|

One of the biggest mistakes new home buyers make is not having their finances organised prior to starting their search for a property. Many people assume that if one has a good income, a home loan is simple to get. Unfortunately, there are a number of steps in the process, and it often takes many weeks or even months to get everything formally approved. By far, the best option is to seek pre-approval before even starting the search for a new home. A pre-approval will allow you to know exactly how much you can spend and give you confidence that your loan application has a high chance of success when the time comes. However, there are still several steps you can take to fast-track the home loan application process, whether that’s pre-approval or unconditional approval. Boost Your Deposit Lenders like to see, firstly, that a potential borrower can manage money and that they represent a low level of risk. The best way to do this is to come up with a larger deposit. Normally, lenders like to see 20%, and anything less than that will mean that you’ll likely be forced to pay Lender’s Mortgage Insurance (LMI). LMI is a one-off insurance premium that the borrower is required to pay to protect the lender in the event of a default. If you’re putting down a larger deposit, you will not need to pay LMI, which makes the loan application process easier. It also opens you up to more lenders who will be willing to take you on. Reduce other debts When a lender is assessing your loan application, they are really assessing how likely you are to be able to continue to make repayments on any money they lend to you. If you already have large debts, particularly unsecured debts such as credit cards, it can make your application less appealing. If you are in a position to do so, it is well worth paying down all of your smaller debts or consolidating them. It is worth noting that lenders are also very interested in your overall borrowing limit when it comes to things like credit cards. Even if you don’t use that limit, they assess you as if you do. If you don’t need that extra capacity, it might be worth reducing your credit card limits. Check your credit record The very first thing most lenders are going to do when you apply for a home loan is take a close look at your credit record and credit score. Your credit record is your track record of how you have managed credit in the past. It contains a list of all the times you’ve applied for credit, records any missed payments and even shows if you’ve paid on time or early. The good news is that if you’ve been diligent with your repayments in the past, this will be reflected in a good credit score. However, if you’ve had a few issues, you can still turn things around. Start by making all your repayments on time and pay your bills the day you receive them. If you’re having trouble with current debts, it might be worth looking to consolidate them and tidying up your finances. Make sure your credit history is in order, and this will dramatically speed up your application process. See your home loan options in less than 5 minutes Arguably, the most important element of the property journey is obtaining finance. One of the most confusing parts of the process for first home buyers is the difference between the various types of approvals. Most commonly, when you are looking to obtain finance to purchase a home, there will be two separate approvals that you’re likely to encounter, and it is vital that you understand the differences between them. Conditional Approval If you choose to purchase a home using a ‘subject to finance’, without some form of indication from a lender that you will be able to access that finance, you could find yourself in a tricky situation. Commonly, homebuyers will look to gain conditional approval for a loan, which is more commonly known as a pre-approval. A pre-approval is a powerful tool for the homebuyer, as it gives them a very clear indication from a lender as to what they will be able to borrow, based on their personal and financial situation. Once you have submitted your loan documents and all the required documentation, such as payslips, group certificates and/or bank statements, the credit team will assess your application and if you are successful, you will be issued with a conditional loan approval. What this means is that a bank will pre-approve your home loan, up to a certain borrowing limit, subject to you finding a property that meets the agreed criteria, and provided that your situation doesn’t change in the coming months. Generally, a pre-approval is valid for three months, but it is merely an indication, and not a guarantee that you will get a loan. A pre-approval is a powerful tool for you as a buyer, because it makes you appear serious in the eyes of vendors and sales agents, whilst also giving clarity as to just how much you are able to spend on a property. Unconditional Approval Once a homebuyer has found a property, they can go back to the lender that offered a pre-approval and seek a home loan. When a lender is satisfied that you have met all of their criteria, including LVRs, valuations and your own personal financial situation, you will be fully approved and you will have unconditional approval. It is possible that a lender won’t offer you a home loan after you have made an offer on a property, if that property is unique in some way, or if there are issues with it in the eyes of the lender. The most important part of the loan application process is to work closely with a mortgage broker. They are in the best position to be able to help you navigate any issues that might arise, and they also communicate closely with the lender. If you’re unsure about where your application is at any given time, your mortgage broker will be able to help guide you through the process. See your home loan options in less than 5 minutes One of the most powerful elements of property investing is that you can access the equity you have in your current property to continue to invest and grow your portfolio.

It can be a misconception that you need to have huge sums of money to grow a large portfolio when in reality, you just need to wait for the natural growth that occurs over time and leverage the equity that has been created. What is Equity? Equity is simply the market value of your property, less the money you have owing on it. For example, if your property is worth $500,000 and you have a mortgage of $300,000 remaining on the property, then you have $200,000 in equity that you can access to continue to invest. Building on this example, if the value of your property grew further to $600,000, that would mean that you would then have $300,000 in equity in which to invest. This highlights the power capital growth can have, when it comes to building a large property portfolio. Accessing Equity The first step in accessing the equity you already have in your home is to get your property valued. It is important to get it valued by an independent valuer who works with a range of lenders. Your mortgage broker will be able to guide you on the process. Similarly, they will also be able to help you structure your loans in a way that will be most suitable for your situation. For instance, you might want to cash out a portion of your equity and leave it in an offset account to use as a deposit on an investment property. It’s also worth noting that to access the equity in your home, you will still need to meet the normal requirements from the lenders when applying for a home loan. Mainly, that means you will need to be able to service the loan based on your current income and expenses. Investing Your Equity Your mortgage broker will be able to work with the lender to determine not only how much equity you can access, but they will also be able to set a pre-approval limit for your next purchase. As a general rule, you only want to borrow up to 80% of the property’s value in order to avoid other costs such as Lenders Mortgage Insurance. Returning to the example of our property that is worth $500,000 with a $300,000 mortgage - while you have $200,000 in equity, you will likely only want to access $100,000, which is 20% of the property’s value. These funds can then be used to pay for the deposit on another property as well as additional costs such as stamp duty, settlement and your valuation expenses. Over time, we know that property is an appreciating asset and when your properties rise in value, you will be creating more and more equity that you can continue to access. This is how you can build up a large portfolio, with only the one initial deposit on your first property. See your home loan options in less than 5 minutes Buying a home is quite often the largest financial decision most people make, and it’s one that needs to be carefully considered.

Prior to going down the path of purchasing a home, it’s vital that you get your finances in order to ensure that firstly, you can get the required finance, and secondly, you will be able to manage the repayments going forward. There are a few things you can do with your personal finances to give yourself the best chance of getting into your dream home. Start Saving Being able to manage money is an important life skill, and unfortunately, it is not one that everyone has. When it comes to purchasing a home, there are a number of benefits to having an effective savings plan. The first is that lenders require you to come up with a 20% deposit. While there are other options at your disposal that can help here, generally speaking, borrowers requiring an LVR (Loan-to-Value Ratio) greater than 80% will be required to pay Lenders Mortgage Insurance (LMI), which can be expensive. It’s also worth remembering that on top of your deposit, you could be required to pay stamp duty (unless exempt) and certainly settlement costs, amongst other expenses. Getting into the habit of putting money aside every week and working within a budget and towards a goal will also hold you in good stead when the time comes to start making repayments. Another important consideration is that lenders require you to have a certain amount of money in genuine savings. The ability to show them not only your savings but a track record of managing your money well makes you stand out as a person they will want to lend to. Improve Your Credit One of the key factors lenders look at is a borrower’s credit score. A credit score is effectively your track record of managing debt. Get into the habit of paying off bills when you receive them and always pay down your credit cards each month. Practices like this will help boost your credit score, and lenders will certainly take note. Pay Off Debt If you’re looking to take out finance for a new home, one of the things that a lender will certainly want to know about is any outstanding debts. Your payments on these debts will be a factor in calculating your ability to service any future loans. On top of this, lenders also assess your debt-to-income ratio, and many of the major banks have fixed metrics that they must adhere to. Paying off debts is typically a good idea, regardless. However, when you’re looking to take on more debt, it’s important that you don’t have things like overdue credit cards and personal loans with high interest rates weighing you down. Get Pre-Approved The best way to know just how you are looking financially, in the eyes of a lender, is to get a pre-approval. By talking to a mortgage broker and starting the process of getting pre-approved, you will get a very clear understanding of where you currently stand. If there are any issues with your credit history or outstanding debts, your mortgage broker will be able to sort them out; or at least start the process of turning things around. See your home loan options in less than 5 minutes When Christmas is coming up it’s important to start thinking about your budget over the holiday period.

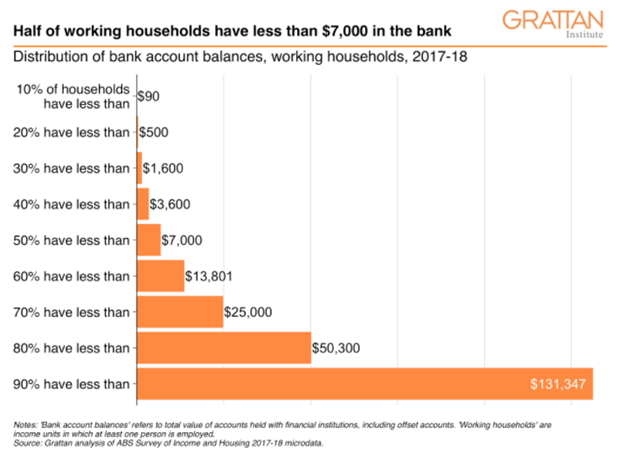

While we all love giving presents, if you’re looking at potentially applying for a home loan in the new year, it’s important that you don’t do any damage to your chances of getting finance by overspending in the next few weeks. What we do know, is that lenders take a snapshot of your financial situation when they assess your application for finance and if you’ve been busy racking up credit card debt, it might come back to hurt you in the future. Here are some quick tips for budgeting at Christmas. Allocate Money Upfront There’s a good chance that you will be spending this Christmas, so do it wisely. Make a budget and try and stick to it. Lenders will look at your bank and credit card statements from at least a three month period, so if you’re looking to have a clean record for your loan application, it might be worth keeping the charges down. One idea could be withdrawing cash and paying for things with physical money, that way you can allocate funds upfront. Another budgeting idea is to simply spend a fixed amount per person. That way you can allocate a pool of money and everyone gets a fair deal. One of the big traps that a lot of people fall into is minimising the spending at Christmas, only to get sucked into all the Boxing Day and holiday sales. When you’re allocating your Christmas budget, it might be worth applying that to the entire holiday period. Don’t overextend yourself While any credit card debt isn’t great, the worst thing you can do is take on more credit cards. When it comes to borrowing money, your current debt is just as important as how high your credit limits are. If things are a bit tight on your loan application, it might even be worth getting rid of your credit cards to boost your borrowing capacity. This is tough to do if you have outstanding balances and it’s even more difficult if you can’t pay them off. Invariably, if people have the money (or credit) at their disposal, they tend to spend it. Keep both the credit card spending down and certainly don’t take out any new cards in the coming months. Even if there are some great sales on. Avoid Buy Now, Pay Later These days, everyone is moving toward the buy now, pay later (BNPL) phenomenon. While it might be convenient, you don’t want these types of payments to impact your chances of securing a loan. While BNPL isn’t technically an application for finance, it could impact your credit score. More importantly, a lender will make an assessment on what type of borrower you are and if you have hundreds of these types of payments coming out of your account, it won’t look that good on the application. These days, every lender will assess your credit score and go over your bank details with a fine-tooth comb, so it is important to have things in order. Christmas is an incredible time of year and it’s great to give to family and loved ones. Just don’t overdo it or it could cost you a lot more in the long run, when the time comes to get a loan approved. See your home loan options in less than 5 minutes Over the course of the last few months, the COVID situation has shown us just how important it is to have some money in the bank. During the lockdown, many Aussies experienced job losses and lowered income, and as the weeks in isolation rolled by, even generous government payments couldn’t stretch to cover the bills and many savings accounts were depleted. According to research from the Gratten Institute, only 20 per cent of Australians have more than $50,300 in savings. A whopping 50 per cent of Australians have less than $7,000 in the bank. Unfortunately, these numbers are certainly telling us that the average Australian isn’t prepared for that rainy day when it finally arrives. Source: Gratten Institute Given the long-term strength of the housing market in Australia, it’s understandable that most Australians have a large portion of their wealth tied up in the family home. Perhaps they put any spare cash into paying down their loans, which is a prudent thing to do. However, that doesn’t always make it easy when you need to access some spare cash.

Fortunately, there are a few money management options for homeowners who want to get their hands on some cash - just in case. Redraw Facilities In years gone by, most borrowers have looked to a simple principal and interest loan with the goal of paying it over the lifetime of the loan - normally 25 to 30 years. Some of these loans afford you the ability to redraw any extra money you’ve put into the loan, over and above the contracted principal loan and interest repayments. Basically, if you’re ahead on your payments, some lenders will let you access that money, a little bit like a savings account. While this is good in theory, and certainly some Australians will have accessed this type of facility in recent months, the big issue is that the offer to redraw is still at the discretion of the lender. So theoretically, a lender can refuse a request to access these extra funds. With that being the case, while a redraw facility is still a positive step toward having cash on hand when you need it, there might just be better options for borrowers to consider. Offset Account These days there is a wide array of loan products that can significantly increase a borrower’s flexibility and reduce the amount of interest paid over the lifetime of the loan. For most borrowers, the best feature is often having a 100 per cent offset account. An offset account is basically a transaction account, that is linked to your loan. Money in the offset account reduces the overall loan balance which in effect, cuts down your interest payments. It’s a way of having your cake and eating it too. By parking some spare cash, or your savings in your offset account, you are going to be saving a significant amount of interest. This is because mortgage rates are virtually always higher than the interest you pay on your mortgage than on savings accounts, or even term deposits. And you can be sure they are far higher than any type of transactional account. You’ll be saving a significant amount of interest and that will put you ahead of just trying to save. Refinancing Depending on your personal circumstances, you could consider refinancing and accessing equity that has been built up in your home. You can then take advantage of your offset account by parking that equity in there and accessing it as you need it, while not paying interest on it. This money could be used in an emergency or even for something like the purchase of an investment property. Not all offset accounts are created equal, but that’s something you can talk to your mortgage broker about. What’s important is that you have control of your finances and you’re able to use that extra money or equity should you need it. As we’ve already seen, $7,000 in savings is not a lot, when something unforeseen comes along. See your home loan options in less than 5 minutes In the current market where property prices are trending higher and there’s a shortage of stock, upgraders and downgraders can find it difficult to get into a new property. For many, the age-old question of whether to buy first or sell first is more prominent than ever with the present housing market favouring sellers.

Fortunately, there is an option that can help in the form of a bridging loan. A bridging loan is a short-term loan that helps buyers purchase a property before needing to sell their current property. In a perfect world, you would sell your property and then go out and find a new property. However, if the perfect home comes along beforehand, you might not want to miss out on the opportunity. That said, there are advantages and disadvantages to bridging loans. Advantages Speed The main benefit of a bridging loan is that you can buy a property right away. You don’t have to wait for the property to sell or even to settle, which can be a long time in some instances. It will also give you room to sell your property, so you aren’t forced to sell immediately at a worse price than you might have received otherwise. Capitalised Interest When you take out a bridging loan, it is normally an interest-only loan, where you pay back all the interest at the end when you sell your original property. With this type of loan, you’re only needing to pay back one mortgage at a time and can pay off all the accrued interest when you sell and settle on your current property. Standard Rates In years gone by, bridging loans weren’t as appealing as they often came with very high interest rates. These days many lenders will offer standard variable rates, but as always, policies differ between lenders and products. Disadvantages More Interest When you are taking on a bridging loan you are technically carrying two properties and therefore will be paying interest on both. The longer it takes to sell your current property the more interest you will be required to pay. Some lenders might even force you to pay higher interest rates after a set period of time. Higher Costs There are certain areas where you will need to pay additional costs when using a bridging loan. For example, given that you have two properties, you will need to pay for two valuations. There can also be costs involved with breaking your current loan to take on a bridging loan. Need To Service the Debt To qualify for a bridging loan, you still need to be able to service the total amount of debt based on your income and expenses. In some ways, this is similar to getting an investment loan. You will also need to have a reasonable amount of equity built up in your current home. See your home loan options in less than 5 minutes One of the biggest mistakes new property buyers make is not understanding how much a property is actually worth. This is common with inexperienced buyers who have trouble purchasing a property at auction.

The auction process is not always easy to navigate, which is why it’s important to find out how you can quickly and easily get a better understanding of what a property’s true value actually is. Ask An Agent Sales agents are at the coalface of the property market. They are normally very approachable people who are prepared to take the time to discuss property in their local area. If you’re interested in purchasing a certain property, it’s possible to contact a number of local agents and get their opinion on what it might be worth. Agents know what types of property are currently in high demand, as well as what has recently sold and for how much. They can be a very valuable tool in getting a clear understanding of what your property (or one you want to purchase) might be worth. Online Tools These days there are a host of free online tools that can value a property. It’s simply a matter of entering the address and the algorithm will give you a quick idea of what a property is likely to be worth based on recent sales history. While this is not a perfect valuation, it should give you some idea of what a property is worth because it does factor in what has been selling in the local area. Hire A Valuer If you want a very accurate idea of a property’s true value, you can hire a professional valuer. Many buyers choose to do this as a lender will require a valuation before approving a home loan. While a lender may not accept your independent valuation, it will give you an accurate idea of what a property is worth and if you can afford it. Comparable Sales The vast majority of valuers in Australia price a property based on comparable sales. Comparable sales are simply sales of similar properties that have occurred in the past few months. The good thing these days is that much of the sales data is available for free online, and you can use those figures independently to come up with a rough valuation. The most effective way to do this is to go to a listing portal that provides recent sales data and find all the properties in the same suburb that have occurred in the past three to six months. From there, you can narrow that list down to properties that match yours in terms of the dwelling type, age, condition, and land component. At this point you can see the sales of properties very similar to your own. This will give you a good idea of what the property might be worth. If there is a property that has sold that is very similar to your property of interest, you can take this one step further and contact the sales agent to get an idea of how the property sold. Ask them how many people viewed the property and how many offers were made. If the property sold at auction, see if you can get any insight into the number of bidders and how it went. The more information you have the better, as this will help you make the most informed decision about your own property, or one that you’re looking at buying. See your home loan options in less than 5 minutes Owning your own property is normally very high up on the list of things people want to achieve in their life. However, depending on your financial goals and what stage of life you’re at, what you hope to achieve with property will likely differ quite considerably.

For first home buyers, the biggest question is usually whether to rent or buy? Advantages of Buying Capital Gains The most obvious advantage of buying a property is that you own it and benefit from the capital gain on the property, should its value increase. However, you also have to pay all the costs such as council and water rates and ongoing maintenance. You Control It When you own a property, you get to do anything you want to it. A common complaint from renters is that they aren’t even allowed to put up a picture hook. That’s not an issue if you buy a house. Add Value If you own a property, you’re able to add value to it and manufacture equity in certain ways. The most common strategy for this is to do a small renovation or even a subdivision. More Affordable In a lot of cases, you will find it is more cost effective to buy than rent, in the current environment, thanks to record-low interest rates. If you’re living in an area where you can pay less on your mortgage than you would renting, then the incentive is certainly there to go out and buy. Advantages of Renting Flexibility One of the greatest benefits renters enjoy is flexibility. Many people who choose to rent do so because they are able to rent in highly desirable locations, like the inner city that offers a great lifestyle and amenity. For many of these high-demand locations, purchasing a property can be very expensive and outside the budget. Lower Fixed Costs Costs are usually less of a burden for renters as the landlord is generally required to pay many of the ongoing costs of the property, including strata fees, water and council rates, and maintenance. Cash Flow Renting can allow you to free up more cash, so you can put it into other ventures. If you’re trying to start a business or you want to spend your money on things like travel, then renting can be advantageous. Rentvesting Over the past few years, there has been a growing push from property investors in Australia to continue renting and purchasing an investment property instead of a home to live in. This is a way you can get the best of both worlds – you can live in a great location and still invest in property elsewhere. Rentvesting is increasingly common in places like Sydney and Melbourne, where house prices are higher. See your home loan options in less than 5 minutes Over the past few months, we’ve been hearing more about serviceability buffers and how they might impact home buyers’ ability to borrow. However, many people don’t understand what a serviceability buffer is and how it works. Simply put, a serviceability buffer is the minimum interest rate a lender is expected to use when assessing a loan application. Lenders look at a borrower’s income and expenses to determine how much capacity they have to borrow. On top of this, they take into account the potential interest rate payments both now, and in the future. They do this by applying a serviceability buffer over and above the minimum monthly payment, based on current interest rates. The body that implements these serviceability buffers on banks and lenders are known as The Australian Prudential Regulation Authority (APRA). APRA are an independent Government Agency that sets the serviceability buffer requirement and also implements other measures aimed at helping maintain the stability of property. Other measures APRA looks at include limits on debt-to-income ratios or LVRs. Recently, APRA announced that it would be increasing the serviceability buffer of home loan applications from 2.5% to 3%. This effectively means borrowers will be able to access less money and have a smaller borrowing capacity. APRA estimates the 50 basis points increase in the buffer will reduce maximum borrowing capacity for the typical borrower by around 5%. With interest rates at record low levels, the belief is that the RBA will eventually raise interest rates, however, at this stage, they have indicated that this might not happen for some time. Raising serviceability buffers are a way to reduce the overall level of lending and also cool property markets that have been running hot, particularly along the East Coast of Australia. Higher serviceability buffers generally impact investors more than owner-occupiers, given they often carry higher debt loads. The last time serviceability buffers were introduced were during the most recent property boom on the East Coast in 2015, which lead to a slowdown in house price growth. See your home loan options in less than 5 minutes |

EDITOrCategories

All

Archives

December 2023

|

|

Read about us on KochiesBusinessBuilders and Linkedin

Partner with Adobi Mortgage Solutions Contact Bruce Johnstone (03) 9996 8553 or email bruce@adobi.com.au |

©2021 ADOBI® MORTGAGE SOLUTIONS ABN 94465268443

Suite 405, 585 Little Collins Street, Melbourne, VIC 3000 Telephone: (03) 9996 8551 Credit Representative Number 536529 authorised under Australian Credit Licence 384324 Your complete financial situation will need to be assessed before acceptance of any proposal or product Please review our Lenders, Terms of Use and Privacy Policy Member 87449: AFCA - Australian Financial Complaints Authority Member M-351557: FBAA - Finance Brokers Association of Australia |

RSS Feed

RSS Feed