along. See your home loan options in less than 5 minutes |

EDITOrCategories

All

Archives

December 2023

|

|

Read about us on KochiesBusinessBuilders and Linkedin

Partner with Adobi Mortgage Solutions Contact Bruce Johnstone (03) 9996 8553 or email [email protected] |

©2021 ADOBI® MORTGAGE SOLUTIONS ABN 94465268443

Suite 405, 585 Little Collins Street, Melbourne, VIC 3000 Telephone: (03) 9996 8551 Credit Representative Number 536529 authorised under Australian Credit Licence 384324 Your complete financial situation will need to be assessed before acceptance of any proposal or product Please review our Lenders, Terms of Use and Privacy Policy Member 87449: AFCA - Australian Financial Complaints Authority Member M-351557: FBAA - Finance Brokers Association of Australia |

RSS Feed

RSS Feed