|

After a tough period over 2022 and 2023, the commercial property market can look ahead to consolidation and the prospect of a recovery emerging in 2024, according to Knight Frank.

Knight Frank Chief Economist, Ben Burston, said the sustained pressure of higher rates has naturally put pressure on asset values and this is still playing out to varying degrees. “Part of the uncertainty has been a disconnect between formal valuation metrics and market sentiment,” Mr Burston said. “However, with more deal evidence now coming through and formal valuations likely to be adjusted further in the December cycle, we expect the gap between sentiment and formal valuations to erode substantially over the next six months so that by mid-2024 the picture will be clearer for buyers and sellers alike, helping to restore confidence and liquidity.” Mr Burston said that while reductions in asset value are never welcome, the flipside is the re-emergence of value looking forward. “Higher yields act to reset the market and provide a more attractive entry point for investors, generating the prospect of higher returns,” he said. “This is clearly illustrated when we assess historic market cycles and the performance achieved after pricing is reset in the aftermath of interest rate hiking cycles.” He said the period immediately after the conclusion of previous rate hike cycles ending in 1994, 2000 and 2010, was in each case a very attractive time to buy, achieving above-average returns over the following five years. “This is not to say that history will repeat, and investors cannot take for granted that interest rates will fall exactly as anticipated,” he said. “But careful asset selection will maximise the chances of strong performance whether it is achieved through income growth or boosted by a return to yield compression as interest rates revert in 2024-26.” The recent rate hikes by the Reserve Bank of Australia (RBA) have understandably put borrowers under pressure. The fact that the RBA has implemented a handful of consecutive holds is little consolation for those struggling with higher borrowing costs.

However, taking a proactive approach can help you mitigate the impact of rising interest rates and put you back in control of your financial situation. Here are some strategies you can consider: Review your budget Start by conducting a detailed review of your budget. Analyse your income, expenses, and debts to identify areas where adjustments can be made to allow for higher repayments. Look for opportunities to cut back on discretionary spending or make lifestyle adjustments that will free up additional funds to help with your mortgage repayments. Negotiate with your lender Reach out to your lender to discuss securing a lower interest rate. If you are transitioning from a fixed-rate period, you may be facing a variable interest rate that's higher than what your lender offers to new borrowers. This is where a mortgage broker can help negotiate a different rate with your current lender, if possible. Refinance to a lower interest rate If your current lender is unwilling to provide a competitive interest rate, refinancing with a different lender might be an option. Mortgage brokers can help compare rates and loan terms which could give borrowers some additional room to breathe. Refinancing can not only lead to better interest rates but may also allow you to consolidate debts or access equity in your home at the same time. Make extra repayments Making additional repayments on your mortgage can significantly help you in the long run – if you have the scope and spare income. By reducing your principal, you'll lower the amount of interest charged on your home loan. By paying off your loan faster you will be less susceptible to future rate hikes. Extend the loan term While it may not be the preferred option for everyone, extending the loan term can reduce your monthly payments. However, it's important to understand that this also means paying more interest over the lifespan of your loan. This can be a good short-term solution. Seek out better features Consider features that can reduce the amount of interest you pay on your home loan like an offset account or redraw facility. These features enable you to use surplus funds or savings to offset your mortgage balance. Fix your home loan Fixing your home loan can be a strategic move to manage rising interest rates. By locking in a fixed rate, you shield yourself from the risk of further rate hikes, providing stability and potentially saving money on your mortgage repayments. Record low vacancy rates across the industrial property sector will continue to put upward pressure on rents, according to a new CBRE report.

The CBRE report said that industrial rents are expected to rise by more than 5 per cent next year, with Sydney experiencing a spike of more than 11 per cent. Across Sydney, industrial rents rose 38 per cent this year to $200 per square metre with the vacancy rate falling to just 0.2 per cent. CBRE’s head of Industrial and Logistics Research Australia, Sass J-Baleh, said about 4.6 million square metres of warehousing is due to be built over the next two years, with half already pre-committed. “We expect that even if demand weakens significantly in 2023, there is still not enough supply to satisfy space requirements from major occupiers that are setting up their activities and supply chains for the long-term servicing of the Australian population,” Sass J-Baleh said. With property markets cooling down from the recent boom, there are now more opportunities for investors to enter the market. With listings increasing and less competition, it could be a good time to think about buying an investment property.

Here are some quick tips for investors. Get specific – while national property markets might be slowing down, it doesn’t mean that all locations are. When investing, research properties at the suburb level and compare the number of listings with overall demand to get a sense of what’s happening in that area. Tight supply can drive prices higher. Crunch the numbers – with borrowing costs on the rise, it’s important to have a clear understanding of how much your investment is going to cost and what it’s going to take in. Talk to experts like property managers if you need more information – and don’t get emotional about the purchase. Work with a mortgage broker – in the current interest rate environment it’s important to compare your mortgage options to get the best interest rate and loan product for your personal situation. A mortgage broker is an incredibly valuable asset for investors. For borrowers trying to save money on their home loan, it might be worth looking at the frequency of your repayments.

A small change from monthly to weekly might not make much of a difference to your household budget, but it could go a long way to cutting down your interest over the life of the loan. The most important thing to know about home loans is that interest is calculated on the daily balance and charged to the loan account monthly in arrears. If you take the minimum monthly repayment and pay half every two weeks, borrowers can save a significant amount off both the term and interest. There are 26 fortnights in a year – the equivalent of 13 monthly repayments rather than 12, meaning you’re actually paying more than the minimum. If borrowers choose to pay weekly, they could save more on interest but not so much on the term. Most business owners would understand the frustration that comes with having to get paid for work or orders that have already been completed.

In many instances, businesses might need to wait 60 days or more to get paid, which can put a strain on the business's cashflows and makes it difficult to grow. Fortunately, there are options to help alleviate the stress of waiting to get paid. Business loans A business can often get a fast cash injection by way of a business loan or line of credit. Business loans are organised through a lender with the help of a finance broker. Each lender will have its own criteria that a business must meet to get approved for a loan. Loan amounts will also vary between lenders. Typically, a business loan is unsecured, which means that the interest rate will normally be higher than a comparable secured loan. As a result, a business loan might be a quick way to help with a business's cashflow, however, it still might come at a cost. Invoice finance Another option to help elevate the cashflow issues that come from waiting for payments is invoice finance. Invoice finance is also organised through a lender, but is normally done on an ongoing basis. This means your business and the lender will have an ongoing relationship which in turn tends to lead to more flexibility and potentially cost-effectiveness. If you set up a certain arrangement with a lender, it’s possible to change terms as time goes on as your business grows or if your requirements change. Invoice finance is a good option if you’re looking at ways you can grow your business with the help of a lender. It can save you from making repeat applications for finance and there are also other features that the lenders can offer that might be able to assist your business. For businesses, the ability to access finance can make a huge difference to your success and ability to grow.

Regardless of the type of asset finance you’re looking for, your ability to repay debt will likely be examined by a lender. Lenders will assess your risk profile to determine things like your interest rate, so it’s important to understand how your business looks in the eyes of a lender. Here are some factors that impact your risk profile:

With the RBA’s ongoing cash rate hikes, mortgage rates are also continuing to climb.

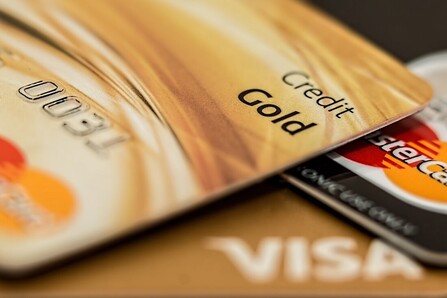

The resultant increase in servicing costs has led many new borrowers to find they might not be able to borrow as much as they previously could. Fortunately, there are some steps you can take to boost your borrowing capacity. Pay down existing debt If you’ve got several different loans, it’s likely they are weighing heavily on your borrowing capacity. A debt by itself means you have money going out every month reducing your overall income. The obvious solution is to pay down your debts as much as you can before applying for a home loan. However, you can also look to consolidate those debts by rolling some of the higher-interest debts into a new loan with a lower interest rate. This should free up some money that you can use to pay off those debts faster, or use to service a new home loan. Reduce your credit card limit When you have a credit card, even if you don’t use it, your borrowing capacity will be reduced. Banks assess your credit card limit as if it is maxed out, so if you aren’t using a certain card or it comes with a very high limit, it may be doing you more harm than good. If you’re really struggling with borrowing capacity, it could be a good idea to get rid of the credit card altogether – or at the very least reduce its limit. Apply for a joint loan If you’re on a single income, it can be difficult to afford the high price of homes these days. If you’re looking to invest or buy a home to live in, by applying with your spouse you are likely able to borrow more. If you live together, many of your expenses will be shared and your higher income will mean you should be able to borrow more. Opt for a positive cash flow When a lender looks at your application for a loan, they will also include the potential income from the property if you are trying to buy an investment. If you need to boost your borrowing capacity, it might be worth looking at a positively geared property. That means a property where the rental income is greater than the cost of servicing the debt and the annual expenses. That means you will only be assessed on your current income and expenses. You likely won’t have to contribute any funds towards the ongoing costs of holding and maintaining the property. While many people are excited about the idea of buying their first home, it can also be overwhelming knowing that you have to eventually pay off a large mortgage.

The good news is that with some simple strategies, there are ways to pay off your home loan faster than expected. Borrow less than you can afford It’s important to have a very clear understanding of what your financial situation is going to look like once you’ve taken on a mortgage. If you’re struggling to qualify for a home loan, then an option is to simply purchase a cheaper property. While you might not get into your dream suburb straight away, as your equity position improves you can use that to move forward and upgrade. In addition, a more affordable home would mean you can pay down your debt faster. Increase your repayment frequency Most lenders will typically put you on monthly mortgage repayments. While this might be convenient, it might not be the most cost-effective option for you. If you increase your repayment frequency to fortnightly or weekly, you will end up making more repayments over the course of the year and be paying down a higher amount of debt. There are only 12 months in a year, while there are 52 weeks and 26 fortnights. That means your loan gets paid off faster and you’ll also be saving interest along the way. Along the same lines, you also have the option of increasing your repayments. You don’t have to simply pay down the minimum each month. The more you can pay down that principal component the better. Use an offset account These days, there are several home loans that come with useful features that can help save you money on interest. An offset account is one such tool. This feature operates like a transaction account, however, it is linked to your home loan account. Your total interest repayments are calculated based of the value of your home loan, less the funds in your offset account. This means the more money in your offset account, the less interest you’ll pay. In turn, you can use those extra funds to make higher repayments on the principal loan. If your current home loan doesn’t come with an offset account or lacks the flexibility that you need, it might be worth speaking to a mortgage broker to compare your options. Real estate around the world is expected to outperform both bonds and shares over the next five years, according to a new report from Oxford Economics.

Between 2022–2026, Oxford Economics have predicted total returns for real estate and real estate investment trusts (REITs) to average 6.5 to 7 per cent per annum. This is significantly higher than bonds and equities, which are expected to return just 0.7 per cent and 2.5 per cent per annum, respectively. Oxford Economics expects interest rates to remain at low levels in the coming years, which will help underpin real estate prices and drive economic growth. Most businesses understand the importance of investing in equipment to move their business forward. As the saying goes, you need to spend money to make money. Here’s why it’s important.

EfficiencyOld equipment might get the job done, but is it going to be the most efficient way of doing things? With equipment financing, you can improve productivity, reduce project timelines, and increase the output of your business without needing additional resources. Tax benefitsDepending on your individual circumstances, you could be eligible for write-offs and deductions that see you benefiting more from investing in new equipment than if you didn’t. Workplace satisfactionWith new, state of the art equipment, your business becomes a place employees want to be, and customers want to visit. With better aesthetics and new technology, the increased capabilities make your business stronger and more desirable. Prime industrial rents surged by double digits in most capital city markets in 2021 as tenants were pushed to compete for the small amount of available space on the market. According to JLL, the highest prime effective rental increases occurred in Perth (up 14.6 per cent), Melbourne (14 per cent) and Adelaide (13 per cent) over 2021. In the secondary market, effective rents rose 16 per cent in Brisbane and Melbourne and 10 per cent in Sydney. Around the country, a record 4.4 million square metres of warehouse space was taken up in 2021. This is a 52 per cent rise on the 2.9 million square metres taken up in 2020. The data from JLL shows that prime industrial rents increased by more than 10 per cent in most capital city markets, fuelled by the acceleration of online retailing and supply chain disruptions. JLL believe the completion of 1.3 million square metres of new logistics facilities in the next six months will ease pressure on companies needing warehouse space and create a more normalised rental market. Two-thirds of this new supply is already accounted for in leasing pre-commitments. Fourth-quarter 2021 figures from JLL show 877,200 square metres of space was leased over the last three months of the year. The majority of this activity was in Melbourne (39 per cent) and Sydney (33 per cent). Last year, JLL says 1.47 million square metres of new space was developed nationally, which was in line with the 10-year annual average. The full-year gross take-up total (4.4 million square metres) was 82 per cent higher than the long-term annual average. JLL still expects above-average growth in the major markets in 2022 with many owner-occupiers requiring immediate access to more space. While most people will typically look to take out a variable home loan, it is first worth considering what might happen with interest rates in the future and whether that means you should think about a fixed-rate home loan.

A fixed-rate home loan simply means that the interest rate on the home loan is fixed for a certain period of time. For most fixed-rate home loans, that is going to be around two to five years. However, there are a number of other factors that you need to consider apart from just the fixed interest rate. Advantages The main advantage of a fixed-rate home loan is that with a set interest rate, you will have a degree of certainty around your weekly and monthly repayments. If you have budget constraints, then fixing your home loan might be an option so you know where your finances stand each month. However, if you believe interest rates are going to rise in the future, it might be worth looking at locking in a fixed-rate loan. This will ensure your repayments remain at their current level for the term of the loan, regardless of what happens to underlying interest rates and changes from the RBA. Disadvantages While it is good to have certainty around your repayments, one of the big disadvantages of a fixed-rate home loan is the lack of flexibility. If you take out a fixed-rate loan and want to change out of it or refinance, there are likely going to be higher break costs involved than with a simple variable loan. Also, a number of the features that can save you a lot of money, such as offset accounts and redraw facilities, are typically not available on fixed-rate home loans. While you might save money with rising rates, you could have potentially saved even more if you’d had a superior loan product with more features. In the current environment with record-low interest rates, there are numerous home loans with very attractive introductory offers. If you qualify for a home loan with an introductory rate, that might be a better option than going with a fixed-rate loan. It would be more flexible, and the net result could be very similar. Finally, it’s also worth noting that actual rates that come with fixed-rate loans are often a reflection of where banks and lenders believe interest rates are headed. If fixed-rate loans have higher interest rates than comparable variable rates, it suggests lenders believe rates will rise. Even if you take out a fixed-rate home loan, your repayments might still end up being more, even if interest rates and your repayments would have risen with a variable home loan. If you like the idea of having some certainty, but you’re still not convinced about a fixed-rate home loan, then it is possible to fix a portion of your loan. That way you can get the best of both worlds. Be sure to contact your mortgage broker to discuss your options. See your home loan options in less than 5 minutes In the current economic climate, low interest rates are not just a bonus - they are expected. Fortunately, if you are working with a mortgage broker, they will be able to help you get the very best deal you can and that will mean you will be receiving the very best interest rates on your home loan. So how do you actually go about getting a lower interest rate? Ask for a Better Rate As simple as it sounds, if you feel you could be getting a better rate, you might simply be able to ask for one. If you’ve been with a lender for a long period of time and have a great track record of making your repayments on time, they won’t want to lose you. That gives you some power to go and ask for a better rate. In many instances, lenders will incentivise new borrowers with low rate deals for a period of time. Your mortgage broker might be able to help you get a better rate simply by asking them for the same type of deal new borrowers are getting. Be a Borrower Banks Love If you want to negotiate lower rates or even refinance, you need to be someone that banks will happily lend to in the first place. There are a number of factors that might make your loan application far more appealing than other borrowers. This might include, only asking for a lower LVR - this means your loan is a far safer proposition. Have a strong employment history. If you’ve been in the same job for many years and are in a permanent position, banks are going to be very happy to lend. Lenders are assessing the risk that you are going to pay them back, so having steady employment is a key indicator for them. You will also need to have a good credit history. A track record of payments made on time with no defaults is vital to get the best possible rates as any blemishes on your credit history will severely impact your application, let alone your negotiating power. Walk Away The reality is that refinancing is a real option for most borrowers and one they should strongly consider. If your bank is not prepared to budge, it might be worth looking elsewhere and walking away. If you are a borrower that banks love and you’ve already asked for a rate cut, then you should really be looking at your options. Your mortgage broker is always going to be your first port-of-call and they will be able to quickly and easily assess your options and match you with the right type of loan and the best possible interest rate. The days of sticking with the same lender for 30 years are long gone and it is important that all borrowers are constantly hunting for the very best deal they can find - especially when it comes to interest rates. See your home loan options in less than 5 minutes Now that the new year is here, it’s time to start looking at all the ways you can make the most of your investment property. Tax is a complicated subject, which is why you should always speak to an accountant. However, the onus is on you to keep good records.

Keep Good Records If you want to claim your expenses on your rental property, it’s vital that you have good records. If you’re working with a property manager, this can be made a lot simpler as they will likely take care of all the running costs for you. However, if this is a new investment property or you’re self-managing, then you need to keep all the documents and receipts that you think will be relevant. Know Your Deductions While your accountant will know exactly what you can and cannot claim, it’s important that you take responsibility for examining all the associated costs that come with the property and seeking clarification from the accountant. Typical expenses that you can claim include: ● Repairs and maintenance ● Improvements/Renovations ● Advertising costs ● Cleaning ● Gardening ● Water ● Electricity and gas charges ● Pest control ● Land taxes ● Lease / property management costs ● Security monitoring costs ● Capital works Pre-Pay Your Expenses Depending on the type of loan you have, it might be possible to pay your interest upfront; hence you can claim it as a deduction for that financial year. Depending on your overall income and tax planning, this might be a useful strategy to consider. Similarly, it is also possible to pre-pay things like insurance and even do repairs and maintenance early. Claiming Depreciation If you have a new property or if you’ve undertaken significant renovation, then it might be worth looking at how you can claim depreciation. To do this, you will need a depreciation schedule, and this is commonly done through a quantity surveyor. Many investors fail to claim depreciation, and this can be a mistake. It certainly is if you have a new house or apartment. Interest Expenses Often, the largest expense that investors face is interest on their home loan. It’s important to understand that interest expenses and the associated fees and charges are tax-deductible expenses. See your home loan options in less than 5 minutes As the price of property surges across Australia, so does the cost of getting into the property market for many first home buyers.

For the most part, if you’re wanting to get a home loan from a bank or lender, they will require you to come up with a deposit. Depending on the lender, this can be anywhere from 5-20%. With house prices continuing to climb, many first home buyers get stuck in the trap of trying to save money for a deposit, only to watch house prices increasing in value and leaving them behind. Fortunately, there are ways first home buyers can get into the market more quickly and with a lower deposit to ensure they don’t miss the opportunity to enter the market. One of the most popular options for many first home buyers is to use a ‘Family Guarantee’ or ‘Guarantor Loan’. A family guarantee effectively uses the equity in another person’s property to account for a portion of your deposit. The most common situation is when parents use the equity in their home to help their children buy their first home. In practice, it is possible to use the equity in a family member’s home to cover the 20% deposit for the purchase of a property. The balance of the loan is then secured against the property you are buying. It’s also worth noting that the person or persons that act as a guarantor can limit their guarantee to only that portion of the loan. In the example of parents putting up the 20% deposit through their equity, they would not be liable for the full value of the property. However, this is something you should speak to your mortgage broker about. When you use this type of strategy, it is possible to effectively get a high loan-to-valuation ratio (LVR) without the need to pay lenders mortgage insurance (LMI). LMI is a form of insurance that is in place to protect the lender, and the borrower is required to pay it when they are borrowing more than 80% of the value of the property. LMI can run into the tens of thousands of dollars and is a significant cost that borrowers need to manage if they intend to access a loan with an LVR above 80%. The other advantage of using a guarantor-type loan is that first home buyers are still able to access the various first home buyer grants. For many first home buyers, the ability to access the various grants and also be exempt from stamp duty is the real reason why they are able to get into the property market. In recent times, first home buyers have been able to access other programs such as the First Home Loan Deposit Scheme (FHLDS), which operates in a similar manner and where it is the government that effectively helps guarantee higher LVR loans. However, there are price caps on the properties you can purchase, and the program is limited each financial year. While using a family guarantee is a great way for first home buyers to get into the property market, it is still not without its risks. The guarantor is putting their property at risk should the borrower default on their payments. It is vital that you speak with your mortgage broker and get professional advice before deciding to go down the path of using a family guarantee or guarantor loan. See your home loan options in less than 5 minutes The vast majority of people who look to purchase property will do so with the help of finance.

If you need to use finance to purchase a property, then you certainly need to include a ‘subject to finance’ clause in your offer. A subject to finance clause is a condition that is attached to the offer which effectively means the transaction will go ahead if the buyer is able to get finance for the purchase of the property. There are also other common conditions that most buyers will use on the purchase of a property, including being subject to a building and pest inspection or subject to a satisfactory valuation. These are all measures that are put in place to protect the buyer to some degree, most of which are considered standard and aren’t likely to impact the strength of your offer. How Does a Subject to Finance Clause Work? It’s always a good idea to speak to a mortgage broker well in advance of putting an offer in on a property. In reality, it is best that you have also taken this one step further and received a pre-approval from a lender. This not only gives you the confidence that you are going to be able to get finance on a purchase, but it will also give you a very clear indication of how much you can actually spend - including all acquisition costs. A pre-approval can also make your offer stronger in the eyes of the selling agent who is ultimately paid when the transaction goes through. It is also important to understand that a pre-approval isn’t a loan. You still need to make an offer subject to finance and will also need to receive a satisfactory bank valuation - which is why these two conditions go hand-in-hand. Each state has slightly different procedures in place around the offer and acceptance process, with some that are heavily focused on using auctions over private treaty sales. While some states also have cooling off periods. If you put in an offer that is subject to finance and you are running out of time to secure your finance, you will need to get your solicitor to inform the sales agent in writing to get an extension. If you don’t, you could potentially lose your deposit. Finance is arguably the most important part of the property buying process because without it you can’t move forward. Being organised and getting pre-approved will put you in the strongest position to acquire the property you want and to make sure the transaction goes through without a hitch. Even if you don’t have any loans or debts, having a credit card might be enough to significantly reduce your borrowing capacity.

The reason why a credit card can be a hindrance to your ability to borrow money, is that lenders assess your credit card on the overall limit, not on how much you currently have in credit card debt. Even if you’ve never reached your credit card limit since you’ve had the credit card, many lenders will assess a credit card as if it is maxed out. For example, if you have a credit card with a limit of $10,000, the lender is likely to assess your debt based on around 3% of this total amount per month. This monthly amount, which in this case would be $300, is added to your ongoing expenses, with the result that your overall borrowing capacity is reduced. With a credit card limit of $10,000, that could mean a $75,000 reduction in borrowing capacity, which is significant and can quickly limit the number of potential properties a first home buyer has access to. Assessing Your Situation Lenders do not only focus on what your credit card limit will do to your borrowing capacity. They also take other factors into consideration! One of the most important elements of any debt, in the eyes of a lender, is your track record of making repayments. If you continually miss payments and increase your debt levels, that doesn’t bode well in the eyes of a bank. Similarly, if you are living off your credit card, and are one pay cheque away from not just missing a payment, but also missing your rent, then that doesn’t make you look overly appealing in their eyes. It is important to understand that, with the implementation of Comprehensive Credit Reporting (CCR), lenders have incredibly detailed data on your spending habits, drilling down to how early or late you pay off your debts, or other bills. Credit Cards Are Not All Bad Now that we understand the impact credit cards have, it’s also important to note, that having a credit card is not necessarily a bad thing in the eyes of a bank. As mentioned, how you manage your credit cards is far more important than the fact that you have them. Lenders like to see that you are responsible with money. In fact, if you have a credit card and manage the credit very well, you will be looked upon far more favourably than someone who doesn’t have a credit card at all. Whether or not you get rid of your credit cards to help you get a home loan really comes down to a few key factors.

If you’re reliant on your credit cards, take a step back and assess your personal financial and living situation and get that in order before you start the home loan application process. While we all know that property prices have risen steadily in Australia for many decades, there is a big difference between the top-performing properties and those that have struggled. While the suburb and area are important factors in property selection, many investors fail to identify some of the red flags that might weigh on a property’s potential for growth.

These are some of the most common red flags to look out for: Hidden Costs While most investors will pay close attention to the asking price of a potential property, many miss some of the hidden costs. While building and pest issues are usually addressed, there are other hidden expenses that it is important to look for. If you’re looking at buying an apartment or unit, the costs that come with a strata complex can be very high. In most cases, you will be required to pay strata fees, which are typically higher in newer buildings that offer facilities such as gyms and pools. Similarly, strata companies generally put money towards things such as sinking funds or even have special levies in place to pay for large capital works. Older buildings can experience a range of expenses relating to maintenance, upgrades, or restoration. Be sure to get a copy of the minutes from the past few strata meetings to see what the board has in mind for expenses going forward before buying a strata-titled property. Whereas if you own a house or even a block of land, councils can require ratepayers to contribute additional levies for projects in the area. This has the potential to hurt your investment as you not only have to pay the costs, but you’ll also have trouble selling the property until those expenses have been met. Public Housing While we all know that suburbs grow at different rates, it’s important to take into consideration things like public housing in the area. If there is a lot of public housing on a certain street, it’s likely that the entire block will be negatively impacted in terms of possible growth. A Long Listing If a property has been on the market for a long time, there is likely a reason for this. It could just be that the vendor has unrealistic expectations. However, in certain circumstances, there might be a more serious issue with the property. This doesn’t necessarily rule the property out; however, if the vendor is unwilling to negotiate, you are well within your rights to walk away. On the other hand, it is important to remember, that just because a property is reasonably priced, doesn’t always mean it’s good value. Incorrect Listings While sales agents might be good at selling properties, they are not always property experts. This is often the case when it comes to things like the development potential of property. These days, if you can subdivide a property, it will likely be marketed as having that potential. A property with development potential will often be priced higher than a comparable property that can’t be subdivided. The issue with these properties is that not all sales agents are experts at property development. Just because an area has been rezoned to encourage development doesn’t necessarily mean that every property will be a viable one. It is always best to do your own due diligence on a property before making an offer. Or, at the very least, include in your offer some key clauses that protect you. House prices across Australia are continuing to see a sharp rise, and that can make it very tricky for buyers. Clearly, most states are in the grip of a seller’s market, so it’s important to both adjust your expectations and know how to buy when prices are rising.

Have finance organised Arguably, the most important element of buying a property during any market is to make sure you have your finance organised. However, when markets are rising, you not only need to know how much you can spend, but you need the confidence to be able to act quickly. As prices move higher, we also see the time it takes to sell a property, fall dramatically. As a buyer, if you have a preapproval in place, you’ll be able to make an offer early and have the confidence that your finance won’t be an issue. Look at all options Most Australian’s like to browse the real estate portals and then attend open homes on the weekend. Unfortunately, when markets are hot, you need more options, or you’ll be stuck fighting over the few properties that are actually listed for sale. One of the most effective things you can do is get on the email list of the leading agents in the suburb or suburbs in which you are wanting to buy. Sales agents often let people know about upcoming listings, and if you are confident and prepared, you might be able to make an offer before the listing ever sees the light of day. Do your research When markets are moving, it seems as if every property is selling well above its asking price. It is incumbent upon you, the buyer, to understand where the market is at in your area of interest, and the best way to do that is to track recent sales. By understanding what’s selling, you will know what a fair price is and also how long you have to act. Talk to all the sales agents in your area if you want even more insight as they are the ones who are always on the pulse of the market. Manage your expectations When markets are moving, it's unlikely that you’re going to get a significant discount on a property that has multiple interested parties. If a market is rising by 5% each quarter, it's conceivable that from the time you began your search to when you go to put in an offer, some property might have appreciated sharply in value. Again, you will need to know your market and put in an offer that is competitive. There’s no point fighting over a few thousand dollars and missing out when houses are rising by double digits on an annual basis. Most Australians are familiar with investing in real estate and understand the value that a property portfolio can create over time.

However, few property investors venture outside the world of residential property and consider commercial property. While commercial property is a little more difficult to understand than residential, it offers several significant advantages for investors. Higher Yields Most commercial properties have far higher yields than residential properties. It’s not uncommon to see 7-10% yields on commercial properties, which is something that few residential properties can generate. The benefit of high yields is that your asset is contributing to your cash flow every month. Most residential properties are negatively geared investments. Lower Costs Generally, the tenant of a commercial property pays all the outgoing costs associated with the property. That includes maintenance, rates and any strata fees. That means that the rent you receive each month is net of costs and the only real expense that you need to consider is property management fees. All leases are different, so it is important to get the lease reviewed prior to purchasing a commercial property. Loyal Tenants One of the big appeals of commercial properties is that they have long-term leases. It’s not uncommon to see commercial properties leased out to the same tenant for many decades. The reason for this is simple; it is the place of business, and the location is often a vital component of a business. However, the flip side of a long lease is that it can take longer to attract a new tenant in the event the business decides to end the lease. Steady Growth Commercial properties are priced a little differently from residential properties, in that the price is based on a multiple of the lease price. This can make commercial properties a little harder to understand for many new investors. The important thing to understand is that lease increases are generally incorporated into the lease. What this means is that each year the lease will increase in line with either inflation or the broader market. Capital Growth Potential Many people believe residential property is superior to commercial because of the ability to improve a property and add value to it. However, this is equally true of commercial property. As mentioned, the value of the property is tied to how much that property leases for. Anything you’re able to do to increase that lease will mean a higher property value. Things like renovations and subdivisions are quite feasible with commercial properties. Ultimately, whether to invest in commercial or residential isn’t mutually exclusive. A balanced property portfolio should contain a combination of both residential and commercial, and the mix will depend on where you are in your investment journey and what your financial goals are. First home buyers in Australia are in an enviable position at the moment, with a host of both state and federal government incentives available, making it far easier than it has been to get into a home of their own.

While there are a range of grants and exemptions available in the current environment, one of the most effective is the First Home Loan Deposit Scheme. The First Home Loan Deposit Scheme is a federal government backed initiative, that allows first home buyers to buy a home without needing a large deposit. Generally speaking, most lenders like to see a homebuyer contribute a 20 per cent deposit, which equates to an LVR (loan to value ratio) of 80 per cent. When the deposit drops below that 20 per cent threshold, the buyer is often asked to pay Lenders Mortgage Insurance or LMI. LMI is an insurance policy that effectively protects the lender if either the value of the property falls significantly, or if the borrower gets themselves into financial trouble. While LMI is a one-off premium, the cost can be well above $10,000 which puts more pressure on the home buyer, who is also being asked to contribute a deposit. As a result, the Federal Government introduced the First Home Loan Deposit Scheme, which allows a first home buyer to contribute as little as five per cent as a deposit and the Government will effectively act as the guarantor to the loan. In some ways, this is similar to a guarantor loan, which would commonly see a first home buyer’s parents acting as the guarantor. The added benefit of the First Home Loan Deposit Scheme, is that it can be used in conjunction with the other incentives and grants that are available to first home buyers. That means a first home buyer will still be able to access the First Home Owners grant and stamp duty exemptions that most state governments provide. The First Home Loan Deposit Scheme is also available to be used alongside some of the other federal and state government building grants such as HomeBuilder. However, there is an important consideration when looking at the packages. To access the First Home Loan Deposit Scheme, you will still be required to contribute a five per cent deposit from genuine savings. That means things like the first home owners grant won’t count towards your deposit. Accessing the First Home Loan Deposit Scheme While the First Home Loan Deposit Scheme, will be able to get people into their first home faster, there are still a list of requirements that you must meet to access the program. The first is that the property you’re intending on purchasing must be less than the various caps that have been set for each state and territory. State or Territory Capital city and regional centres Rest of state New South Wales $700,000 $450,000 Victoria $600,000 $375,000 Queensland $475,000 $400,000 Western Australia $400,000 $300,000 South Australia $400,000 $250,000 Tasmania $400,000 $300,000 Australian Capital Territory $500,000 – Northern Territory $375,000 – On top of these limitations, there are also requirements around how much you’re able to earn. Singles must be making less than $125,000 per year, while couples can only earn $200,000. Each financial year the Commonwealth Government makes 10,000 grants available and 5,000 of these are allocated to both CBA and NAB, while the remaining 5,000 are spread amongst second and third-tier lenders. It’s also important to note, that you will still have to meet the normal serviceability requirements to access the grant. That means you’ll have to have enough income to service any debt, based on your current earnings and expenses. The best way to see if you’re able to access the First Home Loan Deposit Scheme, is by speaking with a mortgage broker who will be able to assess your current situation and what you’re looking to achieve. While it’s nice to be selling when markets are strong, this can also cause a number of issues for those who are needing to sell their home before trying to buy another.

We would see this commonly with upgraders and downgraders, who might be at the time in their lives when they need more space for the family or, on the flip side, would like a smaller home that requires less maintenance as they get older. Both sets of potential buyers will likely need to sell their own property before making an offer on another one. This can be a tricky situation to navigate, and it’s important to consider a number of factors when trying to sell. Appraise Your Current Home The first thing you need to get a clear understanding of, is just how much your current home is worth. In a seller’s market, prices can move quickly, so even in the space of three months, your property might have gained significant value. It’s always good to get multiple opinions from the leading sales agents in your area as they are on the pulse of what is selling. They can also give you a very clear idea of how fast your home might sell and also whether the property type is what buyers in that area are looking for. Look to Auction There’s no doubt that if you want to get the most you can for your property, auction is the best option in a hot market. Auctions are most effective when there are multiple interested parties who are prepared to bid against one another. However, if you need more flexibility around the terms, such as settlement, then it might be worth considering selling by private treaty. That could come at the cost of extracting the very best price. Longer Settlements If you need time to buy a home after selling, then it’s well worth pushing for a longer settlement period on your own property. It’s possible to get four-month settlement periods, and you will likely need that time to go through the buying process. Bridging Loans If you are looking to sell, but really want to buy a certain property, there are options to consider, such as a bridging loan. These loans often come with higher interest rates but can be a useful way to get the best of both worlds. Given that the property market is strong, the odds of selling your home go up; you just don’t have that certainty when you have already sold your property. Pre-approval What you can do is start talking to a mortgage broker about what your finance options are like, and in some cases, it will be possible to get a pre-approval together. A pre-approval in conjunction with a good appraisal of your current property will give you a clear idea of how much you can afford to spend in the future. Even if you’re starting out the selling process, it is well worth getting a good understanding of how much you can potentially spend and start monitoring the market. See your home loan options in less than 5 minutes One of the most frustrating things that could happen to a homebuyer is getting your application for finance declined.

By this stage, you’ve already likely been to dozens of home opens, organised all your paperwork and potentially even put an offer in on a house. Falling over at the last hurdle is not only frustrating, but it can also feel like your dreams are over. But they don’t have to be, and more importantly, there are a few things you can do to make sure your loan application doesn’t get declined. Borrowing Amount The more you’re looking to borrow from a lender, the more risk it presents to them. If you want to borrow more than 95%, that can be a red flag for a lender. Most banks like to see you come up with a 20% deposit, which means an 80% LVR. While this might not be possible, there are other options you can look at like a higher LVR and paying Lenders Mortgage Insurance. If you do need to borrow with a higher LVR and only have a small deposit, you might want to look at a guarantor loan or even taking advantage of a Government program such as the First Home Loan Deposit Scheme. Stable Employment In a perfect world, when you apply for a loan, the lender would like to see that you’ve got a long-term stable job with a regular paycheck. Unfortunately, things are not always that simple and these days, many people have very unique work situations. If you’re self-employed or haven’t been in your current job for at least six months, then lenders might not look favourably on your application. Fortunately, there are lenders that understand your situation and therefore it is important that you work with a mortgage broker who can match your employment situation with the right lender. If you’re unemployed, you’re going to have a very tough time getting finance of any kind. These days, even if you’re asset rich, you still need to be able to show how you intend to service the debt. Credit History Having bad credit is often a red flag to a lender and it is not always one that is easy to overcome. If there is an error that has been made on your credit file, then that is something you can sort out. However, if you’ve been bankrupt in the past, you might need to work with a specialist lender. Spending Habits Banks and lenders like to see that you’re able to manage money effectively. If you’re spending habits aren’t great, then that’s likely a sign that you might not be able to manage a mortgage. Putting together a few months where you keep your spending habits under control is important. But it’s also more important to not have a host of debts that need paying each month, such as car loans or personal loans. Lenders don’t look favourably on these types of costs as they are fixed costs, unlike your discretionary spending. Buying an Unusual Property If you’re looking to buy a property that might be tricky to sell in the future, banks won’t like the look of it. That might mean a holiday home or even a rural block of land. Banks will always consider the worst-case scenario, and if they need to sell the property because you can’t make the payments, they want something that will be able to sell quickly and easily. Get Pre-Approved To avoid getting into a situation where you might get declined, it’s vital that you go and speak to a mortgage broker before you even start looking for properties. That way, they’ll be able to assess your personal situation and also give you some guidance around the types of properties you’re going to be able to afford. See your home loan options in less than 5 minutes A balloon payment is a one-off lump sum that you pay to the lender at the end of your car loan’s term. Balloon payments are more common with car loans for businesses and are a great way to help reduce your monthly repayments and free up cash. However, there are a number of advantages and disadvantages that you need to weigh up before deciding to go down the path of a loan product with a balloon payment. Advantages Cash flow The most obvious reason to make a balloon payment at the end of the loan term is so you can free up cash with lower payments over the life of the loan. For businesses, this can be important as the funds can be used in other areas to help you grow your business. If you’re able to save on the upfront costs and delay some of those costs, you could potentially be in a stronger financial position in the long run. Keep the car new One of the other key reasons you might consider this type of loan product is that it allows you to sell the vehicle at the end of the lease term to make the balloon payment. You’re then able to go and take out another loan to purchase a new car in the same fashion. The allows you to keep the car new which can reduce the cost of servicing and maintenance as the car is generally going to be under the manufacturer’s warranty. You’ll also be able to have a more technologically advanced vehicle. Disadvantages Higher overall cost Generally speaking, if you’re using a loan product with a balloon payment, the overall cost of the loan in the long term is likely going to be higher. This might be OK if you’re putting the funds to better use in the short term, however if you’re not, this type of loan can become a hindrance. Depreciation It’s hard to predict what the value of the vehicle might be when the term of the loan ends. If a car has depreciated in value by more than expected, you might find yourself in a situation where you need to pay back more than the value of the car. This large payment could catch you unaware if you’re not prepared for it. See your vehicle finance options in less than 5 minutes |

EDITOrCategories

All

Archives

December 2023

|

|

Read about us on KochiesBusinessBuilders and Linkedin

Partner with Adobi Mortgage Solutions Contact Bruce Johnstone (03) 9996 8553 or email [email protected] |

©2021 ADOBI® MORTGAGE SOLUTIONS ABN 94465268443

Suite 405, 585 Little Collins Street, Melbourne, VIC 3000 Telephone: (03) 9996 8551 Credit Representative Number 536529 authorised under Australian Credit Licence 384324 Your complete financial situation will need to be assessed before acceptance of any proposal or product Please review our Lenders, Terms of Use and Privacy Policy Member 87449: AFCA - Australian Financial Complaints Authority Member M-351557: FBAA - Finance Brokers Association of Australia |

RSS Feed

RSS Feed