|

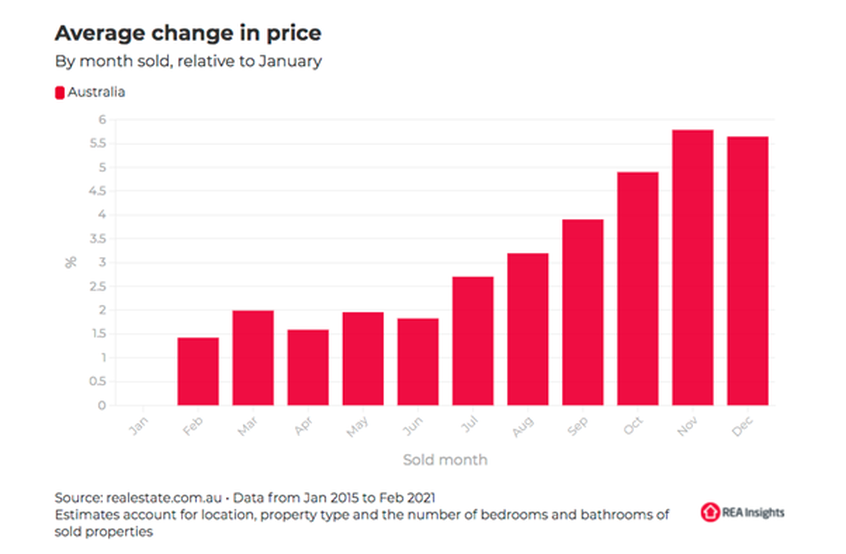

With the spring selling season coming to an end and Christmas just around the corner, many buyers and sellers are getting ready for a well-deserved break. The traditional belief is that spring is the best time to sell and it’s for that reason we see the largest volume of transactions taking place throughout September, October and November. This is followed by a sharp drop in transactions over the summer months. Interestingly, if you’re a buyer, then summer could well be an opportunity for you to find a great property at a decent price. In fact, research from realestate.com.au suggests that if you’re a buyer, January might be the month that represents the best buying opportunities. Source: realestate.com.au

This data found that across the country, properties sold in November have attracted prices almost 6% higher than those in January. According to the numbers, January has been the cheapest month to buy a property over the past three years. However, there are some big differences in the various capital cities, with the biggest seasonal impact being felt in Sydney, Melbourne and Hobart. Across these three capital cities, houses sold for prices in December that were 10% higher than in January. The belief is that in spring there are more auctions taking place, which leads to higher prices in Sydney and Melbourne in particular, which feature the majority of auctions. The fact that January can attract lower prices also has to do with the fact that many properties that might not have sold in December were held over until January. The impact of the time you buy and sell is a lot less prominent in other capital cities, but it still does occur in both Brisbane and Adelaide. In Perth, it appears that the best time to buy is during the winter months. As we move into the new year, the question remains, will this trend continue? 2021 hasn’t been a normal year by any standard, however, transaction volumes are getting higher each week as many people who have been holding off on buying or selling finally start to get active. See your home loan options in less than 5 minutes |

EDITOrCategories

All

Archives

December 2023

|

|

Read about us on KochiesBusinessBuilders and Linkedin

Partner with Adobi Mortgage Solutions Contact Bruce Johnstone (03) 9996 8553 or email [email protected] |

©2021 ADOBI® MORTGAGE SOLUTIONS ABN 94465268443

Suite 405, 585 Little Collins Street, Melbourne, VIC 3000 Telephone: (03) 9996 8551 Credit Representative Number 536529 authorised under Australian Credit Licence 384324 Your complete financial situation will need to be assessed before acceptance of any proposal or product Please review our Lenders, Terms of Use and Privacy Policy Member 87449: AFCA - Australian Financial Complaints Authority Member M-351557: FBAA - Finance Brokers Association of Australia |

RSS Feed

RSS Feed