|

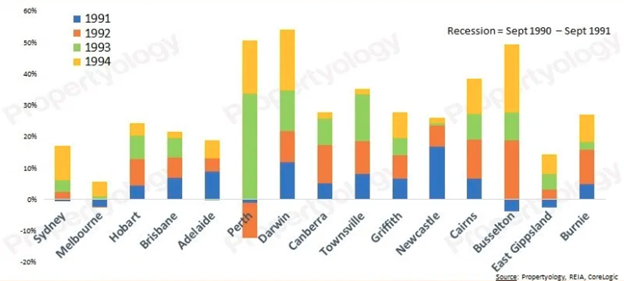

There’s been a lot of talk recently, about the prospect of Australia and many other countries around the world falling into a recession. These days, the word ‘recession’ isn’t as scary as it used to be as most people understand that this is a technical definition, that just means two consecutive periods of negative economic growth. With the severe limitations placed on the economy, through lockdown measures, used to combat the spread of COVID-19, it’s no surprise that the economy might slow down. But as we’ve also seen, things are improving rapidly and business is getting back to normal relatively quickly. That said, it is interesting to look at just how resilient Australian property has been in the past and why we should be optimistic about what that means for the coming months and years. ‘The Recession We Had to Have’ The last time Australia fell into a recession, it was the residential property market that really did buck the trend. The ‘recession we had to have’ happened in the early 1990s after a period of strong growth in the ‘roaring ’80s’ and the ensuing property boom. At the time, growth fell by 1.7 per cent and the unemployment rate jumped to 10.1 per cent. While the numbers looked bad on the surface, they didn’t impact property prices like many thought it might. In fact, it was quite the opposite. In the 12 months after the recession began, property prices in Sydney fell by only 0.7 per cent, Melbourne by 2.4 per cent and Perth by 1 per cent. On the flip side, house prices grew in value in Brisbane by 6.8 per cent and Hobart by 4.2 per cent. Not exactly what many might have expected. In the three years after 1991, property prices showed cumulative growth of more than 20 per cent in 5 of Australia’s 8 major capital cities. Source: Propertyology During that same period of time, unemployment was sitting around 10 per cent, with some areas even higher than that.

As we can see, property prices grew significantly in Perth and Darwin between 1991 and 1994, while our major two cities of Melbourne and Sydney both saw growth of between 5 and 18 per cent. Again, a long way from the calls being made recently of 30 per cent falls. Interestingly, there were also a number of regional areas that performed very strongly through that period as well. House prices in Townsville grew by over 30 per cent, Griffith by around 25 per cent, Cairns by nearly 40 per cent and Busselton in Western Australia by around 50 per cent. This data really highlights the fact that not only does Australian property have a history of performing strongly during tough times, but there really isn’t just one single house market in Australia. The most recent data from CoreLogic has indicated that the combined capital cities fell in value by just 0.5 per cent in May, which they labelled a sign of just how ‘resilient’ the property market has been. As lockdown measures across the country ease and the real estate industry gets back to business, the chances of a ‘V-Shaped’ recovery continue to increase. And once again it looks like property could play an important role in Australia’s economic recovery. See your home loan options in less than 5 minutes |

EDITOrCategories

All

Archives

December 2023

|

|

Read about us on KochiesBusinessBuilders and Linkedin

Partner with Adobi Mortgage Solutions Contact Bruce Johnstone (03) 9996 8553 or email [email protected] |

©2021 ADOBI® MORTGAGE SOLUTIONS ABN 94465268443

Suite 405, 585 Little Collins Street, Melbourne, VIC 3000 Telephone: (03) 9996 8551 Credit Representative Number 536529 authorised under Australian Credit Licence 384324 Your complete financial situation will need to be assessed before acceptance of any proposal or product Please review our Lenders, Terms of Use and Privacy Policy Member 87449: AFCA - Australian Financial Complaints Authority Member M-351557: FBAA - Finance Brokers Association of Australia |

RSS Feed

RSS Feed